Fri 31 Oct: After the Bell

Your 5’ evening market wrap 📄📈

See the ‘Market Data’ post for tables & charts.

Happy Halloween,

Technology leads the charge as markets close October on a high note: AI, earnings, Amazon and the Fed steal the spotlight.

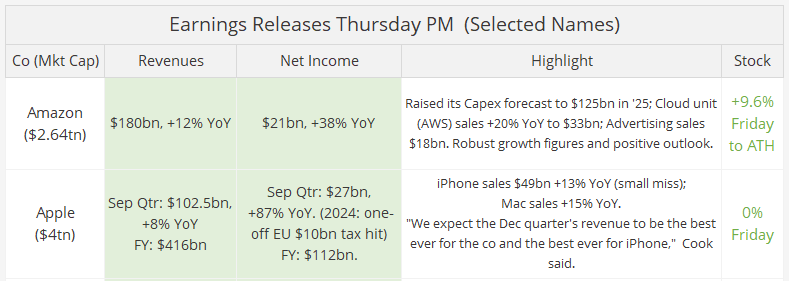

The week ended on a positive note, driven by robust earnings from Amazon, which surged 10% to a record high and lifted broader sentiment. Equity market strength remains highly concentrated in AI-related and large-cap technology names after a packed week of corporate results. The S&P 500 finished the week slightly higher, while the Nasdaq Composite outperformed with a 2.2% gain as the tech sector led the advance.

However, performance across the broader market was uneven. Materials, Consumer Staples, Real Estate, and Utilities each fell between 3% and 4%, and the equal-weight S&P 500 declined nearly 2% WTD, highlighting continued market concentration.

In fixed income, core Treasury yields were steady on Friday but ended the week roughly 10bp higher across the curve, with the 10-year yield closing near 4.09%. Currencies were quiet, with the DXY $ index modestly firmer on £ weakness. Gold fell 3% this week to $4,012 after the Fed struck a hawkish tone despite cutting rates.

In October, the S&P 500 rose 2.2%, the dollar gained 2%, crude oil advanced 2%, gold climbed 4%, and the 10-year Treasury yield ended unchanged.

Earnings: Large-caps Exxon, Chevron and AbbVie beat top and bottom estimates on results released before the open, but AbbVie’s stock dropped ~5% due to concerns about rising costs, a sharp decline in operating margin, and lowered full-year profit guidance.

The week’s notable large-cap mover is Fiserv (mcap $35bn). The Wisconsin-based global payments and fintech company disappointed on Wednesday with its quarterly results. Stock plunged 44% (its worst day ever), erasing $30bn of market cap, and accumulated a 68% drop YTD to its lowest level in 8 years. It missed top and bottom estimates, slashed full-year guidance and announced a management reshuffle. The new CEO, Mike Lyons (ex-PNC), suggested that the assumptions and projections made by prior leadership were too optimistic. It also announced a stock move from the NYSE (FI) to the Nasdaq (FISV) in November (chart on Market Data post).

Data: €-zone headline inflation eased to 2.1% YoY in October from 2.2%, nearing the ECB’s 2% target as President Lagarde warns of global and wage-related risks. The core inflation reading held steady at 2.4%, marginally above forecasts, as services inflation remains sticky at 3.4% while energy prices fell again.

→ China’s NBS Manufacturing PMI fell to 49.0 points, down from 49.8 in September, marking the lowest level since April and indicating continued contraction in manufacturing activity. The Non-Manufacturing PMI (Services) rose slightly to 50.1, suggesting stable expansion in services and construction.

Corporate Deals: North Carolina-based life insurer Brighthouse Financial (mcap $3.3bn, a spin-off from MetLife in 2017) is nearing a $4bn take-private deal with investment firm Aquarian Holdings, which is backed by RedBird Capital Partners and Abu Dhabi’s Mubadala Investment, according to media. Shares jumped 28% today to a near all-time high.

IPOs: London’s LSE saw a few significant listings this week in an otherwise lacklustre year.

→ UK-based food and drink company Princes Group, a subsidiary of Italy’s New Princes, known for canned tuna and tomatoes, raised £400mn and was priced at £4.75, the bottom of the guidance range for a £1.2bn valuation. It received a cool response from investors as shares closed unchanged. New Princes bought Princes from the Japanese group Mitsubishi last year for £700m.

→ On Thursday, specialist UK digital banking and lending platform Shawbrook Group raised £348mn and was priced at £3.70, achieving a valuation of £2bn. It is controlled by private equity firms BC Partners and Pollen Street Capital. Stock closed the week firmer at £3.91.

Week ahead:

→ Data: M: US ISM Mfg PMI; T: US Jolts job openings, US trade and factory orders; W: US ISM Services PMI; F: US monthly employment report scheduled, Michigan Consumer Sentiment, and China trade.

→ Central Bank meetings: The Reserve Bank of Australia on Tuesday (unch at 3.6% exp), the Bank of England (unch at 4% exp), and Banxico on Thursday.

→ Earnings: M: Palantir; T: AMD, Uber, Amgen, Pfizer, BP, Ferrari, Shopify; W: McDonald’s, Qualcomm, AppLovin, BMW; Th: ConocoP, Airbnb, AstraZeneca, Engie; F: Constellation.

Enjoy your weekend

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient’s personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.