Fri 26 Sep: After the Bell

🎙️📄

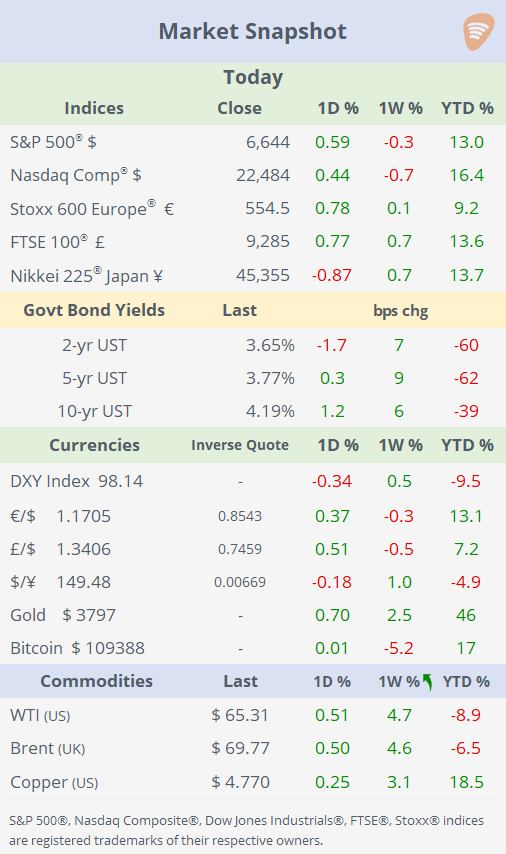

See the ‘Market Data’ post.

Good evening,

Markets ended the week on a positive note, supported by a benign PCE inflation update and resilient income and spending data. Leading equity indices rose between 0.5% and 1% on Friday, though they still posted modest weekly declines and lagged Europe, where stocks traded firmer both today and over the week. All major US sectors advanced on the day, but only energy and utilities managed to finish the week notably higher.

Core bond yields were little changed on Friday but climbed several basis points across the week, with attention now shifting to next Friday’s employment report. Over the past week, the implied probability for a quarter-point Fed rate cut at the late-October meeting eased from 92% to 88%.

In commodities, crude oil gained 4.5% on the week, while precious metals also rallied, with gold futures closing just below $3,800.

Regarding trade, Trump announced a new round of tariffs set to take effect next Wednesday, including a 100% levy on branded or patented pharmaceutical products from companies not building manufacturing plants in the US. Additional tariffs include 50% on kitchen cabinets and bathroom vanities, 30% on soft furniture, and 25% on heavy-duty trucks.

Data: US Headline PCE inflation, the Fed’s preferred measure, rose 2.7% YoY in August, the highest since February, while Core PCE held at 2.9%, matching expectations and the prior month. The prints underline persistent price pressures, yet the Fed majority and markets still see room for rate cuts, keeping easing bets alive. US personal income rose 0.4% MoM in August, while personal spending increased by 0.6%, both surpassing expectations and indicating sustained consumer confidence.

On the negative side, the Univ of Michigan’s Consumer Sentiment Index fell to 55.1 in September, marking its lowest level since May. The decline reflects growing concerns about high prices and a softening labour market, with 44% of respondents reporting that inflation is eroding their personal finances.

Geopolitics: Trump signed an order declaring TikTok US sale ready, valuing it at $14bn, with China’s Xi reportedly approving the deal and Michael Dell and Rupert Murdoch among investors, while Oracle and Silver Lake hold a 50% stake.

Deals: Video game maker Electronic Arts (mcap $48bn) is reportedly in advanced talks to go private at a $50bn valuation, backed by investors including Silver Lake and Saudi Arabia’s Public Investment Fund. Shares jumped 14% today to an all-time high and accumulated a 31% rally YTD.

In private markets, Dutch tech investor Prosus will acquire French online platform La Centrale from Providence Equity Partners for €1.1bn, giving its OLX Group a leading position in one of Europe’s largest used-car markets.

Media reports suggest that the private equity owners of real estate software provider MRI Software are exploring a sale or IPO, targeting a valuation of ~$10bn.

Denmark’s Ørsted, the world’s largest offshore wind developer, is reportedly in talks with Apollo to sell a stake in the £8.5bn Hornsea 3 UK wind farm.

Week ahead: M: Carnival earnings; Spain inflation. T: RBA policy rate (unch at 3.6% exp); Germany, France, Italy inflation; Nike earnings. W: US ISM mfg PMI; €-zone inflation. Th: US factory orders; Switzerland inflation. F: US non-farm payrolls; ISM services PMI.

Enjoy your weekend.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient’s personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.