Mon 27 Oct: After the Bell

Your 5’ evening market wrap 📄🎙️📈

See the ‘Market Data’ post for tables & charts.

Good evening,

It was a strong start to the week for risk assets, driven by updates on the trade front, ahead of this week’s Fed meeting and tech mega-cap earnings reports.

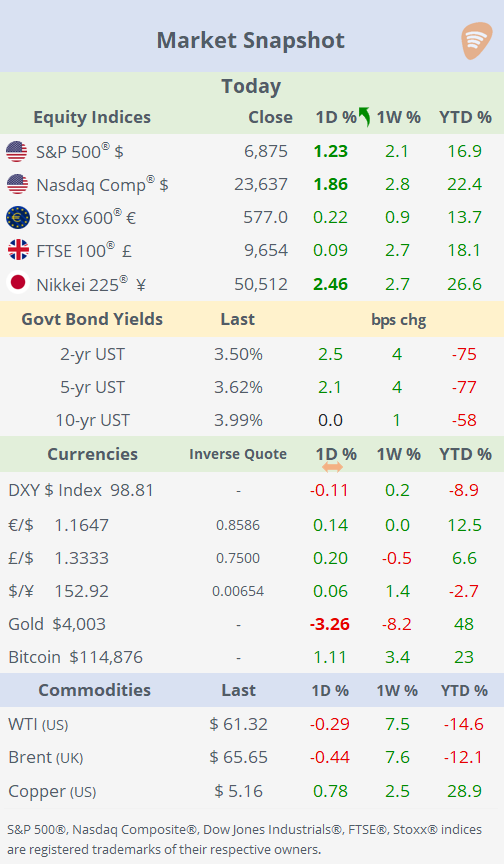

Stock indexes hit new record highs after reports of “constructive” trade talks between US and Chinese officials in Malaysia. Key issues discussed included export controls, tariff suspensions, and fentanyl enforcement. Optimism ahead of the Trump–Xi summit later this week boosted investor sentiment. Benchmarks in the UK, France, Japan, South Korea and Taiwan also hit all-time highs. The positive tone pushed gold prices below $4,000, down 9% from their record high a week ago. Core bond yields, major currencies, and crude oil prices saw little movement today, with markets largely focused on equities and trade headlines. There were no major economic data or corporate earnings releases of note today.

Geopolitics: Trump and Treasury Secretary Bessent’s bet on Argentina paid off: Javier Milei and his La Libertad Avanza right‑wing party won a decisive victory in yesterday’s midterm election, securing 41% of the national vote, while the Peronist left‑leaning opposition, Fuerza Patria, received 31.7%. The result gives Milei at least one-third of seats in both legislative chambers, enough to preserve veto power and push through key decrees. The win is widely seen as a boost for pro-market policies in the country. The peso (ARS) appreciated 5% while stocks skyrocketed 30% and bonds gained over 20% on average on Monday.

→ Russia claims to have successfully tested the world’s first nuclear-powered missile, capable of flying 8,700 miles and evading defences.

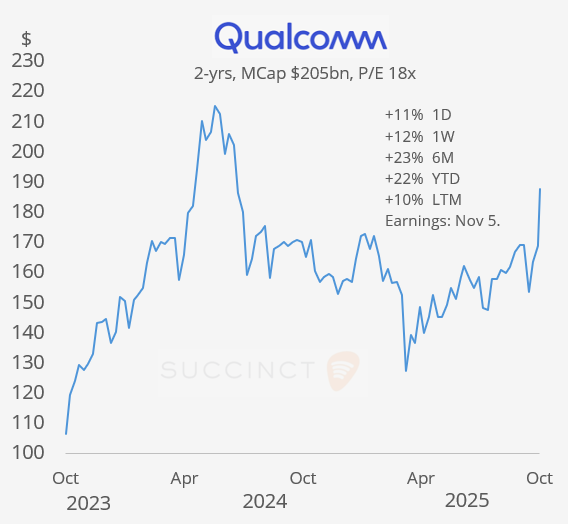

A notable large-cap mover today was semiconductor maker Qualcomm (mcap $205bn), which surged over 11% today (+23% YTD), following the announcement of new accelerator chips. These chips, optimised for AI inference tasks in data centres, position Qualcomm to compete with Nvidia and AMD in the rapidly growing AI infrastructure market. It also revealed a significant partnership with Saudi Arabia’s HUMAIN, which plans to deploy 200 megawatts of AI computing capacity using Qualcomm’s chips starting in 2026.

Business news: Amazon (mcap $2.4tn) announced plans to cut 30,000 corporate jobs, ~10% of its corporate workforce (it employs a total of 1.56mn people), marking one of the largest workforce reductions in its history. Shares added just 1% today.

Weather: Hurricane Melissa is intensifying into a Category 5 storm, posing a severe flooding threat to Jamaica, Haiti, and Cuba.

Corporate Deals: It was an active start of the week for M&A deals.

→ New Jersey-based American Water Works Co (mcap $27bn) and Essential Utilities (mcap $11.5bn) of Pennsylvania, announced an all-stock merger that will create a utility valued at ~$40bn (or $63bn including debt) to serve 4.7mn connections across 17 states and will be named American Water. Shares of both barely moved today.

→ Swiss pharma giant Novartis (mcap $252bn) agreed to acquire Avidity Biosciences (mcap $10bn) for $12bn ($72 per share), marking its largest deal in over a decade. The offer represents a 46% premium and expands Novartis’s pipeline in rare disease therapies. Avidity shares rallied 42% today to their all-time high.

→ Janus Henderson (mcap $7.3bn, AUM $457bn), the British American global asset management group headquartered in the City of London, received a take-private bid in cash from Nelson Peltz’s Trian Fund Management and General Catalyst that values the firm at $7.2bn. Janus jumped 11% today to a 4-year high and is 10% higher YTD.

→ In the US regional bank sector, Ohio-based Huntington Bancshares (mcap $22bn) will acquire Mississippi-based Cadence Bank (mcap $7bn) in a $7.4bn all-stock deal. Cadence shares are trading at their all-time high after gaining 10% this year.

IPOs: MapLight Therapeutics debuted on the Nasdaq, pricing its IPO at $17 and raising ~$260mn. The California-based biotech firm, specialising in treatments for central nervous system disorders. Shares gained 8% today to a market cap of $770mn.

Day ahead: Earnings by Visa, UnitedHealth, UPS, PayPal and HSBC.

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient’s personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.