Mon 15 Sep: After the Bell

🎙️📄+ Market Data

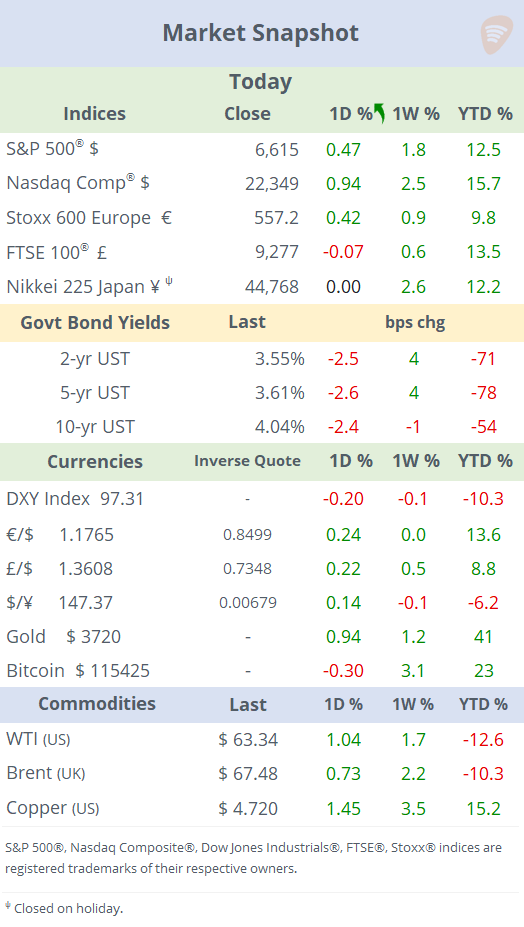

See the ‘Market Data’ post.

Good evening,

U.S. stocks hit fresh record highs today, led by a Tesla surge after Elon Musk disclosed a $1bn share purchase. It was a light day on the data and earnings front, with markets instead driven by an almost certain Fed rate cut this week and optimism over the U.S. and China moving closer to a framework deal on TikTok. Markets expect a 25bp Fed rate cut on Wednesday and assign a 75% chance to another quarter-point move in October to 3.875% mid-rate.

In geopolitics, the U.S. and China agreed on a preliminary framework for TikTok regulation ahead of Wednesday’s deadline, a move aimed at preserving the possibility of a Trump - Xi summit.

“The relationship remains a very strong one!!!”, Trump posted on Monday.

Business headlines: CEO Musk bought $1bn worth of Tesla stock (+3.5% today), a move that marks his first open-market acquisition since early 2020 and comes amid Tesla's strategic shift towards AI, robotics, and robotaxi initiatives, as well as his record compensation package.

Trump urged U.S. companies to abandon quarterly earnings reports, suggesting semi-annual disclosures would save money and let executives focus on operations.

“Subject to SEC Approval, Companies and Corporations should no longer be forced to ‘Report’ on a quarterly basis . . . but rather to Report on a ‘Six (6) Month Basis’,” Trump posted.

Economic releases: China's economic indicators showed signs of slowing growth. Industrial production increased by 5.2% YoY, marking the slowest pace since August 2024. Retail sales rose by 3.4%, the weakest since November. New home prices declined 2.5% YoY, continuing the downward trend in the property sector. These figures suggest a cooling economy, prompting expectations for additional stimulus measures to support growth.

Regarding sovereign credit ratings, S&P raised its long-term rating on Spain on Friday by one notch to A+, leading to a rally in sovereign bonds, with the 10-year Bono closing at 3.23% today.

Along with that, Fitch Ratings downgraded France by one notch to A+. The downgrade reflects concerns over France's persistent public deficits, rising debt, and political instability, which have hindered efforts to implement effective fiscal reforms. 10-yr French bonds (OATs) are yielding 3.50% (+28bp YTD), 80bp over German Bunds and very close to Italian BTPs at 3.52%. Corporate bonds issued by several French blue-chip companies (Airbus, L’Oreal) are trading through the French curve despite their illiquidity.

Deals: In private markets, Singapore’s SWF GIC is selling U.S. landlord Yes! Communities to Brookfield in a $10bn transaction, marking one of the largest real estate takeovers in three years. Also, Blackstone agreed to buy a natural gas plant in Western Pennsylvania for nearly $1bn, as it bets on rising U.S. electricity demand to power A.I. technologies.

IPOs: UK fintech company SumUp is considering an IPO that could value the business between $10-15bn. Ottobock, a German prosthetics manufacturer, announced plans to raise €100mn in Frankfurt and estimates a valuation exceeding €6bn.

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.