Gold: From War to Central Banks & Speculators

Context, Background, Relative Value in 5 mins.

This week’s highlight: gold’s rally. The full post is open-access; feel free to share it🙏

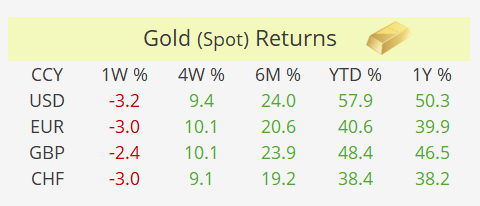

Gold reached new record highs last week, briefly touching $4,380 before a swift correction to around $4,110 by week’s end, yet remains firmly in the spotlight as demand stays strong across investors and central banks alike. This time, however, the move appears to be driven less by macro fundamentals and more by momentum. Behind the familiar “safe-haven” narrative lies a surge in speculative participation, investors chasing exposure on top of an already solid foundation of central bank demand, led by China and other emerging economies (India, Poland, Turkey).

For years, the gold market’s structural base has been remarkably steady. Roughly half of the world’s above-ground stock (valued at about $29tn) is held as jewellery, while annual consumption still sees around 45–50% absorbed by jewellery buyers, mainly in India and China. Industrial uses (electronics, medical devices, aerospace) account for only a small fraction (5-7%). The real swings in demand come from private investors and central banks, which together have represented roughly half of total global demand over the past three years.

The recent rally, though, reflects a clear change in investor behaviour. ETFs and futures traders have been adding exposure, seeking protection against policy uncertainty and riding the price momentum. Demand for gold as a store of wealth and imperfect inflation hedge is well established, but the latest surge has been amplified by speculative flows and FOMO. Investors are leaning into the trade not just for safety, but also for capital gains, a sign that greed, rather than fear, is now the dominant force.

That said, the foundation of this bull phase was laid by central banks. Since 2022, official-sector purchases have provided powerful support, with central banks accounting for roughly one-quarter of global demand, the highest share in more than a decade. The People’s Bank of China (PBoC) has led the way, steadily increasing its gold reserves from around 2% to nearly 10% of total reserves in just three years. China now holds about 2,303 tonnes (74mn troy ounces), or $303bn worth of gold, making it the world’s sixth-largest holder. That is still under a third of the Federal Reserve’s gold holdings.

