Mon 13 Oct: After the Bell

🎙️📄+ Market Data

See the ‘Market Data’ post for tables & charts.

Good evening,

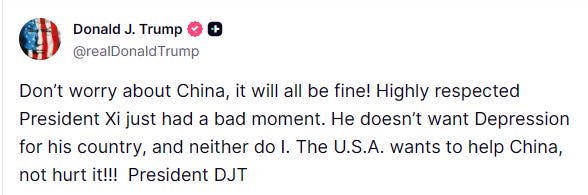

After Friday’s sell-off on fears of new US-China tariffs, Trump softened his rhetoric over the weekend, signalling on Sunday a more cautious approach that helped calm markets. Risk assets rebounded and recovered some of the lost ground as the ‘TACO’ trade held up for investors. Stock indices gained over 2% while bond markets were closed for Columbus Day. Crude oil also pulled back from recent losses, rising 2% on Monday, boosted by the Middle East peace deal.

Precious metals rallied to fresh records, with gold trading above $4,100 and silver jumping over 6%. The London silver market (LBMA) is experiencing a historic short squeeze, pushing prices above $50 for the second time in history, driven by a severe shortage of available physical silver and soaring borrowing costs for short positions. Traders are urgently transporting silver bars from New York to London via costly air freight to meet demand amid shrinking inventories and fears of US tariffs on critical minerals.

A notable mover among mega-caps was Broadcom (mcap $1.67tn), which surged 10% after OpenAI announced a new partnership to co-develop up to 10 gigawatts of AI accelerators. The deal comes a week after OpenAI’s multibillion-dollar agreement with AMD for up to 6 gigawatts of AI processors. Broadcom is 53% higher this year.

Geopolitics: Tension in the Middle East softened as Trump and Gaza mediators signed a cease-fire deal following a hostage-prisoner swap, signalling progress in the Israel-Gaza conflict.

French Politics: President Macron reappointed Sébastien Lecornu as Prime Minister on Friday, four days after his resignation, to stabilise the government and finalise the 2026 budget. Lecornu unveiled a new cabinet on Sunday, retaining key ministers and introducing new faces to address France’s political and economic challenges.

Economics: China’s exports jumped 8.3% YoY in September, smashing forecasts, while imports surged 7.4%—the strongest since April 2024, with both figures driven by new demand outside the US and strategic stockpiling. Despite fresh US tariffs, exports to markets like ASEAN and Africa reached record highs, but exports to the US slumped 27%, and the trade surplus shrank more than expected.

India’s headline CPI inflation fell to 1.54% YoY in September, its lowest reading in over 8 years, well below consensus and the central bank’s lower bound. The drop was driven by deepening food price deflation, and the persistent easing trend now opens the door for a potential rate cut by the RBI in December.

Germany’s wholesale prices rose 1.2% YoY in September, the fastest pace since March and up from 0.7% prior, marking ten straight months of gains. The increase was led by higher food, beverage and metal prices.

Earnings: Fastenal (mcap $49bn), a wholesale distributor of industrial and construction supplies, reported a small miss on net profits while revenues met expectations, up 12% YoY. It also cautioned about potential margin pressures in the next quarter due to ongoing cost increases and possible delays in pricing adjustments. Shares dropped 7% today, are down 12% over the past week, but remain up 20% YTD.

Business News: The founder and CEO of First Brands stepped down, weeks after the auto parts supplier filed for bankruptcy amid an accounting scandal that has left lenders searching for over $2bn in missing funds. Funds managed by UBS and Jefferies are among the most exposed.

Deals: In Europe, Czech-based lottery and gaming company Allwyn and Greek gambling operator OPAP (mcap €7.4bn) will merge in an all-stock deal to create a €16bn European gambling giant, with Allwyn holding 78.5%, making it the world’s second-largest listed gambling company after Flutter.

In the private markets, Brookfield, already the owner of 74% of Oaktree Capital Mgt, will acquire the remaining 26% for $3bn, expanding its private-credit business.

Also, Citadel agreed to acquire Hamburg-based power trader FlexPower, which manages over 1,700 MW across six European markets. Financial terms were not disclosed.

Day Ahead:

Earnings (AM): JPM, Citi, Goldman, Wells Fargo, J&J, LVMH.

Data: UK employment report.

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient’s personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.