Fri 14 Nov: After the Bell

Your 5’ evening market wrap 📄📈

Indices + LargeCaps + FX + Treasuries + Commodities tables on the ‘Market Data’ post.

Good evening,

This week’s market narrative revolved around the Fed’s re-pricing, the end of the US government shutdown and ongoing questions around stretched AI-related valuations. Wall Street’s initial relief at the government reopening on Thursday quickly faded as investors shifted their focus to a backlog of delayed economic data, the risk of slower Fed rate cuts, and the elevated valuations of major tech names.

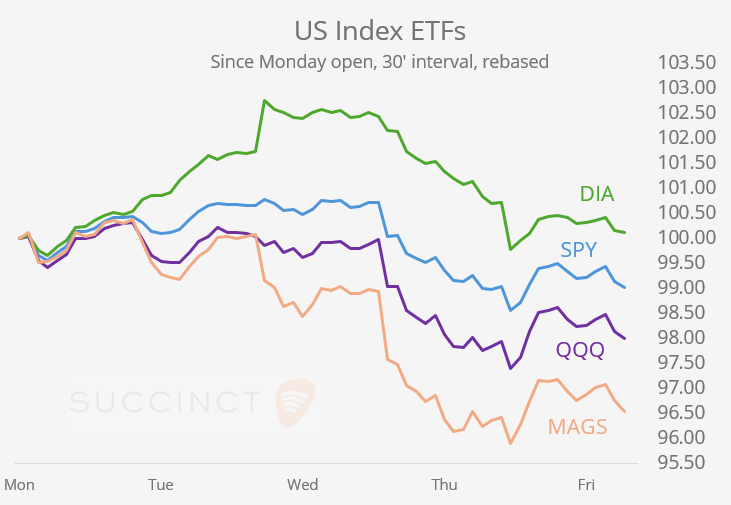

US equities had a volatile Friday and week, with the S&P 500 and Nasdaq Composite ending little changed on the day and marginally lower for the week, despite sharp intraday swings. Energy and healthcare led sector gains, while consumer discretionary lagged; among large caps, Eli Lilly and Cisco outperformed while Strategy, AppLovin and Dell Technologies declined.

European benchmarks struggled on Friday but still closed the week notably higher, while Asian indices echoed Wall Street’s Thursday weakness and sold off sharply into their Friday close.

Core bond prices remained under pressure, pushing yields higher on the day, the week and across the past month. Futures markets ended the week pricing a 46% chance of a quarter-point Fed cut in December, down from 94% four weeks ago. The shift weighed heavily on precious metals and cryptos: silver fell 5% today, and Bitcoin slid below $95k — its lowest level since May and now flat year-to-date.

In European bond markets, UK government borrowing costs surged sharply after Chancellor Rachel Reeves scrapped a planned income tax increase, which shook investor confidence in her Budget and intensified the challenges facing the Labour administration. The 10-year Gilt yield rose 15bp to 4.58%, the highest level in a month.

In commodities, renewed tensions in the Black Sea lifted oil by 2% on Friday, allowing crude to finish the week slightly higher.

Geopolitics: Russia launched a massive attack on Kyiv, hitting multiple districts and causing fires and widespread damage, marking an escalation of the conflict in the Ukrainian capital.

Trade deals: →The Washington and Switzerland reached a trade deal to cut US import tariffs on Swiss goods from 39% to 15%, easing pressure on the Swiss economy after the high tariffs were imposed in August over a $38bn goods deficit.

→ The US also sealed a trade deal with Argentina yesterday, focused on expanding market access for US goods, including medicines, chemicals, machinery, IT products and medical devices, while Milei’s government agreed to simplify export rules and reduce non-tariff barriers.

Data: → China’s latest economic data show a sluggish growth trend: retail sales rose just 2.9% YoY in October, industrial production grew 4.9% YoY, its slowest pace since August 2024, and fixed‑asset investment fell 1.7% YoY, marking the worst decline in over five years.

→ Today’s US PPI and retail sales releases were suspended due to the government shutdown.

Deals: → Merck & Co, will acquire Cidara Therapeutics (mcap $6.9bn), a San Diego‑based biotech, for $9.2bn, paying $221.50/share in cash. Cidara shares have more than doubled today to accumulate a 710% gain this year.

→ H. Lundbeck (Danish pharma, neurology focus) made an unsolicited bid for Avadel Pharmaceuticals (mcap $2.3bn) of up to $2.4bn, topping Avadel’s existing deal with Alkermes (Irish biopharma), which is 15% lower. Avadel shares jumped 22% today and are 122% higher YTD.

Week Ahead: → Data: M: Japan GDP, Canada inflation; T: US Industrial production, trade figures; W: US housing starts, building permits and FOMC minutes, UK inflation; Th: US existing home sales, China loan prime rates; F: Global PMIs, Japan inflation.

→ Earnings: T: Home Depot; W: Nvidia, TJX, Palo Alto Networks; Th: Walmart, Intuit.

Enjoy your weekend.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient’s personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.