Fri 17 Oct: After the Bell

📄+ Market Data.

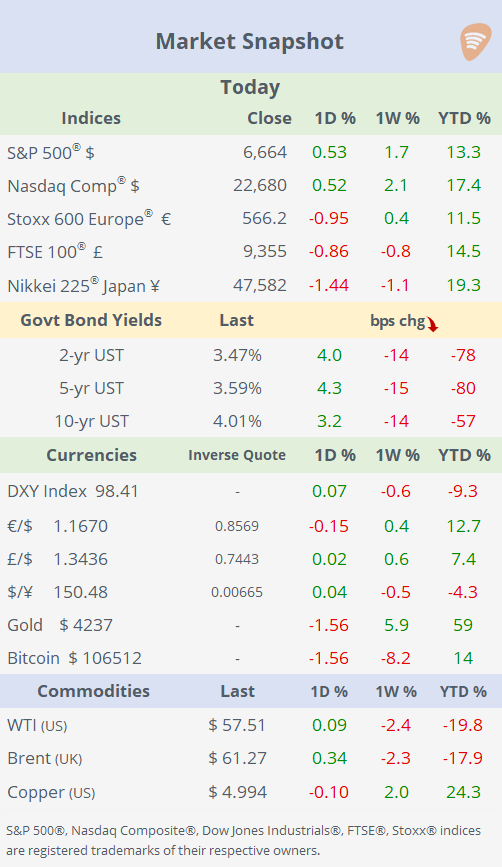

See the ‘Market Data’ post for tables & charts.

US equities closed the week on a firmer note as fears surrounding credit markets and mid-sized banks subsided, helping risk sentiment stabilise. The Nasdaq Composite advanced over 2% for the week, extending this year’s gain to 17%.

Treasuries rallied strongly, with yields falling across the curve. The 2-year bond yield dropped to 3.47%, near its three-year low, as investors continued to price in rate cuts. In European bond markets, UK Gilts rallied this week, sending 10-year yields down 21bp to 4.54%. The move reflects investor optimism as Chancellor Reeves considers tax rises and spending cuts in next month’s Budget.

In commodities, gold and other precious metals paused after touching record highs earlier in the week, reflecting some profit-taking and calmer risk sentiment. Silver prices plunged over 6% today, marking their steepest drop in six months. This pullback was driven by somewhat reduced tensions with China and signs of easing in the historic squeeze in the London market.

Bitcoin slumped roughly 8% WTD to its lowest level since early July, extending losses from last week’s sharp risk-off episode.

Tariffs: Trump said that the US is “going to do fine with China,” but his recent comments on a threatened 100% tariff on Chinese goods remain ambiguous. He acknowledged the levies aren’t sustainable but added they “could stand,” leaving uncertainty over whether they will be implemented.

Geopolitics: Trump met with Ukrainian President Zelensky at the White House with an eye on ending the war and expressed hope Ukraine would not need US Tomahawk missiles.

Central Banks: Mostly dovish remarks by Fed officials on Friday. St. Louis Fed Musalem signalled support for another rate cut this month, emphasising caution amid inflation risks. He stressed a data-driven approach, ready to ease policy if labour market weaknesses emerge, but warned against overly accommodative moves. Fed fund futures are fully pricing in two quarter-point rate cuts by the end of the year from the current target rate of 4 – 4.25%.

Earnings: The overall sentiment from today’s results by financial firms is mixed. American Express reported strong results, exceeding expectations and raising its full-year guidance, while Truist Financial’s earnings beat forecasts, though revenue slightly missed. State Street delivered solid performance with increased revenue and earnings, but disappointed slightly on net interest income. Oilfield services company Schlumberger surpassed earnings estimates but faced challenges in revenue growth. The main moves among stocks that reported today include Amex’s +7% (best Dow 30 member) and Truist’s +4%.

Outside of earnings, a notable mega-cap mover on Friday was Oracle (mcap $830bn), which fell 7% despite announcing ambitious long-term growth targets, including $225bn sales by 2030 and strong AI infrastructure demand. The sharp drop was driven by investor concerns over near-term execution risks, significant capital expenditures, and scepticism about the pace of converting demand into revenue amidst supply constraints.

Deals: It was a quiet end of the week for corporate deals. Spain’s BBVA (mcap €96bn) failed in its €17bn hostile takeover bid for smaller rival Banco de Sabadell (mcap €15bn) after securing only 25.5% of Sabadell’s shares, falling short of the 30% threshold required to advance the deal. BBVA shares rallied 6% today, while Sabadell plunged 7% but remains 61% higher YTD.

In the UK, Smiths Group (mcap £7.8bn) agreed to sell its electric components unit, Smiths Interconnect, to Koch Industries’ Molex Electronic Technologies for £1.3bn. Smith Group’s shares are 40% higher this year.

Week Ahead:

M: China loan prime rates, GDP, industrial production, retail sales, and fixed investment; Germany PPI inflation.

T: Canada inflation.

W: UK inflation; Japan trade.

Th: Korea rate decision; US jobless claims and existing home sales.

F: US CPI inflation (subject to shutdown situation) and new home sales; Flash PMIs G7 countries; UK retail sales; Japan inflation.

It will be a busy week for earnings releases starting on Tuesday.

Enjoy your weekend. Please 🙏 use your referral link to share!

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient’s personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.