Mon 17 Nov: After the Bell

Your 5’ evening market wrap 📄📈

Indices + LargeCaps + FX + Treasuries + Commodities tables on the ‘Market Data’ post.

Good evening,

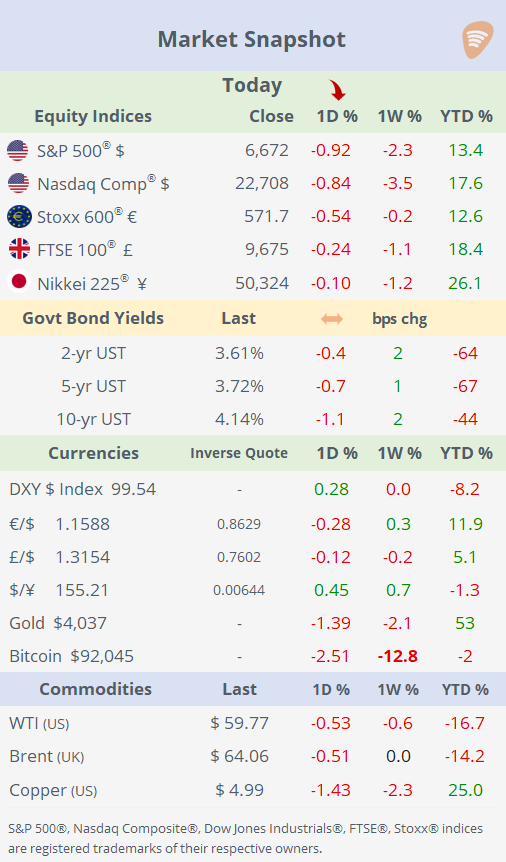

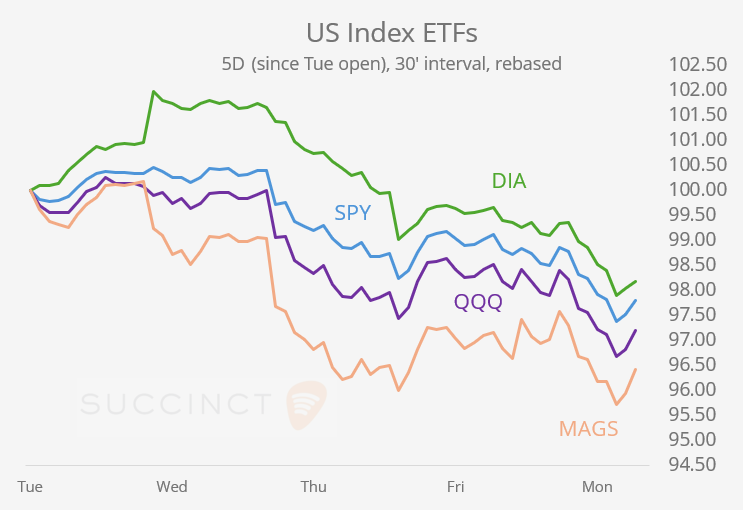

The selloff intensified on Monday, with equities falling sharply across regions as US financials, tech names and especially mid- and small-caps led the decline, including a 2% drop in the Russell 2000. AI-driven valuations remained the key driver of sentiment ahead of two major catalysts this week: Nvidia’s earnings on Wednesday after the close and the delayed September jobs report on Thursday.

Volatility picked up, with the VIX climbing to 22.4%, its highest level in a month. The dollar strengthened against all major currencies, while cryptos extended their slide, with Bitcoin down 13% for the week to its lowest level since April. Benchmark bond yields were little changed on the day.

Elsewhere, Japanese long‑dated government bond yields surged, with the 20‑year JGB yield reaching almost 2.75%, its highest level in 26 years, as investors reacted to a proposed ¥17tn ($110bn) fiscal stimulus package, weaker-than-expected economic data (GDP), and reduced bond-buying support from the Bank of Japan. The combination of expanded government spending and a less accommodative central bank stance has stoked concerns over higher long-term borrowing costs, prompting the sharp move in the long-end of the curve.

