Thu 11 Dec: After the Bell

Silver and Copper Hit Records Amid Uneven Equity Trading; 5’ evening market wrap📄📈

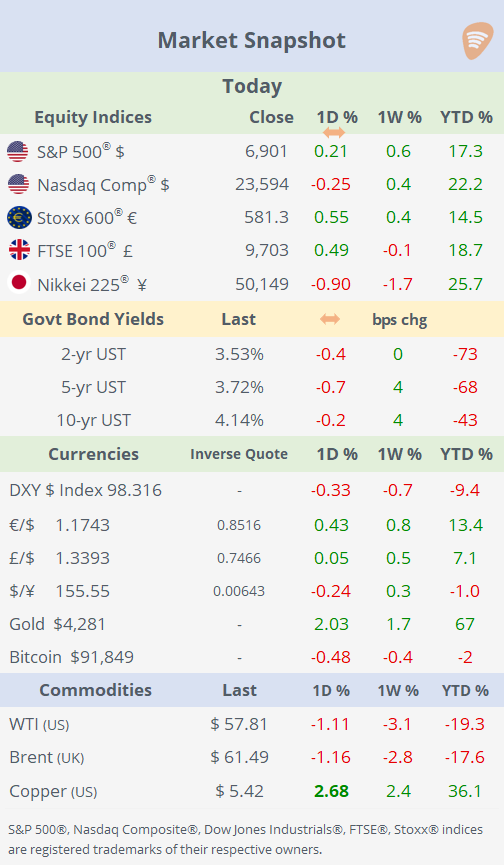

ℹ️ Today’s performance tables & charts on the ‘Market Data’ post.

Good evening,

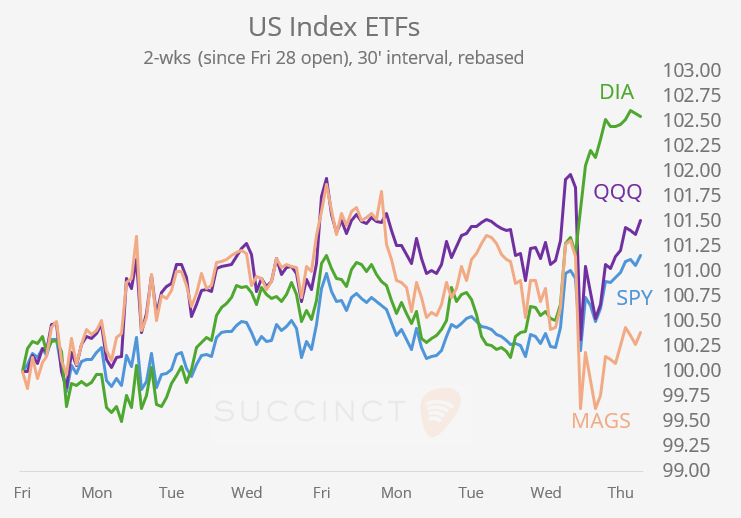

Wall Street failed to carry over yesterday’s optimism from the Fed’s rate cut and upgraded growth outlook, as equity performance diverged on Thursday. Oracle’s disappointing earnings weighed on tech, leaving the Nasdaq slightly lower, while the S&P 500 edged up and the Dow reached a new all-time high of 48,704. Small caps outperformed sharply, with the Russell 2000 rallying more than 1%.

Volatility collapsed, with the VIX falling below 15%, its lowest level since mid-September, signalling limited demand for hedging. The dollar extended its decline, pushing the DXY to an eight-week low.

Today’s notable large-cap mover was Oracle. Shares tumbled 11% post-Q2 earnings reported yesterday after the close, as $16.1bn revenue missed estimates despite +14% YoY growth, with capex surging to $12bn quarterly (FY total now $50bn, +40%). Investor worries mounted over massive AI data centre spending to chase Amazon’s AWS and Microsoft’s Azure leaders, pushing long-term debt to $116bn (+44%), despite orders up 15% to $520bn from Meta and Nvidia deals.

