Thu 14 Aug: After the Bell

🎙️📄+ Market Data

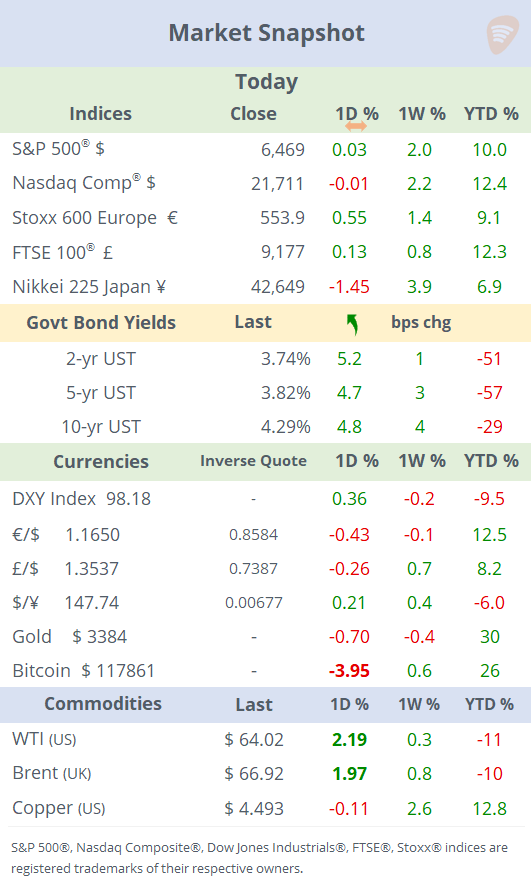

See the ‘Market Data’ post.

Good evening,

Stocks ended little changed on Thursday after a hotter-than-expected US wholesale inflation reading complicated the Fed’s rate-cut outlook. PPI inflation accelerated by 0.9% MoM, the largest monthly gain in over three years. The sharp jump raises concerns that higher business costs could pass over to consumers, keeping inflation pressures elevated and making the central bank’s decision on a September cut more difficult.

Bond yields reversed their recent downward trend and shifted higher, with the Treasury yield curve moving up by 5bp across maturities. Bitcoin and Ethereum fell 4% as the chances for lower rates fell slightly today.

Crude oil partially bounced back, gaining 2% on speculation around tougher sanctions if the Trump-Putin summit on Friday falters, even as markets brace for weaker fundamentals.

ℹ️ Free subscribers and visitors have access to unlocked posts.

Markets’ expectations for a Fed rate cut in September shifted sharply, with the probability of a 25bp cut falling from 94% yesterday to 91%, while the chance of a 50bp cut dropped from 6% to zero, and the odds of no change rose to 9%.

Data: U.S. producer prices (PPI inflation) accelerated 0.9% MoM in July, well above estimates and the largest monthly increase in three years, driven by sharp rises in services and goods. PPI jumped 3.3% YoY, up from June’s 2.4%, signalling growing inflationary pressures.

The UK economy expanded 0.3% QoQ in Q2, down from Q1’s 0.7% but exceeding the 0.1% forecast, signalling slower yet resilient growth. Year-on-year, real GDP rose 1.2%, placing the UK among the fastest-growing G7 economies in H1. The expansion was bolstered by government spending and a June rebound, helping offset pressures from tariffs, weak private investment, and elevated taxes. This unexpected strength provides Chancellor Reeves with some fiscal breathing room ahead of the autumn budget.

Earnings: Despite beating Q3 earnings expectations, Deere & Co (mcap $128bn), cut its full-year outlook as falling equipment sales, oversupply, and tariff pressures weighed on revenue, sending shares sharply lower. The company warned of continued weakness in large agriculture demand but pointed to cost controls and long-term market recovery as potential offsets. Deere fell 7% today but remains 12% higher YTD.

Chip equipment maker Applied Materials (mcap $151bn) reported after the close, beating top and bottom estimates but disappointing on revenue guidance for the next quarter. Shares plunged 11% in extended trading.

Semiconductor manufacturer Coherent Corp (mcap $13 bn) plunged 22% today following yesterday’s earnings release, which showed a margin miss and raised growth concerns, despite the firm beating revenue and earnings expectations. (Investing)

It was a quiet day on the corporate deals front. Centrica Plc (mcap £8bn) and U.S. infrastructure fund Energy Capital Partners have agreed to acquire National Grid’s (mcap £52bn) Grain LNG terminal, Europe’s largest liquefied natural gas import facility, for ~£1.5bn.

IPOs: Miami International Holdings, the parent of New Jersey-based MIAX, which operates nine trading venues across equities and derivatives, was priced at $23 (above the guidance range). It raised $345mn for a total market value of $1.9bn. Shares rallied 34% on their debut on the NYSE. (Barron’s)

Day ahead: Industrial production, retail sales and the Michigan consumer sentiment in the US; GDP in Japan; retail sales, industrial production and fixed asset investments in China.

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.