Mon 8 Dec: After the Bell

Cautious Trading Before Fed Decision; Paramount Disrupts Dealmaking. Your 5’ evening market wrap📄📈

ℹ️ Today’s performance tables & charts on the ‘Market Data’ post.

Good evening,

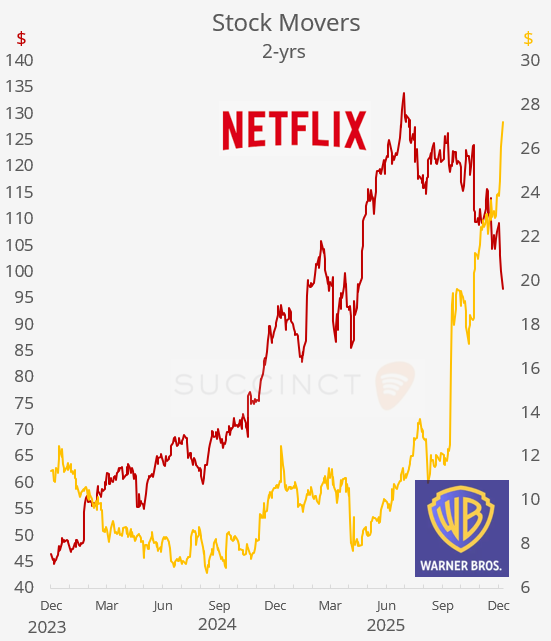

Markets are holding steady ahead of Wednesday’s Fed decision. A rate cut is widely anticipated, but investors remain cautious about the central bank’s tone and forward guidance. The headline corporate story is Paramount’s hostile bid for Warner Bros., a direct challenge to Netflix’s move last week.

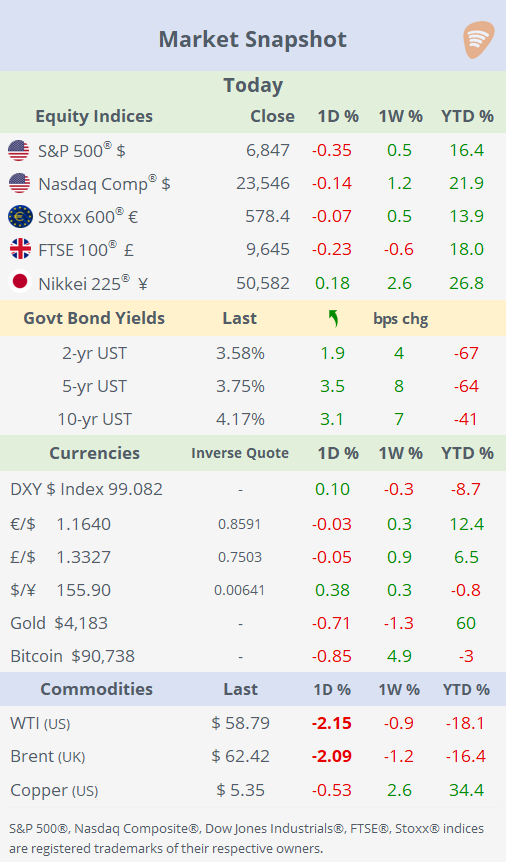

Major US indices slipped about 0.3%, with nearly all 11 S&P 500 sectors in the red. Consumer discretionary led the declines, while technology was the only sector posting gains. Nvidia advanced (1.7%) on optimism over potential approval to export AI chips to China, while Tesla fell more than 3% after a Morgan Stanley downgrade citing near-term pressure in its EV business — even as analysts highlighted its long-term potential in autonomous driving and robotics.