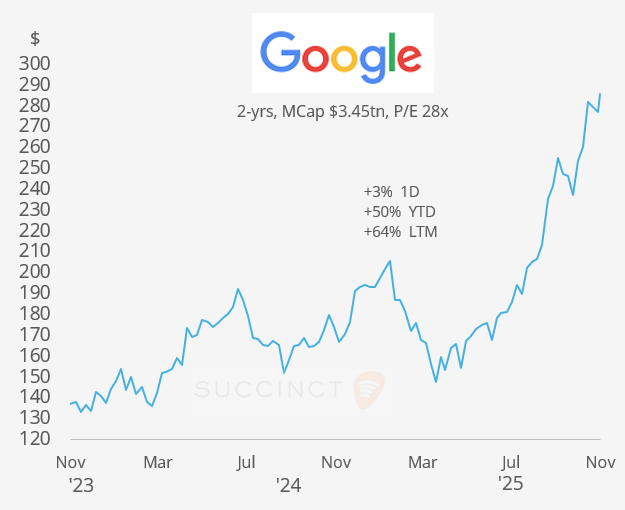

Business News: → Alphabet shares jumped 3% after Berkshire Hathaway disclosed a ~$5bn stake (equal to 0.14%), highlighting a rare tech investment by Buffett amid market concerns over soaring AI spending. The move underscores investor interest in established tech giants despite massive capital outlays on AI infrastructure. Shares are trading at their record high after this year’s 50% rally.

→ Today’s large-cap notable mover was Dell Technologies (mcap $82bn) down 8.4% after Morgan Stanley double-dowgraded the stock to underweight (and other six hardware names) on sluggish expected demand. Dell is 6.3% higher YTD.

Economic Data: → Japan’s GDP fell 1.8% year‑on‑year in Q3 2025, defying expectations of a −2.5% drop and marking a sharp reversal from the 2.3% growth seen in Q2.

→ Switzerland’s economy contracted by 0.5% quarter‑on‑quarter in Q3 as US tariffs and global slowing weighed heavily on chemicals and pharmaceutical exports.

Central Banks: → Fed Vice Chair Jefferson, a voting member of the FOMC, emphasised that the central bank should “proceed slowly” with any further interest-rate cuts, highlighting increased downside risks to employment and noting that current policy remains “somewhat restrictive.”

→ Governor Waller signalled support for a December rate cut, citing mounting concerns over a weakening labour market and sharply slowing hiring.

The market-implied probability of a quarter-point rate cut by the Fed in December fell further today to 43%, while the chance of no change stands at 57%.

Corporate Deals: → Johnson & Johnson (mcap $480bn) is acquiring Connecticut-based cancer-drug developer Halda Therapeutics (privately held) for $3bn, snapping up its oncology pipeline as a hedge against upcoming patent cliffs. The deal underscores Big Pharma’s renewed interest in high-potential biotech companies in a highly competitive M&A environment.

→ Gibraltar Industries (mcap $1.53bn), which manufactures products for residential, infrastructure, renewable-energy and agricultural-technology markets, is buying OmniMax International for $1.34bn in cash from funds managed by Strategic Value Partners. This move broadens its footprint in residential building products. The acquisition strengthens Gibraltar’s portfolio as it pushes deeper into home-improvement and exterior-solutions markets. Gibraltar shares fell 12% today.

→ In a public-to-private deal, Clayton Dubilier & Rice is set to acquire Sealed Air (mcap $6.1bn) for $6.2bn in cash, valuing the packaging group at roughly $10bn including debt. The deal, expected to close in mid-2026, will take the maker of Bubble Wrap private as it aims to revive growth under new ownership.

→ In European credit markets, KKR has agreed to buy up to €65bn of PayPal’s European buy-now-pay-later loans, a renewed deal that provides PayPal with significant balance-sheet flexibility and underscores ongoing investor appetite for consumer credit assets despite higher funding costs.

→ Amazon is launching a $12bn corporate bond sale, its first in nearly three years, including a six-part deal with the longest tranche a 40‑year bond expected to price about 115bp above Treasuries. The issuance adds to a wave of Big Tech debt this year, following Alphabet’s $25bn sale earlier this month, Meta’s record $30bn issuance in October, and Oracle’s $18bn offering in September, reflecting the sector’s push to finance heavy investments, particularly in AI infrastructure.

Day Ahead: → Data: US factory orders, import/export prices, ADP weekly employment.

→ Earnings: Home Depot (AM).

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient’s personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.