ℹ️ Subscription costs $7.5/mth with the annual plan and has a 7-day trial.

Commodities were highly active: precious metals surged, led by silver hitting fresh record highs above $63 and more than doubling YTD; copper also traded at an all-time high following the Fed’s stronger growth outlook, while US natural gas prices slumped.

Copper climbed to a fresh record high of $11,906/ton (+3%) in London, with most industrial metals rising after the Fed’s rate cut and upgraded its growth forecast. Copper has rallied 35% YTD amid mine disruptions, tariff-driven stockpiling, and renewable energy demand. Longer-term, green transition underpins the red metal despite supply fears outside the US.

Finally, front-month US natural gas futures plunged ~8% today to $4.22/MMBtu, extending pullback from three-year highs amid profit-taking after the recent rally. Milder weather forecasts reduced heating demand expectations, compounded by near-record output and ample storage (+5% above normal).

Central Banks: → The Swiss National Bank held policy rate steady at 0%, maintaining 0.25% penalty on excess sight deposits, as expected amid muted inflation at 0.0% YoY in November. Inflationary pressures remain subdued with no material change, supporting price stability while global growth slows from US tariffs. The SNB is ready for FX interventions if needed; no guidance on hikes, leaving open potential for further easing if conditions deteriorate. The Swiss Franc appreciated sharply but remains within a tight range (0.79-0.81) against the $ since June.

→ Brazil’s central bank held the Selic rate steady at 15% as expected, citing balanced risks with inflation at 4.8% YoY (within 3±1.5% target). The COPOM signalled a pause but hawkish tilt for potential hikes if disinflation stalls; FX volatility monitored closely. The BRL appreciated over 1% to accumulate a 12.5% gain against the $ this year.

→ Also, the Central Bank of Turkey cut the policy rate by 150bp to 38%, more than the expected 100bp, as disinflation resumed post-summer pressures, with November CPI at 31.1% YoY (below forecasts). The TRY was little changed at 42.6 per $, 20% lower this year.

Earnings: → After the close, chip giant Broadcom (mcap $1.9tn) beat Q4 revenue and EPS estimates, forecasting Q1’26 revenue at $19.1bn (above consensus) on robust AI chip demand for data centres. Shares rose 3% after-hours (+75% YTD), signalling sustained growth from networking chips like Tomahawk amid no spending slowdown fears.

Data: → The US foreign trade deficit contracted by 11% to $52.8bn, below expectations, with exports at $289.3bn (+3%) and imports at $342bn (+0.6%). China’s gap narrowed by $4bn to $11.4bn on import drop.

→ US initial claims jumped to 236k for the week ending Dec 6 (prior week revised to +192k), exceeding estimates and signalling faster labour market cooling than anticipated.

Deals: → It was a quiet day for M&A. In private markets, Dutch payments group Mollie agreed to acquire UK-based GoCardless for €1.05bn, creating a combined European payments player valued at ~€3bn. The deal adds GoCardless’s bank-payments capabilities to Mollie’s broader financial services platform, which includes card-payment processing. The combined group aims to accelerate consolidation in Europe’s fragmented payments landscape.

→ In Asia, Singapore-based Sembcorp Industries (mcap $8bn) agreed to acquire Australia’s Alinta Energy for an enterprise value of $4.3bn, marking one of its largest international expansions. The Temasek-backed group will gain full control of an integrated utility serving 1.1mn customers.

→ In IPOs, Lumexa Imaging Holdings (LMRI), the second-largest US outpatient diagnostic imaging provider (184 centres in 13 states, MRI/CT focus), raised $462.5mn after selling26% of its outstanding shares at $18.50/share (midpoint of $17-20 range) for a $1.76bn valuation. The stock had a lukewarm debut on Nasdaq today.

Day Ahead: → Data: Inflation in India, Germany, France and Spain; UK GDP, industrial production. → Earnings: none.

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient’s personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.