Fri 16 Jan: After the Bell

Quiet Finish to the Week as Bond Yields Rise and Earnings Drive Caution. Your 5’ evening market wrap📄📈

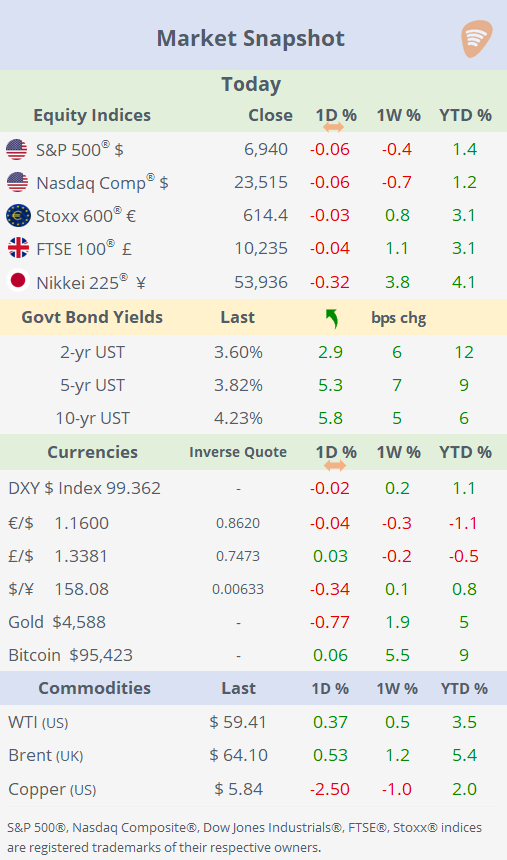

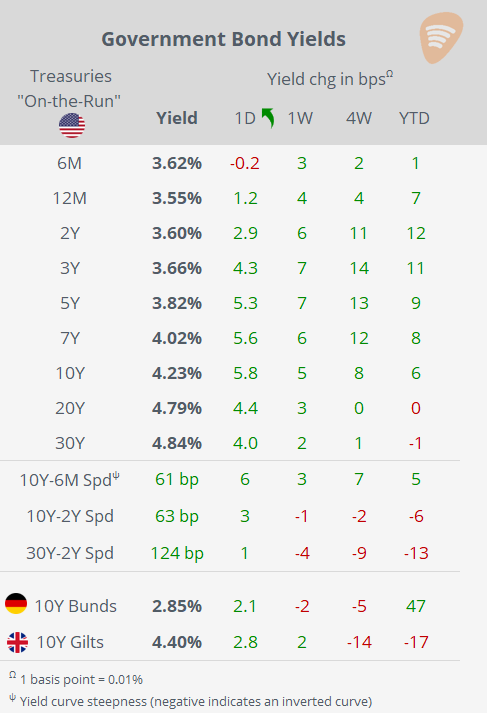

ℹ️ Today’s performance tables & charts on the ‘Market Data’ post.

Good evening,

Equities and currencies were little changed on Friday as markets headed into Monday’s US stock and bond market holiday. Benchmark bond yields edged higher into the close, with the 10-year Treasury rising another 6bp to 4.23%, its highest level since early September, reflecting a continued repricing of rate expectations.

On a weekly basis, major stock indices finished marginally lower, with consumer staples, real estate and industrials emerging as the clear outperformers. In commodities, crude oil ended the week modestly firmer, while cocoa and corn both fell around 5%; silver stood out, surging more than 12% to a fresh record high.

Looking ahead, sentiment is likely to remain driven by ongoing earnings releases following a mixed week for financials, alongside persistent focus on the Fed’s independence and evolving geopolitical risks, as Washington continues to shape its stance on Iran, Venezuela and Greenland.

It was a light day on the data front, but there were some relevant comments from US central bankers. Fed Vice Chair Bowman said the Fed should remain prepared to cut rates if labour market conditions weaken, highlighting growing balance-of-risk considerations between inflation and employment. Separately, Vice Chair Jefferson noted that current monetary policy is well-positioned, supporting a near-term hold as inflation continues to ease and labour market conditions remain broadly stable. The Fed’s next meeting is on Jan 28th, and markets continue to price in an implied probability of 95% for a steady policy rate at 3.5-3.75%.

Earnings: Mixed earnings reports from US regional and custody banks set a divergent tone today.

PNC (mcap $87bn) beat expectations on stronger net interest income and fee growth, pushing its shares 3.5% higher, while State Street (mcap $36bn) missed on EPS due to restructuring charges that overshadowed solid revenue, driving a sell-off (~6%). The split reaction underscored investors’ continued focus on profitability and cost discipline rather than topline strength alone.

Corporate Deals: → Mitsubishi Corporation (mcap $96bn) announced the $7.5bn acquisition (including debt) of Aethon, the largest privately held US shale gas producer, marking the Buffett-backed trading house’s biggest-ever deal. The purchase adds 2.1bn cubic feet per day of Haynesville gas, ~2% of US output, strengthening Mitsubishi’s gas portfolio and positioning it to meet surging AI-driven power demand while enhancing energy security in Europe and Asia.

→ In private markets, San Francisco-based ClickHouse, a cloud-native database startup focused on real-time analytics and AI infrastructure, raised $400mn in a Series D round led by Dragoneer Investment Group at a $15bn valuation, more than double its value less than a year ago.

Week Ahead:

S: China GDP, retail sales and industrial production.

M: Canada inflation. US stock and bond market holiday.

T: UK unemployment rate; earnings: Netflix, 3M, US Bancorp.

W: UK inflation; earnings: J&J, Charles Schwab, Prologis.

Th: Japan inflation, US delayed PCE inflation (Oct/Nov); earnings: Visa, P&G, LVMH, GE Aero, Abbott, Intel.

F: Bank of Japan policy rate, PMIs; earnings: NextEra Energy, Schlumberger.

USMD will return on Tuesday after Martin Luther King Day.

Enjoy your weekend.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient’s personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.