Fri 21 Nov: After the Bell

Your 5’ evening market wrap 📄📈

Indices + LargeCaps + FX + Treasuries + Commodities tables on the ‘Market Data’ post.

Good evening,

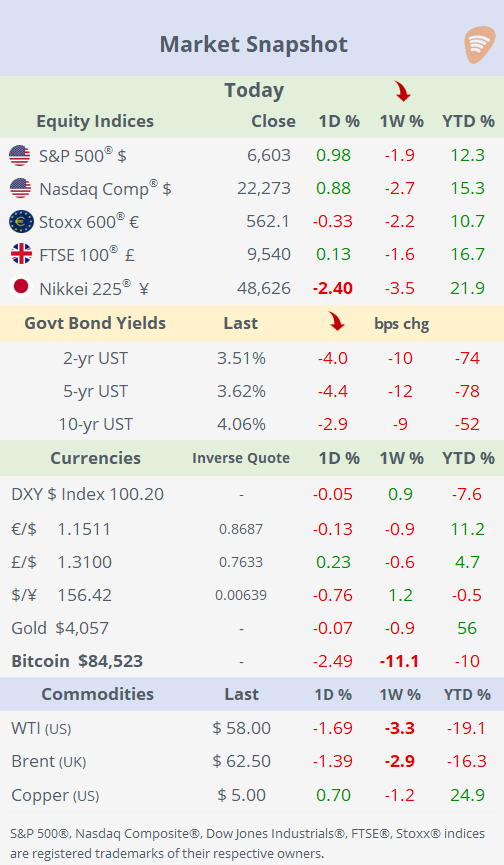

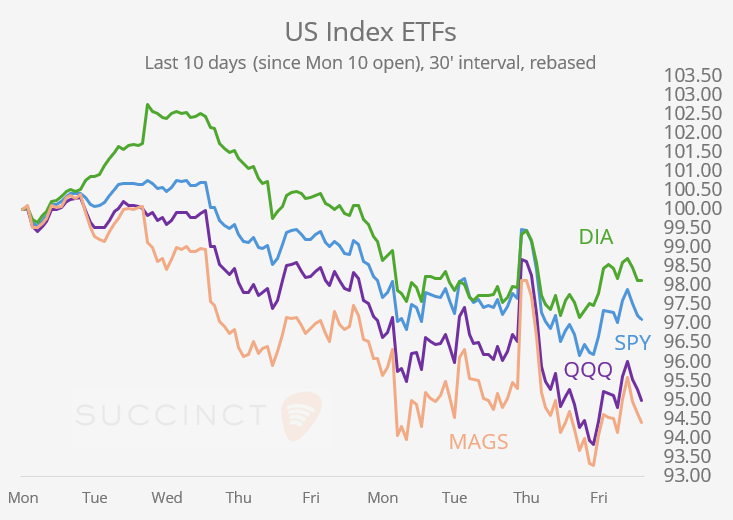

Thursday’s steep risk-off mood carried into Friday’s open, but sentiment reversed midday after dovish comments from NY Fed President Williams. Markets remain volatile, with large intraday swings in stocks and cryptos, while core bond markets and major currencies continue to trade range-bound. Market action remains highly sensitive, with any news on AI valuations or the Fed’s interest rate outlook sparking significant volatility.

Despite Friday’s positive finish, global equities closed the week sharply lower: the US and EU down 2–3%, and Asian markets worse at 3–5%. The US IT sector led the losses, falling over 5%, followed by Energy down 2.8% as WTI crude slid to a four-week low, below $58. US Treasury yields fell ~10bps on the week, with the 2-year note at 3.51%, the lowest in three weeks, on Williams’s comments.

Next week will be short with Thanksgiving, featuring some economic releases and a few large-cap earnings, but nothing is expected to shift the broader market narrative.

Fed: → John Williams, NY Fed President and permanent FOMC voting member, said he sees room for a near‑term rate cut. Fed officials remain divided on a December move amid lingering inflation concerns, but markets shifted to favour a quarter‑point cut after Williams’s dovish comments. The odds for a rate reduction jumped to 70% from 40% following his remarks.

“I still see room for a further adjustment in the near term to the target range for the federal-funds rate to move the stance of policy closer to the range of neutral,” Williams said Friday.

