Fri 7 Nov: After the Bell

Your 5’ evening market wrap 📄📈

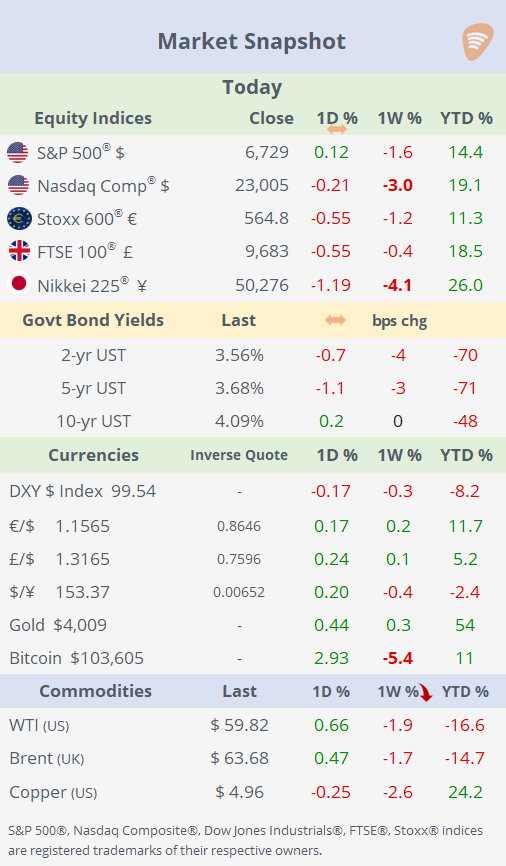

→ Indices + Large Caps + FX + Treasuries (yield curve)+ Commodities tables on the ‘Market Data’ post.

☺️ Friday,

It was a volatile end to the week for markets, with investor sentiment swinging on AI-related headlines, and any economic data available in the absence of official releases due to the government shutdown. Tech stocks, in particular, came under pressure as investors questioned lofty AI-stocks valuations, and every negative economic headline triggered sharp selloffs in the sector.

Today’s weak data on US consumer confidence added to the unease. Preliminary results from the University of Michigan showed household sentiment slipping toward record-low levels, as worries mount over the economic impact of the prolonged government shutdown. This follows yesterday’s report from Challenger, Gray & Christmas, highlighting the steepest private-sector job losses for October in 22 years, leaving the lack of official employment data even more evident.

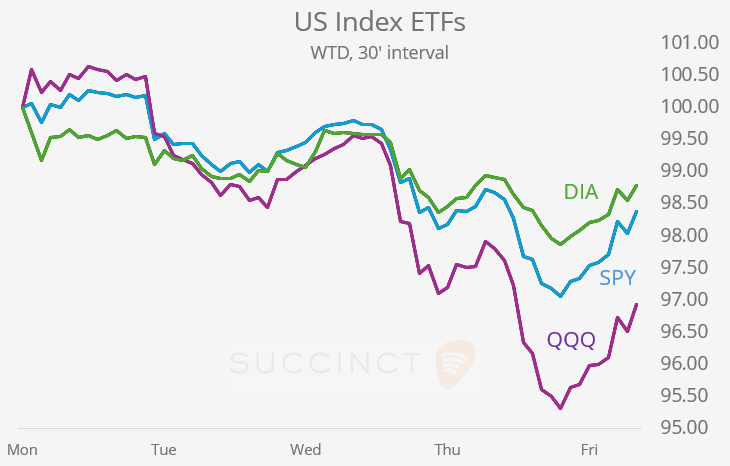

The Nasdaq Composite fell more than 2% intraday before rebounding sharply, but still ended the week down roughly 3%, its worst weekly performance in months. Stocks recovered somewhat toward the close amid reports that Senate Democrats were advancing a new plan to reopen the government. Senate Minority Leader Chuck Schumer proposed a one-year extension of expiring healthcare subsidies to break the month-long stalemate, following an earlier Republican proposal that remains at odds with Democratic priorities on the Affordable Care Act.

For the week, technology stocks were the weakest performers with a 4% decline, followed by communication services, which include a few mega-cap names, down 2.3%.

In currencies, the DXY $ index ended little changed below 100, while cryptos remained active: Bitcoin finished 5% lower and Ethereum down 10% on the week despite a Friday bounce. Commodities also weighed on sentiment, with crude oil closing 2% lower week to date. (see Market Data for tables)

Data: → US Michigan Consumer Sentiment in November (Prelim) fell to 50.3 points, the lowest since June 2022 and the second-lowest level on record. The survey also showed that short-term inflation expectations for consumers increased to 4.7%, while long-term expectations eased to 3.6%.

→ China’s exports fell 1.1% YoY in October, the first decline since February, coming in below estimates and far weaker than the previous month, while imports rose 1% YoY, also missing forecasts and significantly slower than in September.

→ US non-farm payrolls for October were not released today due to the government shutdown; the data was scheduled but postponed.

Earnings: → Constellation Energy, Duke Energy, and KKR all reported earnings today before the open, and none of the stocks showed notable moves because results were generally in line with analyst expectations, with no major surprises or misses to drive volatility.

→ Ubiquiti (mcap $37bn), the computer networking equipment company, beat sales and profit estimates with strong quarterly results, but the stock plunged 20% due to analyst concerns about a steep slowdown in earnings growth next year and its high valuation, trading at 48x trailing earnings and over 64x trailing free cash flow. The stock gained 87% this year.

Deals: Friday was a quiet day for M&A and IPO activity, with no major deal announcements.

→ Comcast’s (mcap $99bn) Sky is in preliminary talks to acquire the broadcasting arm of UK broadcaster ITV (mcap £3bn) for an enterprise value of $2.1bn, a move that sent ITV shares up 16% and would allow the company to focus on its studio operations while expanding Comcast’s European footprint.

→ Nexi SpA (mcap €4.7bn), the Italian payments group, received a firm €1bn bid from private equity firm TPG for its digital banking solutions unit. Nexi shares are down 25% YTD.

Week ahead:

T: UK employment, Brazil inflation; Sony earnings. US bond market will be closed for Veterans Day, while stock markets will be open.

W: Germany PPI, India inflation; Softbank and Munich Re results.

Th: US CPI inflation, UK GDP, inflation, industrial production; Cisco, TransGidm, E.ON, RWE, Infineon earnings.

F: US PPI and retail sales, China industrial production, retail sales and fixed asset investments; Earnings by Japanese bank giants, Allianz.

🙏 Share & enjoy your weekend.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient’s personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.