Mon 24 Nov: After the Bell

Your 5’ evening market wrap 📄📈

Indices + LargeCaps + FX + Treasuries + Commodities tables on the ‘Market Data’ post.

Good evening,

Starting today, we’ll post a ‘Morning Markets Update’ on Substack Notes at ~6 AM NYT — these updates won’t be emailed, but you can catch them directly on Notes.

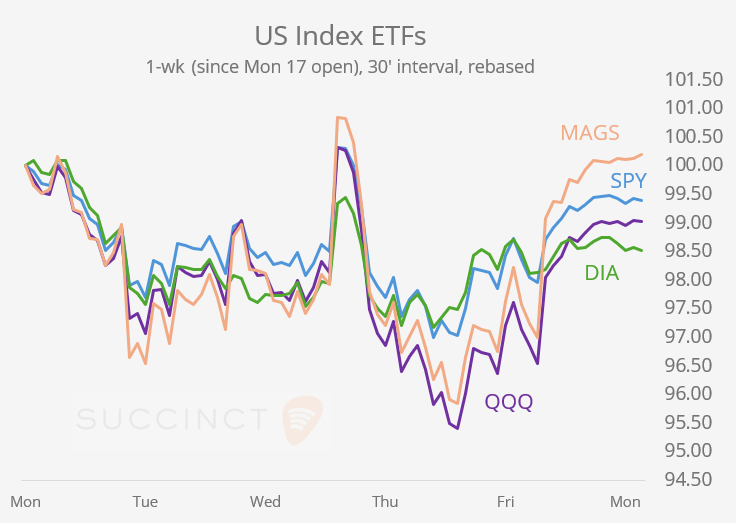

Stocks extended Friday’s rebound, fueled by renewed hopes for a Fed rate cut and positive developments on China trade. The New York Fed head left the door open to a December interest rate cut, and markets are now pricing in an 81% chance of a quarter-point reduction, up from 71% on Friday and 42% a week ago. Volatility in rate expectations has been heightened in recent weeks by delayed and cancelled economic data, Trump’s pressure on the Fed, and mixed views within the FOMC.

IT mega caps rallied today, with the chip sector and AI-related names driving gains. The Philly Semiconductor Index rose nearly 5% and is now 33% higher YTD. The Nasdaq Composite recorded its best day in over six months, while Alphabet shares jumped 6.3% on optimism around its AI model Gemini 3, launched last week. Tesla and Broadcom also contributed to the tech rally.

Trump posted that he held “a very good telephone call with President Xi” and plans to visit Beijing in April. Xi Jinping called him to discuss Taiwan, a flashpoint that has intensified amid Japan’s more assertive stance on the island’s autonomy.

Benchmark bond yields edged lower, with the 10-year Treasury closing at 4.04%, its lowest closing level in nearly a month. Forex markets remained quiet, gold advanced over 1.5%, and Bitcoin gained 2%, pausing its recent decline.

European defence shares fell, with Rheinmetall AG down 5%, after the White House highlighted progress in Ukraine-Russia talks. A notable large-cap mover in Europe today was Danish pharma giant Novo Nordisk (mcap $200bn), whose shares fell 6% after its Alzheimer’s drug semaglutide failed to slow disease progression, trading at their lowest level since mid‑2021 and down 47% for the year.

Central Banks: → Monday was an active day on the Fed front. Trump publicly threatened to fire Jerome Powell, accusing him of being “grossly incompetent” for not cutting interest rates faster, and urged Treasury Secretary Bessent to pressure the Fed to act — warning, “if you don’t get it fixed fast, I’m going to fire your ass.”

→ Fed’s Christopher Waller signalled that a December quarter-point rate cut would be appropriate amid a soft labour market and easing inflation, joining John Williams in setting the stage for Fed easing. He noted the outlook for January is more uncertain, given the delayed economic data from the government shutdown.

→ On Saturday, Boston Fed President Susan Collins said she sees no urgent need for a December rate cut, highlighting the challenge Jerome Powell faces in building consensus amid a divided committee over inflation and labour-market risks.

→ ECB President Lagarde gave a speech today and reaffirmed the central bank’s commitment to its 2 % inflation target and stressed that monetary policy is data‑dependent and meeting‑by‑meeting, with no preset path for rate cuts. She added that financing conditions are now easier, supporting demand, but warned the economy still faces headwinds and that rate cut timing remains uncertain.

Geopolitics: → The first G‑20 summit on African soil adopted a 122‑point declaration on solidarity, equality, and sustainability, advancing climate, debt relief, and multilateral priorities despite the US boycott.

Data: → The Dallas Fed Manufacturing index slid to -10.4 in November, marking the ninth negative reading in the last 10 months, underscoring persistent weakness in Texas factory activity.

→ Sentiment among German companies marginally deteriorated, with the Ifo Business Climate indicator edging lower. In contrast, the other Ifo surveys remained little changed from the prior month and broadly in line with forecasts.

Deals: → Spanish utility Iberdrola (mcap €120bn) has launched a tender offer to take its Brazilian subsidiary Neoenergia (mcap $7.2bn) private, offering $1.2bn to acquire the remaining ~16% of shares it does not already own. Neoenergia shares jumped 7% in São Paolo and are 70% higher YTD.

→ In private markets, British fintech Revolut has completed a secondary share sale valuing the fintech at $75bn, up sharply from its $45bn valuation last year. The transaction was led by Coatue, Greenoaks, Dragoneer, and Fidelity, with participation from investors including NVentures (Nvidia), a16z, and Franklin Templeton.

Day Ahead: Data → US PPI, retail sales, pending home sales, ADP employment.

Earnings → Alibaba, Analog D, Dell T, Workday and HP.

A reminder that US markets will be closed on Thursday and will have an early close on Friday.

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient’s personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.