Thu 13 Nov: After the Bell

Your 5’ evening market wrap 📄📈

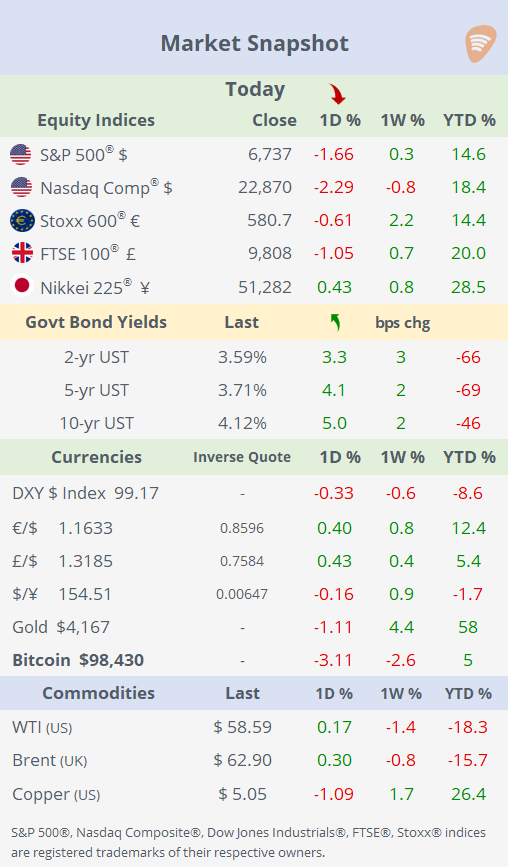

Indices + LargeCaps + FX + Treasuries + Commodities tables on the ‘Market Data’ post.

Good evening,

Markets plunged on Thursday, as a sharp equity sell-off was fueled by growing concerns over lofty AI-driven valuations and a repricing of interest-rate expectations. Investors continued to unload major technology names, particularly those tied to the artificial-intelligence trade, amid worries about stretched multiples and surging capital-expenditure plans.

The Nasdaq Composite fell below its 50-day moving average during the session, triggering algorithmic selling and marking its worst day in four weeks. The VIX volatility index jumped three points to 20.4%, its highest close in a month.

The downturn came as the US government reopened after a record-long 43-day shutdown. With much of the optimism already priced in, markets followed a familiar “buy the rumour, sell the fact” pattern after Trump signed the funding bill into law late Wednesday, following a 222–209 House vote.

The day also brought weak corporate earnings, while traders turned more pessimistic on the interest-rate outlook. Treasury yields climbed, and the probability of a December Fed rate cut fell below 50%, as the central bank continues to operate without key data such as the October jobs and inflation reports.

In currencies, the DXY $ index gave back most of its early-November gains, slipping toward 99, as the $ weakened against the £, Swiss franc, and €. Precious metals paused after recent strength, while cryptocurrencies tumbled, Bitcoin’s end-of-day close dropped below $100k for the first time since early May, and Ethereum plummeted more than 7% to a four-month low.

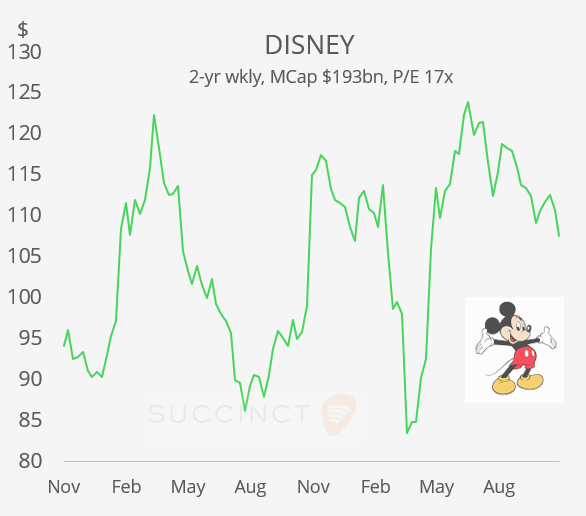

Earnings: → Disney (mcap $191bn) beat earnings expectations but fell short on revenue, which declined slightly YoY. The company’s entertainment segment was supported by streaming growth, while its linear TV business continued to face pressure from declining ad revenues. Disney+ added 3.8mn subscribers, reaching a total of 131.6mn. Net income surged to $1.44bn, +155% YoY. Despite the strong profit performance, shares dropped 8% today on the sales miss, leaving them 5% lower YTD.

Central Banks: A few hawkish remarks by Fed officials today.

→ Cleveland Fed President Beth Hammack supported maintaining restrictive policy to cool inflation, opposing immediate rate cuts. → Boston Fed President Susan Collins advocates for holding rates steady, citing persistent inflation pressures and uncertainty from the government shutdown. → St. Louis Fed Alberto Musalem warned against policies becoming “too easy,” supporting caution on rate cuts

Economic Data: → The White House said that October’s jobs and inflation (CPI) reports are “unlikely” to ever be released.

→ UK economy unexpectedly contracted by 0.1% MoM in September, pulling quarterly growth lower, the slowest since late 2023 and highlighting the economic challenges facing the Labour government as it seeks to support growth. On a YoY basis, GDP expanded by 1.3%. Industrial production fell 2.5% YoY, marking its weakest reading since July 2024, while manufacturing production dropped 2.2% YoY, the lowest print since September 2022.

Deals: → In private markets, Philadelphia-based GoPuff, operating in the instant delivery and convenience retail sector, provides rapid delivery of snacks, beverages, household essentials, and over-the-counter medications directly to consumers’ doors. GoPuff raised $ 250mn at an $8.5bn valuation, well below the $15bn peak achieved in 2021, as it continues to expand its logistics network and city-level micro-fulfilment centres. Eldridge Industries and Valor Equity Partners led the funding round.

→ In credit markets, airline Virgin Atlantic borrowed $745mn backed by Heathrow landing slots from Apollo in a 5-year term loan to finance cabin upgrades and Starlink WiFi.

The IPO market was quiet today, with no major listings raising over $100mn to report.

Day Ahead:

→ Data: US PPI and retail sales (scheduled); €-zone GDP; China retail sales, industrial production and fixed asset investments.

→ Earnings: Japanese mega-banks, Allianz and Siemens Energy.

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient’s personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.