Mon 3 Nov: After the Bell

Your 5’ evening market wrap 📄📈

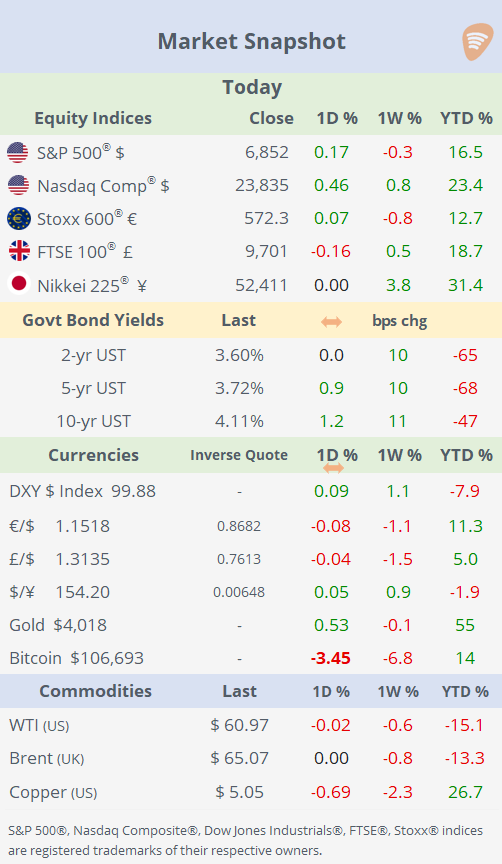

See the ‘Market Data’ post for tables & charts

Good evening,

Equities started the week on a mixed note, with the S&P 500 and Nasdaq Composite closing higher on optimism around AI‑related deals, while the Dow Jones slipped, weighed down by Merck (-4%) and Nike (-3%). Overall, half of the sectors finished in the red, highlighting uneven market breadth.

In forex and commodity markets, the DXY $ index, gold, crude oil, as well as benchmark bond yields, all traded in narrow ranges, showing little change. Meanwhile, the crypto market experienced a sharp pullback, as profit-taking and cautious sentiment sent Bitcoin down over 3% and Ethereum plunging nearly 8% to its lowest level since early August.

Amazon advanced 4% after announcing a $38bn deal with OpenAI to run its AI workloads on Nvidia GPUs via Amazon Web Services. The deal underscores AWS’s central role in powering AI infrastructure and highlights growing demand for high-performance computing.

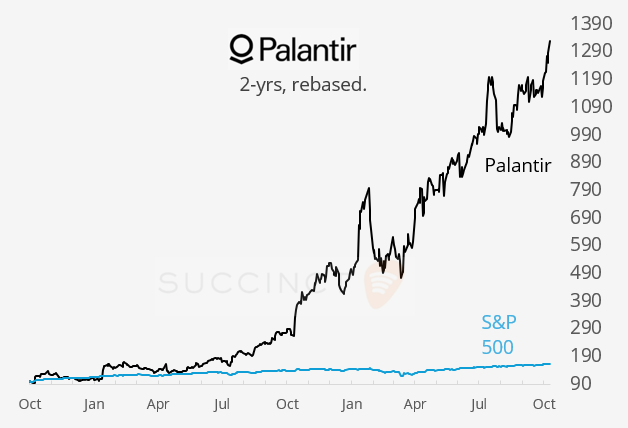

Earnings: After the close, data analytics company Palantir Technologies (mcap $491bn) beat Q3 expectations, reporting $1.18bn in revenue and $600.5mn in operating income. It also raised full-year revenue guidance to $4.4bn from $4.15bn and sees Q4 results above Wall Street expectations, despite analyst concerns over the ongoing US government shutdown. Shares closed 3.3% higher and added 2% in extended trading following the results, to accumulate a 175% YTD gain.

Central banks: Fed officials Austan Goolsbee, Lisa Cook, and Mary Daly signalled uncertainty over a December rate cut, citing inflation and labour-market risks amid missing economic data from a government shutdown. Their comments reflect a divided Fed stance as policymakers weigh the next move in monetary policy. Futures markets are pricing in a 67% chance of a quarter-point rate cut in December, up from 63% on Friday.

Economics: It was a light start to the week on the data front. The US ISM Manufacturing PMI fell to 48.7 in October from 49.1 in September, remaining below 50 since February and signalling that the manufacturing sector continues to contract.

Corporate Deals: → Kimberly-Clark (mcap $34bn) agreed to acquire Tylenol maker Kenvue (mcap $31bn) in a cash-and-stock deal valued at about $40bn, or $49bn including debt. The offer of $21/share represents a 46 % premium to Kenvue’s last closing price. Kenvue was spun off in ´22 from Johnson & Johnson. The merger will create a consumer health-and-wellness giant combining Kimberly-Clark’s Kleenex and Cottonelle brands with Kenvue’s Tylenol and Listerine. Kimberly shares fell 15% while Kenvue jumped 12% but remain 24% lower YTD.

→ Oil & gas producers SM Energy (mcap $2.2bn) and Civitas Resources (mcap $2.6bn) agreed to merge in an all-stock deal, creating a company with an enterprise value of $13bn, focused on the Permian Basin. Civitas shareholders will hold about 52% of the combined company, which will operate under the SM Energy name. The transaction highlights a renewed wave of US energy-sector dealmaking as consolidation accelerates in the Permian. SM Energy shares fell ~7% and are 50% down this year.

→ In private markets, US–Irish industrial conglomerate Eaton Corp (mcap $150bn), best known for power-management and electrical systems, has agreed to acquire Boyd Thermal from GSAM for $9.5bn, its biggest deal to date. The deal strengthens Eaton’s position in the fast-growing data-centre and AI-infrastructure market by adding advanced liquid-cooling technology.

Day ahead:

The Reserve Bank of Australia´s policy meeting (unch at 3.6% exp); US balance of trade; Earnings by AMD, Uber, Arista, Amgen, Pfizer, BP, Ferrari and Shopify.

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient’s personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.