Mon 1 Dec: After the Bell

Stocks Pull Back; Crypto Sells Off as Yields Edge Higher: your 5’ evening market wrap📄📈

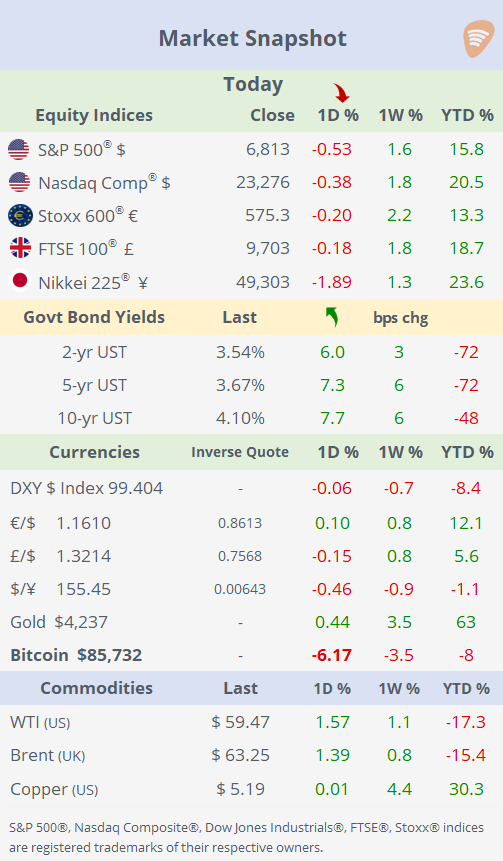

ℹ️ Today’s performance tables & charts on the ‘Market Data’ post.

ℹ️ FYI: We started posting a ‘Morning Markets Update’ on Substack Notes at ~6:30 AM NYT — these updates won’t be emailed.

Good evening,

A soft start to December saw equities retrace part of last week’s Thanksgiving-driven rally, which had been powered by rising expectations of a Fed rate cut and supportive commentary from policymakers. With the central bank now in its pre-meeting blackout, rate expectations hinge on incoming data, especially Friday’s delayed September PCE inflation report, the Fed’s preferred inflation gauge. Despite markets still assigning roughly an 87% probability to a rate cut in eight days, Treasury yields moved higher, led by a 6bp jump at the short end.

Political attention briefly turned to the Fed as Donald Trump said he has selected a successor to Chair Powell, though he offered no name; adviser Kevin Hassett is seen as a leading contender.

The crypto complex dominated headlines today as Bitcoin dropped 6% to ~86,000 in its sharpest decline since March, touching an intraday low near 84,000 after last week’s partial rebound.

In commodities, OPEC+ opted to keep output steady at its November 30 meeting, confirming no additional increases for early 2026 amid soft seasonal demand and excess-supply risks, helping push WTI crude up 1.6% to a 10-day high of $59.5.

In Japan, stocks (-1.9%) and bonds declined today as the Bank of Japan’s governor signalled a potential interest rate hike later this month, marking a shift in the bank’s ultra-loose monetary policy stance. The market reaction reflects investor caution ahead of the anticipated tightening move, weighing on risk assets and government bonds alike. The ¥ appreciated ~0.5% to 155.50.

Data: → US ISM Manufacturing PMI slipped to 48.2 in November, down from 48.7. The indicator has now stayed in contraction territory for nine straight months, with weakness concentrated in new orders, employment and backlogs.

Earnings: → After the close, database cloud platform company MongoDB (mcap $27bn) smashed expectations with Q3 results: revenue rose by 20% YoY to about $628mn, bolstered by strong growth in its cloud database offering (Atlas). It also raised its full-year guidance, signalling confidence in demand, and the stock jumped 16% in extended trading to an 18-month high.

Deals: → Deutsche Börse AG (mcap €41bn) has confirmed it is in exclusive, non-binding talks to acquire the European fund distribution platform Allfunds Group (mcap €4.6bn) in a deal valued at €5.3bn. Allfunds shares rose 18% from their undisturbed price last week.

→ Nvidia disclosed a 13.5% stake in Synopsys (mcap $81bn) worth roughly $2bn, marking a significant move into the electronic design automation ecosystem that underpins advanced chip development. The investment strengthens Nvidia’s positioning across the semiconductor supply chain as AI-driven chip complexity continues to accelerate. Synopsis rose 5% today but remains 10% lower YTD.

→ Goldman Sachs is buying ETF provider Innovator Capital Mgt (AUM $28bn) for $2bn to bolster its GSAM unit.

→ Oil and gas infrastructure company Targa Resources (mcap $39bn) agreed to acquire pipeline operator Stakeholder Midstream (private) for $1.25bn, expanding its midstream footprint in the oil-rich Permian Basin.

→ Somnigroup International (mcap $19bn), the bedding group created after Tempur-Sealy’s acquisition of Mattress Firm, has launched an all-stock bid to acquire Leggett & Platt (mcap $1.6bn) for $1.63bn, offering a ~30% premium to the 30-day average. The deal would fold Leggett & Platt’s adjustable-bed and mattress-spring operations into Somnigroup’s expanding bedding portfolio. Legget shares rose 15% today to accumulate a 23.5% gain this year.

Day Ahead: Data → €-zone, Korea inflation; UK home prices. Earnings → T: Crowstrike Holdings, Scotia Bank, Bank of Nova Scotia.

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient’s personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.