Mon 12 Jan: After the Bell

Fed Tensions and Geopolitics Set the Tone as Gold and Silver Hit Records. Your 5’ evening market wrap📄📈

ℹ️ Today’s performance tables & charts on the ‘Market Data’ post.

Good evening,

Today’s main driver of sentiment was Trump’s confrontation with Jerome Powell. The Fed Chair publicly accused the Trump administration of using the threat of criminal prosecution to pressure the central bank into cutting interest rates, marking an unprecedented escalation in tensions. Prosecutors are investigating Powell in connection with his testimony last summer regarding the Fed’s renovation project. In a rare and unusually direct video statement, Powell framed the Justice Department probe as a direct challenge to the Fed’s independence from political control.

A group of former Federal Reserve chairs, Treasury secretaries, and leading economists voiced support for Powell today, warning that the Justice Department’s threat of criminal prosecution poses serious risks to the central bank. The clash has renewed concerns over its independence and, more broadly, the resilience of US institutional governance.

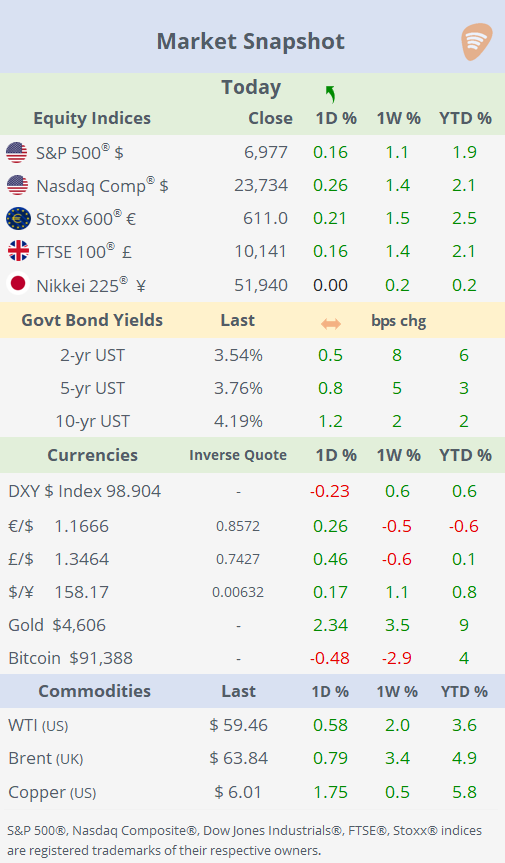

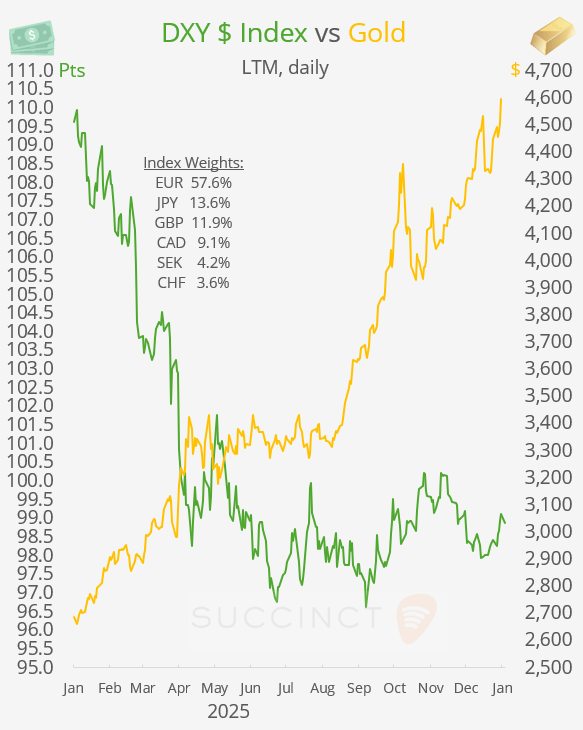

Markets opened the week on a cautious footing as investors digested Powell’s message, alongside renewed geopolitical uncertainty following weekend tensions involving Iran. Equities initially sold off but recovered into the close, and the S&P 500 closed at a new record, while the clearest price action was in commodities: gold rose 2%, and silver surged 7% to fresh record highs, lifting the entire precious metals complex. The DXY $ index edged lower, partially unwinding last week’s gains, as core rates were little changed ahead of tomorrow’s key US inflation print, with 10-year Treasuries at 4.19%. Meanwhile, oil extended its recovery for a third consecutive session, with WTI approaching $60 and trading at a one-month high.

On the corporate news front, Alphabet became the fourth Big Tech company to reach a $4tn market cap, driven by investor confidence that its AI capabilities can compete with rivals such as OpenAI. Sentiment was further boosted by a deal with Apple to integrate Google’s Gemini models into a revamped version of Siri on the iPhone.

Corporate Deals: → In the US biotech sector, Merck & Co (mcap $272bn) is in discussions to acquire cancer-drug developer Revolution Medicines (RVMD, mcap $23bn), with reports suggesting a potential valuation of $30bn. This deal would strengthen Merck’s oncology pipeline ahead of anticipated patent expirations on key products, but no agreement has been signed. Revolution shares jumped 50% in the past five days.

→ Mining giant Rio Tinto (mcap $134bn) is in early talks to acquire Anglo-Swiss miner Glencore Plc (mcap £55bn). A potential merger would create the world’s largest copper producer, capturing more than 7% of global output, exceeding Chile’s state-owned Codelco. The tie-up would also form the largest mining group globally, with an estimated enterprise value exceeding $260 billion, following recent sector megadeals such as Anglo American’s acquisition of Teck. Strategic interest is being driven by surging copper demand from the energy transition and AI, as prices have risen over 40% in the past year amid looming supply constraints. Glencore shares rose 12% in the past five days.

Data: → India’s headline CPI inflation rose to 1.33% year-on-year in December, up from 0.71% in November. This print came in slightly below economists’ expectations and remains well below the Reserve Bank of India’s inflation target range, supporting continued accommodative monetary policy prospects.

Day Ahead: → Data: US inflation (headline CPI expected unch at 2.7% YoY). → Earnings: Q4’25 kicks off on Tuesday with JP Morgan and Bank of NY Mellon.

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient’s personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.