Thu 10 Jul: After the Bell

🎙️📄

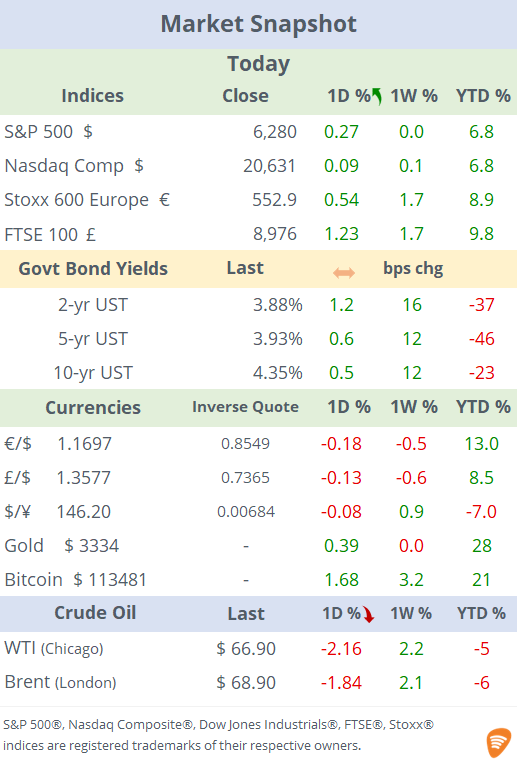

See the ‘Market Data’ post.

Good evening,

A positive start of the Q2 earnings season with a solid Delta Air Lines release, optimism around artificial intelligence as Nvidia’s market cap consolidates above the world historic record of $4tn, helped the S&P 500 and Nasdaq Composite indices close at record highs. Bitcoin also climbed to a fresh all-time high and traded above $113k. Benchmark bond yields barely moved on Thursday with 10-yr Treasury yields at 4.35%, 12bp higher WTD, the $ index finished little changed and crude oil eased 2% on renewed oversupply concerns. Copper futures rose 2.5% after Trump confirmed a 50% tariff will take effect at the beginning of August.

Fed speeches: Governor Chris Waller reiterated his dovish stance with a support for rate cuts as soon as July, calling current policy "too tight" as he sees inflation from tariffs as likely one-off event. Waller also suggested the Fed balance sheet can continue shrinking. St Louis Fed Alberto Musalem had a neutral to slightly hawkish tone, advising patience until inflation effects become clearer.

Economic data: US weekly initial jobless claims unexpectedly dropped to 227k, below estimates and marking a two-month low, confirming the resilience of the labor market and supporting a wait-and-see approach by the Fed. Also, Germany’s inflation (HICP) was confirmed at 2.0% YoY, meeting the ECB’s target. However, the European Commission projects that Germany will significantly underperform average growth in the Eurozone this year.

Monetary Policy: the Bank of Korea maintained its benchmark rate steady at 2.5% as anticipated in a unanimous vote and signalled a potential rate cut during Q3 while warning of significant uncertainty from US tariffs. Korea’s economy contracted in Q1 and headline inflation runs at 2.2%, near the central bank's target.

Earnings releases: Delta Air Lines (mcap $37bn) beat revenue ($15.5bn, +1% YoY) and profit ($2.1bn, +63% YoY) estimates and reinstated this year’s earnings outlook while increasing dividends by 25% on the back of a recovery of fare bookings. Shares rallied 12% today helping the airline sector but remain 6% lower YTD.

Levi Strauss & Co (mcap $7.8bn) reported after the close, also beat sales and earnings expectations and raised full-year sales guidance while planning to absorb some of the cost increases due to tariffs. Shares gained 7% in extended trading and are 14% higher this year.

Corporate deals: Italian food giant Ferrero, privately-owned and maker of Nutella, Tic Tac and Kinder chocolates, has agreed to buy the US cereal co WK Kellogg (mcap $2bn) in a deal worth $3.1bn including debt. Terms: $23/share in cash, a 40% premium to Kellogg’s undisturbed price. Shares rallied 30% today.

Citadel Securities bought Morgan Stanley’s US electronic option market making division for an undisclosed amount.

In private markets, iCapital, a provider of private markets fintech for wealth managment, has raised >$820mn at a $7.5bn valuation. Founded in 2013, iCapital aims to create a marketplace for individuals to invest in private markets.

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.