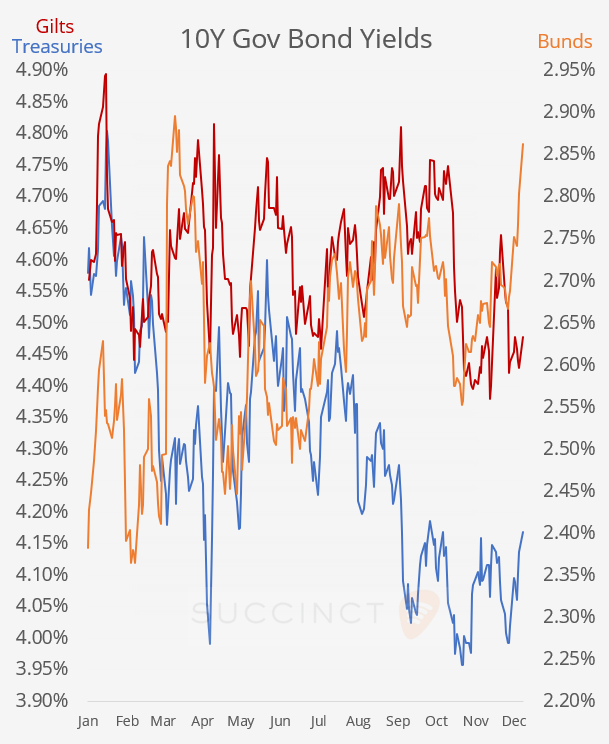

In fixed income, yields continued to edge higher, pushing the 10-year Treasury to a four-week high of 4.17%. German Bunds were the standout mover in Europe, with yields surging to a nine-month high after hawkish remarks from the ECB’s Isabel Schnabel, who signalled comfort with markets pricing in a potential rate hike. The 30-year Bund yield rose to 3.47%, its highest level since 2011.

Oil eased about 2% in a narrow trading range, constrained by uncertainty over Russian supply commitments after Putin pledged uninterrupted fuel shipments to India despite intensifying sanctions. WTI has traded within a band of less than $4 since early November. US natural gas remained highly volatile: after last week’s cold-weather-driven rally to three-year highs, traders took profits today, sending January futures down 8% to $4.87/MMBtu.

Business News: → The Trump administration announced a $12bn aid package for farmers hit by slumping exports and rising bankruptcies. The aid comes after China, the largest buyer of US soybeans, temporarily halted imports, causing a collapse in demand and major disruption to soybean farmers. Meanwhile, farm bankruptcies reportedly rose by about 60% in H1’25 versus H1’24, as agricultural stress mounted.

Data: → China reported that in November its exports rose 5.9 % YoY, reversing October’s contraction and beating expectations. Imports grew by 1.9 % YoY, accelerating from prior months but coming in below some forecasts. As a result, it logged a trade surplus of $112bn. The rebound in exports, alongside muted import growth, suggests that foreign demand is supporting growth even as domestic demand remains weak.

Deals: → Paramount Skydance Corp (mcap $15bn) has launched a $108bn (enterprise value) hostile bid to acquire all of Warner Bros Discovery (mcap $68bn), disrupting Netflix’s (mcap $408bn) previously agreed $82bn partial acquisition. The offer, backed by Middle Eastern SWF and Jared Kushner (Trump’s son-in-law), values WBD at $30 per share. Paramount’s David Ellison (Larry Ellison’s son) argued that Netflix’s proposal was incomplete and undervalued the company. The all-cash bid aims to take full control of WBD’s studio, streaming, and cable assets. Paramount shares rose by 8%, WBD’s by 5% while Netflix dropped over 3%.

→ IBM (mcap $290bn) will acquire Confluent Inc (mcap $10.5bn) for $11bn, paying $31 per share, a 34% premium to its last closing price. The move deepens IBM’s strategic shift toward AI-driven data infrastructure and real-time analytics. The acquisition positions IBM to expand its capabilities in managing and streaming enterprise data for AI applications. Confluent shares rallied 30% today to a YTD gain of just 7%.

→ In IPOs, Medline Industries — a large US-based manufacturer and distributor of medical-surgical supplies and supply-chain solutions — has filed for an IPO, aiming to raise $5.3bn, in what would be the largest US public offering of the year and valuing the company at $50bn. Medline is owned by private equity firms Blackstone and Carlyle, among others, following an LBO in 2021.

Day Ahead: Data → US ADP employment; RBA rate decision (unch at 3.6% expected); Mexico inflation. Earnings → Autozone.

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient’s personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.