Japan’s Cabinet, led by Prime Minister Takaichi, approved a ¥21tn ($136bn) stimulus package on Friday — the largest since the pandemic, though below earlier proposals of ¥25tn. The package comprises ¥18tn in direct spending, ~¥3tn in tax cuts, and ¥900bn in special account expenditures. The ¥ appreciated today to over 156 against the $ on higher inflation data (below).

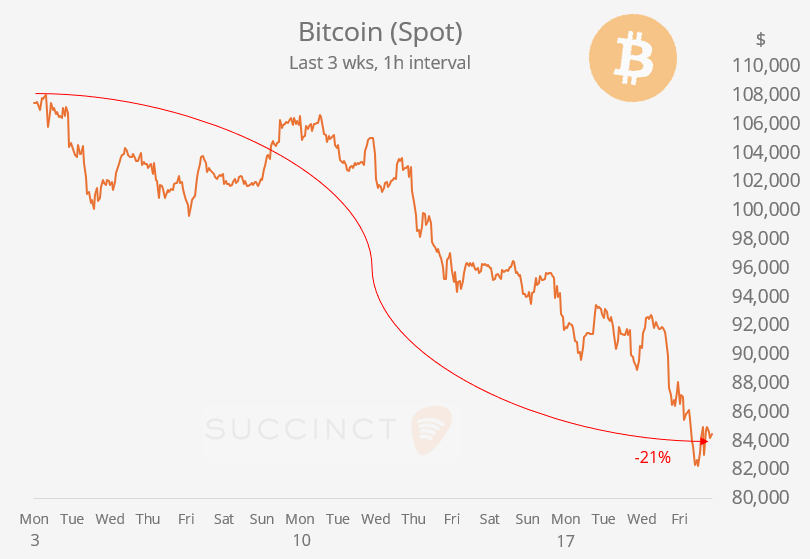

In the crypto space, Bitcoin dropped over 11% this week and traded below $81k at one point today, heading for its worst monthly performance since June 2022. More than $2bn in leveraged crypto trades were liquidated in 24 hours, while investors sold ~$4bn of Bitcoin and Ether ETFs in November. BTC has plunged 33% from its early October peak.

Geopolitics: → Trump said he wants Ukraine’s response to his 28-point peace plan by Thursday, while President Zelensky described facing “a very difficult choice” over the proposals, which would involve major concessions to Russia.

Data: → The University of Michigan US Consumer Sentiment Index fell to 51.0 in November, below the 50.3 forecast, down from 53.6 in October and the lowest print since mid-2022.

→ Japan’s core CPI inflation rose 3.0% YoY in October, up from 2.9% in September, staying above the Bank of Japan’s 2% target. The monthly reading was +0.4% MoM against expectations for a decline.

→ The preliminary November Composite PMIs for the US (54.8) and €-zone (52.4) were released, showing little change from October and offering no major surprises for markets.

Corporate Deals: → GE HealthCare Technologies (mcap $35bn) agreed to acquire medical-imaging software provider Intelerad for $2.3bn, expanding its reach into outpatient and ambulatory care. Intelerad is owned by private equity firms Hg Capital and TA Associates.

→ French waste-management group Veolia Environnement (mcap €21bn) agreed to acquire US hazardous-waste specialist Clean Earth from Enviri Corp (mcap $1.4bn), a US environmental services company, in a $3bn deal including debt. Enviri shares jumped 28% today.

→ In private markets, EQT AB is reportedly nearing a €2bn deal to acquire a majority stake in Belgium-based Desotec from Blackstone, which bought the European environmental services company just four years ago, according to press mentions.

→ Musk’s xAI approaches a $230bn valuation as it plans to raise an additional $15bn in funding. The move underscores continued investor appetite and supports the expansion of the AI-focused firm’s operations.

Week Ahead:

Data → T: US PPI, retail sales, pending home sales, ADP employment. W: US durable goods, new home sales, personal spending; Australia inflation. Th: Korea rate decision. F: Germany, France, Italy inflation; Germany retail sales; Canada GDP.

Earnings → M: Agilent, Zoom, Naspers. T: Alibaba, Analog D, Dell T, Workday. W: Deere.

Holidays → Japan on Monday, US Thanksgiving on Thursday (all mkts closed).

Enjoy your weekend🎉. Please 🙏 use your referral link to share!

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient’s personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.