Fri 5 Dec: After the Bell

PCE Steady, Nasdaq Firm, Treasuries Weaken Into Key Fed Week. Your 5’ evening market wrap📄📈

ℹ️ Today’s performance tables & charts on the ‘Market Data’ post.

Good evening,

Markets ended the week on a constructive note as investors focused on today’s PCE inflation release, the final major data point before next Wednesday’s Fed meeting, and drew further optimism from Netflix’s deal for Warner Bros.

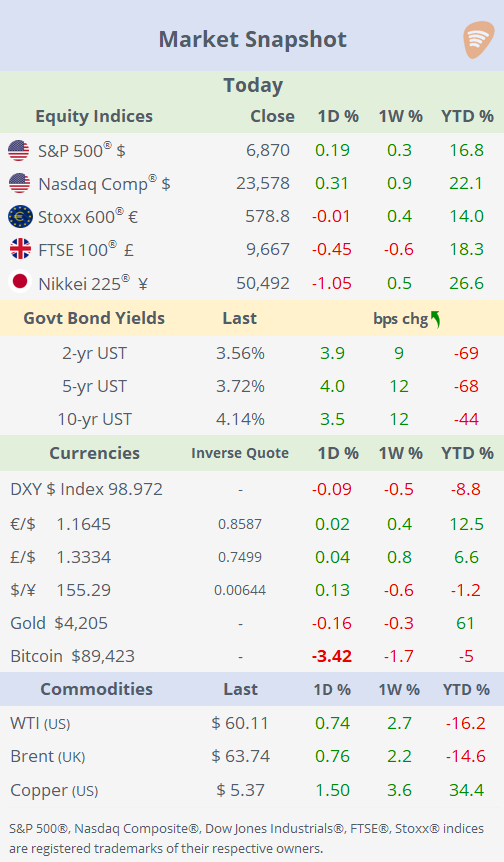

US equity indices advanced again, with Nasdaq benchmarks outperforming, and the S&P 500 now trading just shy of its all-time high. Sector-wise, IT led while healthcare lagged over the week. In rates, Treasuries suffered their worst week in six months as mixed data challenged expectations for the depth of Fed easing in 2026: mid-to-long maturities rose roughly 12bp this week, pushing the 30–2 year spread to 123bp, about 70bp wider YTD. Supply concerns ahead of Monday’s auctions of 3-, 10- and 30-year paper also weighed on sentiment.

Meanwhile, cryptos struggled to hold their recent recovery trend, with Bitcoin and Ethereum falling nearly 4% today to end the week modestly lower.

On the commodities front, US Natural Gas futures rallied over 4% on Friday, accumulating an 8% weekly gain to a 6-month high near $5.30/MMBtu, driven by colder-than-normal weather forecasts across the US Midwest, Northeast, and Great Lakes from December 3-13, which boosted expectations for heating consumption and sparked aggressive buying.

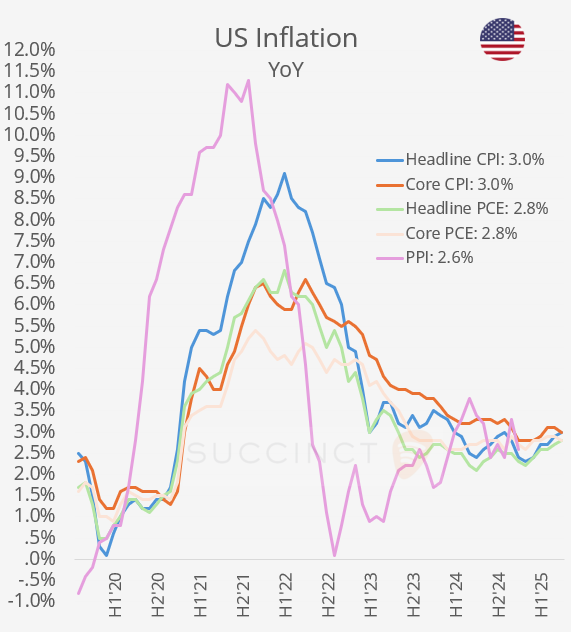

Data: → US headline PCE inflation rose 2.8% YoY in September (delayed release due to the shutdown), indicating headline inflation remains elevated but relatively stable. The core PCE (excluding food & energy) also came in at 2.8%, marking a slight deceleration from 2.9% in August — the first core slowdown since April. The data keeps inflation modestly above the Fed’s target, but supports high odds that markets will price in a rate cut at the meeting next week. The market odds for a quarter-point rate cut remain at 87%.

→ The University of Michigan’s Consumer Sentiment Index (prelim) rose to 53.3 in early December, up from 51 in November, signalling modest improvement. Inflation expectations eased slightly to 4.1% for the year ahead, though sentiment remains near multi‑year lows.

→ US personal income (+0.4% MoM) and spending (+0.3% MoM) are ticking up modestly, pointing to a fairly stable consumer backdrop ahead of the upcoming inflation‑watch events.

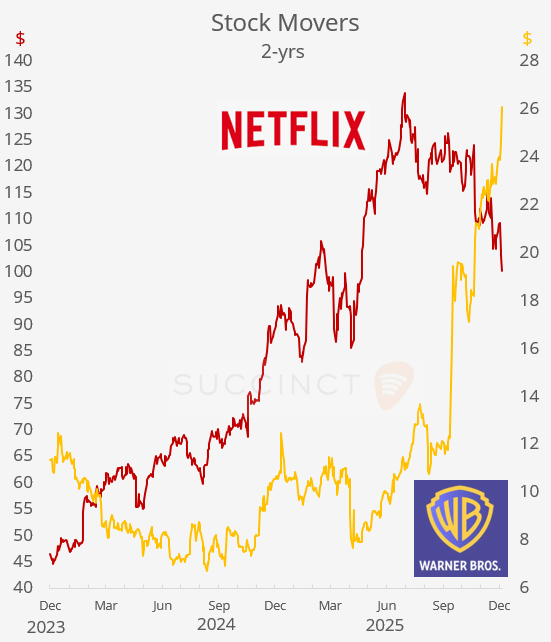

Deals: → Netflix (mcap $426bn) has agreed to acquire Warner Bros Discovery’s (mcap $64bn) studio and streaming businesses (film, TV content and HBO/HBO Max), valuing the division at $72bn ($83bn of enterprise value). The deal excludes WBD’s linear-TV and global-networks assets (e.g. CNN), which will be spun off into a separate public company, preserving their legacy cable structure. For Netflix, the acquisition significantly expands its content library and production scale, marking a strategic push to own one of Hollywood’s biggest studios while shedding legacy linear-TV burdens.

Netflix has secured a $59bn bridge loan from Wall Street banks to help fund the transaction, marking one of the largest debt financings ever for an M&A deal. WBD shares rose over 6% (+147% YTD) while Netflix fell 3% today (+12% YTD).

Day Ahead: Data → M: China trade; T: RBA rate decision; W: Fed & BoC rate decision, China inflation; Thu: US PPI inflation; F: UK GDP.

Earnings → T: Autozone; W: Oracle, Adobe, Synopsys; Th: Broadcom, Costco.

That’s all for this week. 🙏 share USMD:

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient’s personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.