The Anatomy of Electronic Arts’ $55bn LBO

Background, Valuations Metrics and Stock Performance in 5 minutes⏳

Electronic Arts Inc. (EA) is an American video game publisher headquartered in Redwood City, California. William ‘Trip’ Hawkins III (71), a former director of strategy and marketing at Apple who studied Strategy and Applied Game Theory at Harvard University, founded the company in 1982. EA was a pioneer of the early home computer game industry and promoted the designers and programmers responsible for its games as “software artists”.

Today, EA boasts one of the most extensive content libraries in the video game industry, featuring blockbuster franchises such as EA Sports FC, Madden NFL, and The Sims. Games can be played on Sony’s PlayStation, Microsoft’s Xbox and Nintendo’s Switch consoles, as well as on PC, mobile devices, and via cloud subscription services like EA Play and Game Pass.

Deal Announcement: Monday, 29th Sep, before market open.

Acquirers: The Public Investment Fund, Saudi Arabia’s SWF (already owned 9.9% of EA); Silver Lake, a technology-focused PE firm; and Affinity Partners, a private investment firm founded by Jared Kushner (Trump’s son-in-law).

Bid: $210 per share in cash. Shares Outstanding: 251mn. Equity Value: $52.7bn (largest LBO ever by equity value).

Premium: 8.6% above the previous close and 23% over the 10-day average close.

EA’s Total Debt: $1.95bn. LBO’s Enterprise Value: $54.6bn.

Stock (close on Oct 3): $200.69 (all-time high), a 4.64% discount to the bid.

Timing: The deal is expected to close in Q1 FY’27 for EA (Q2’26 calendar year).

Merger Arbitrage Spread: assuming the deal is completed at the end of Q2’26, and no dividends are distributed, buying EA’s stock would represent an annualised return of 6.2%.

Deal Funding: 64% equity (ie. $35bn in cash) + 36% debt ($20bn, JPM lead arranger).

Deal Termination Fee: $1bn.

Key EA Financials (TTM): Revenues $7.47bn, Earnings $1.04bn (Profit Margin 14%), EBITDA $1.92bn, FCF $1.75bn.

Takeout Multiples (TTM): EV/EBITDA=28.6x, EV/Revenues=7.3x, P/E=50x, FCF Yield (Free Cash Flow/EV)=3.2%.

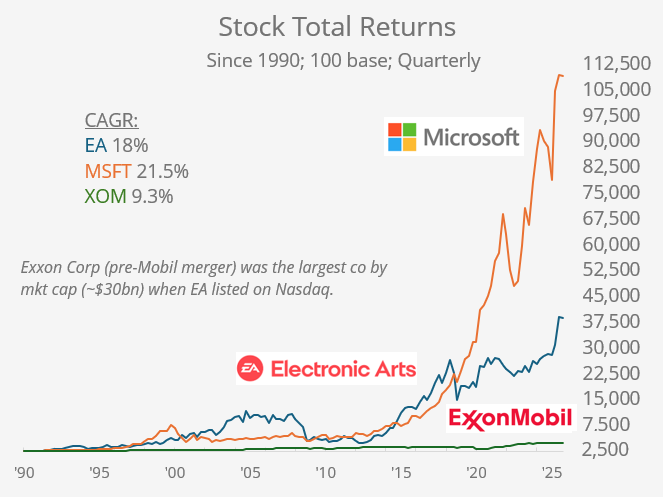

Stock Performance: EA stock delivered a return of 394 times, equivalent to a CAGR of 18.05% since going public in Sep 1989 (36 years) at a market value of ~$84mn, adjusted for its four stock splits and accounting for the low cash dividends in its history. It was listed on Nasdaq under the symbol ETRS and first traded at $0.51 (adjusted), and changed its symbol to EA in 2011. S&P 500’s TR CAGR during the same period: ~11%.

Deal Rationale: The transaction represents a significant bet that AI can reduce Electronic Arts’ operating costs, enabling the equity consortium to handle substantial debt on a company that has traditionally maintained minimal net leverage.

Regulator Approval: Committee on Foreign Investment in the U.S., Federal Trade Commission, Federal Communications Commission, State Attorneys General, International Regulators (EU, UK, China, Japan).

Other Large LBOs:

The EA go-private transaction represents the largest announced LBO deal ever in terms of cash received by shareholders, as well as the biggest all-cash deal so far this year.

It exceeds the 2016 EMC/Dell $67bn enterprise value deal, which included a stock component and also had Silver Lake as an investor. Following the $24bn takeover of Dell Inc in 2013, the company returned to public markets in 2018, via a complex listing buying out VMware’s public tracking stock (DVMT), then relisting as Dell Technologies on the NYSE, and is worth $94bn today.

In 2007, a private equity consortium including KKR, TPG, Goldman Sachs and Carlyle acquired Texas utility TXU for an EV of $45bn, 90% funded by debt. Energy Future Holdings (TXU’s parent) filed for bankruptcy in 2014, the largest U.S. corporate bankruptcy since the GFC, with private equity owners losing billions and creditors having to restructure the debt.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient’s personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.