Fri 10 Oct: After the Bell

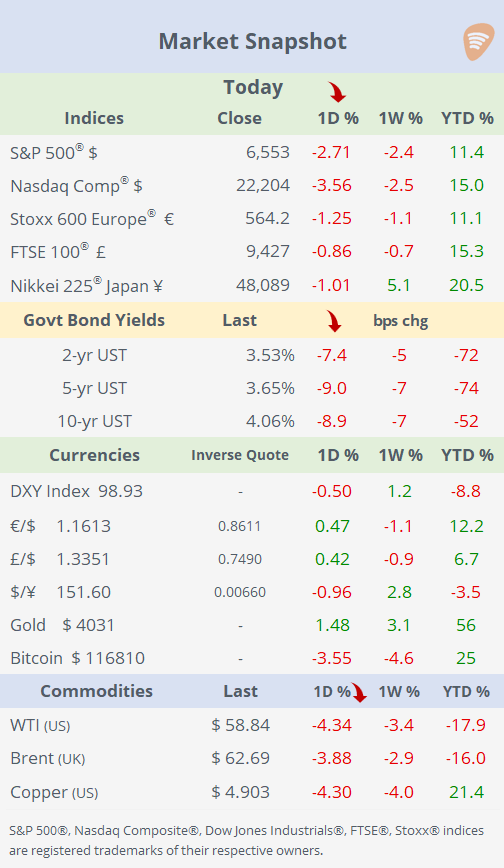

🎙️📄+ Market Data. Stocks, oil and cryptos plummet. Bonds rally. Risk-off Friday on Trump's new tariff threat.

ℹ️ Free subs: USMD’s subscription costs $7.50 per month with the annual plan – for now, and has a 7-day trial. Visit About to learn about the Refer & Save program and pay even less.

See the ‘Market Data’ post for tables & charts.

Good evening,

Wall Street and European stocks sold off sharply today, retreating from record highs, while bonds rallied, as trade tensions resurfaced. Leading indices plummeted over 3% on Friday to end the week 2.5% lower. It was Nasdaq’s steepest daily fall since early April. The Vix index jumped to 21.7%, a four-month high. Core bond yields plunged by around 9bp across the Treasury curve, with 10-year yields at 4.06%, the lowest close in three weeks.

Several mega caps fell sharply today, including Nvidia, Amazon, Tesla and Broadcom, losing 5%. On a WTD basis, the best-performing stock among large-caps was AMD with a 30% gain on the back of its deal with OpenAI, and the biggest loser was Ferrari with a 21% drop. This week, all sectors declined except for utilities and consumer staples, while energy was the weakest performer.

The risk-off sentiment hit crude oil hard with a 4% drop to a 5-month low as WTI ended the week at $59. Copper, grains and softs also sold off on Friday to finish the week with losses. The $ fell, gold gained, and cryptos collapsed (BTC -4%, ETH -7%).

On a long post this morning via his social media platform, Trump threatened to impose “massive” new tariffs on Chinese imports following China’s announcement of expanded export controls on rare earth elements. These materials are crucial for industries such as electric vehicles, aerospace, and defence. Trump criticised China’s actions as “hostile” and suggested cancelling an upcoming summit with President Xi Jinping.

Data: October preliminary Michigan Consumer Sentiment indicator came in at 55 points, slightly above estimates but still below its 5-year average of 62.

Deals: Johnson & Johnson (mcap $460bn) is reportedly in talks to acquire biotech Protagonist Therapeutics (mcap $5.6bn), following their co-development of a treatment for ulcerative colitis. The deal could give J&J access to Protagonist’s drug rusfertide. Protagonist’s shares rallied 30% today and accumulated a 130% gain YTD.

In private markets, drugmaker Bristol Myers Squibb (mcap $90bn) announced it will acquire privately held cell therapy firm Orbital Therapeutics for $1.5bn in cash, as it seeks to diversify beyond aging products facing increasing generic competition. Bristol’s shares are down 21% this year.

Warburg Pincus is reportedly close to acquiring a large minority stake in French private diagnostics company Sebia, in a deal valuing the group at around €5.4bn. The investment would mark one of Europe’s largest private healthcare transactions this year, reflecting a renewed interest in medical diagnostics among private equity firms.

Week Ahead:

M: China trade; India inflation; Fastenal earnings.

T: Q3 earnings season kicks off with JPM, Goldman, Citi, Wells Fargo, J&J and BlackRock. UK employment report; Germany ZEW surveys.

W: China inflation; €-zone industrial productions. Earnings: Bank of America, Morgan Stanley, ASML.

Th: US retail sales, PPI, jobless claims. Earnings: TSMC, Charles Schwab, BNY.

F: US industrial production, housing starts, import/export prices. Earnings: Amex, Truist.

Enjoy your weekend.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient’s personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.