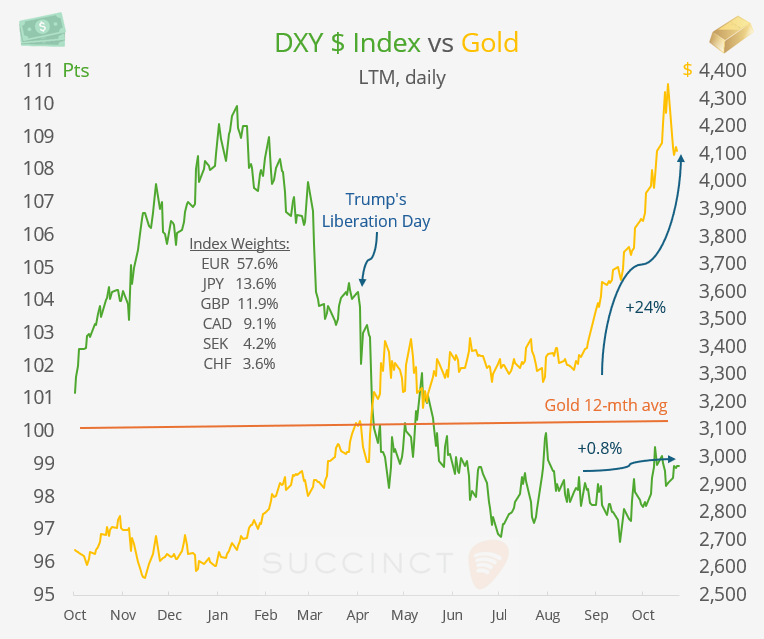

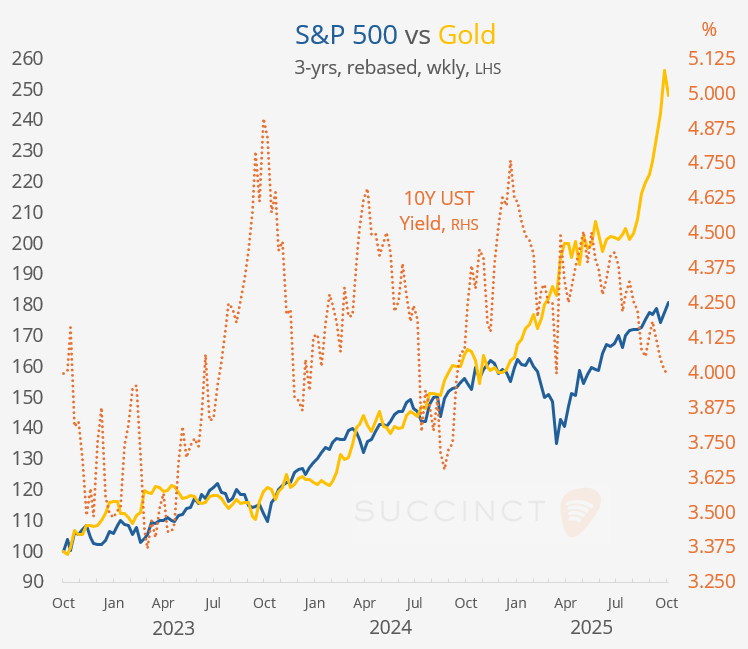

Beijing’s shift toward gold is part of a longer-term strategic rebalancing. The PBoC began accumulating more aggressively a few years ago, when 5-year U.S. TIPS yields were negative. Since then, real yields rose as the Fed tightened policy, peaking around +2% at the start of 2025 before easing back to roughly +1.2% now. This decline in real yields has strengthened the fundamental case for gold in recent months, providing additional fuel to the rally.

At the same time, China has steadily reduced its exposure to U.S. Treasuries, down about 42% since 2013, to roughly $730bn today (~24% of total reserves), underscoring a broader trend of de-dollarisation. That term describes the slow move by some countries to reduce reliance on the U.S. dollar as a reserve and settlement currency, often in response to geopolitical and financial risks. After Western sanctions froze hundreds of billions of Russia’s reserves in 2022, following Putin’s invasion of Ukraine, the logic of holding gold rather than fiat assets became undeniable: bullion stored domestically is immune to freezing, seizure and default.

Globally, the combined value of central bank gold holdings has now marginally surpassed their holdings of U.S. government debt, $4.1tn versus $3.9tn, a symbolic milestone in the shifting global reserve mix. This steady official accumulation has provided an underlying floor for prices even during periods when Western investors were on the sidelines.

But in recent weeks, it’s the investor side of the equation that has taken over. As real yields declined and expectations of rate cuts rose, speculative inflows into gold ETFs and futures have surged. The Dollar Index has remained broadly stable, yet gold prices have jumped, evidence that the rally is being driven by sentiment rather than by currency weakness.

Adding to the mix, geopolitics has returned as a market driver. The prospect of renewed U.S. - China trade tensions, especially with Trump signalling potential new tariffs and a harder stance on imports, has reinforced gold’s safe-haven appeal.

That combination of softer rates, lingering inflation uncertainty, and fresh geopolitical friction has created the ideal backdrop for a broad-based gold rally. Central banks continue to buy for strategic reasons, while investors are piling in for tactical ones. Together, they’ve built a powerful demand dynamic that keeps gold near record highs.

Looking ahead, a packed week, featuring the Trump-Xi Jinping summit, the Fed’s guidance at its policy meeting, and the potential resolution of the U.S. government shutdown, could generate significant movement in gold, though the direction remains uncertain.

Learn more About “US Markets Daily”.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient’s personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.