Mon 22 Sep: After the Bell

🎙️📄+ Market Data

See the ‘Market Data’ post❗

Good evening,

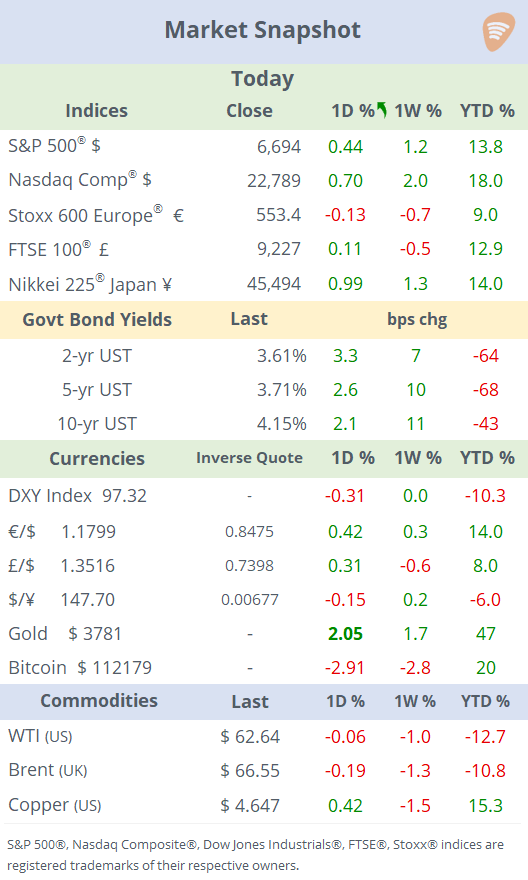

Equities extended their rally to fresh record highs, with the Nasdaq up 18% YTD, outperforming European benchmarks in local currency terms. Optimism was fueled by progress in U.S.-China trade talks and news of Nvidia’s investment in OpenAI.

In bond markets, yields edged higher by a few basis points despite dovish signals from Fed officials, while gold closed at a record high. Newly appointed Fed Governor Stephen Miran said he favours cutting interest rates by ~2 percentage points, warning that current levels are too high and could threaten the U.S. economy. The statement did not affect traders’ expectations of a quarter-point rate cut in October, which still carries a 90% probability. Gold hit a fresh record high of $3,781, driven by expectations of further rate cuts.

In geopolitics today, the UK, Canada, and Australia recognised Palestine as an independent state, aiming to support a two-state solution. The move comes as Israel intensifies military action in Gaza and expands settlements in the occupied West Bank. The US, Japan, Germany and Italy have not yet followed. TikTok Deal: China’s ByteDance pledged to keep TikTok available to U.S. users, easing concerns over a potential ban.

Business headlines: Nvidia plans up to $100bn investment in ChatGPT’s parent to expand data centre capacity, with rollout starting in 2026. Nvidia advanced 4% today to a total market cap of $4.47tn.

Economics: In a light day for data releases, China maintained its one-year LPR at 3.00% and the five-year LPR at 3.50%, unchanged for the fourth consecutive month. Despite economic headwinds with slowing factory output and weak retail sales, Beijing is holding rates steady, signalling caution rather than aggressive stimulus for now.

Corporate Deals: Pfizer (mcap $137bn) will acquire weight-loss drug developer Metsera (mcap $5.6bn) for up to $7.3bn, at a 43% premium to its previous close, marking its return to the obesity drug market. Shares surged 61% and accumulated a 110% rally this year.

Healthcare firm Premier (mcap $2.3bn), a provider of supply chain and services solutions for hospitals, will be taken private by Patient Square Capital in a $2.6bn deal. Shares gained 10% to a two-year high and are now 33% higher YTD.

PROS Holdings (mcap $1.1bn) agreed to be acquired by Thoma Bravo in a deal that values the software company at $1.4bn. Shares rallied 40% on Monday.

In the Spanish banking sector, BBVA improved its bid for Sabadell (mcap €16bn) to €17bn, seeking to close an 18-month pursuit of the smaller Spanish rival. Sabadell shares fell 4% today but remain 72% higher this year.

In frontier markets news, the U.S. Treasury signalled a potential financial rescue for Argentina following last week’s steep market sell-off and ahead of mid-term elections next month, considering swap lines, debt purchases, and direct currency support.

Argentina is a systemically important U.S. ally in Latin America, and the Treasury stands ready to do what is needed within its mandate to support Argentina, Bessent said.

Credit ratings: Fitch upgraded Italy's long-term credit rating by one notch to BBB+ (stable outlook), citing improved fiscal performance and political stability. 10-year BTPs are yielding 3.54%, almost unchanged YTD, and 79bp over Bunds.

Day ahead: G7 PMIs for September; Jerome Powell’s speech in Rhode Island; Micron Tech earnings after the close.

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.