Thu 15 Jan: After the Bell

Banks Recover, Oil Drops on Iran De-Escalation, $ Hits 6-Wk High ➡️

ℹ️ Today’s performance tables & charts on the ‘Market Data’ post.

Good evening,

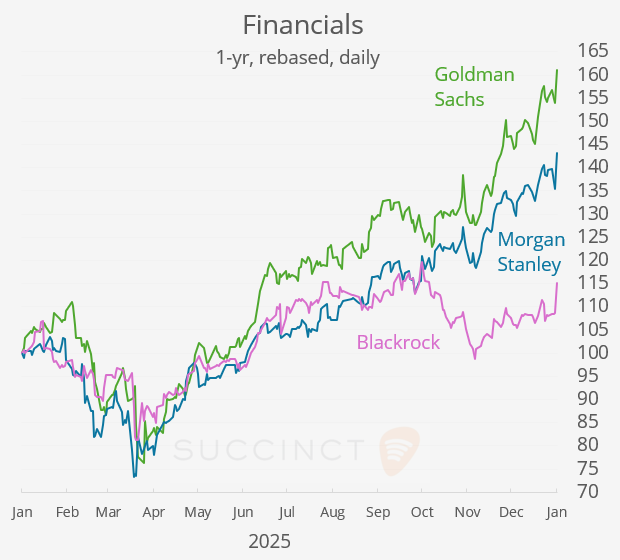

Equities closed higher today as strong earnings from leading financial firms, including Goldman and Morgan Stanley, helped reverse the negative tone of the previous two sessions, when results from JPM and Citi had disappointed. The rebound in the sector supported benchmark indices across the board, even as gains remained measured.

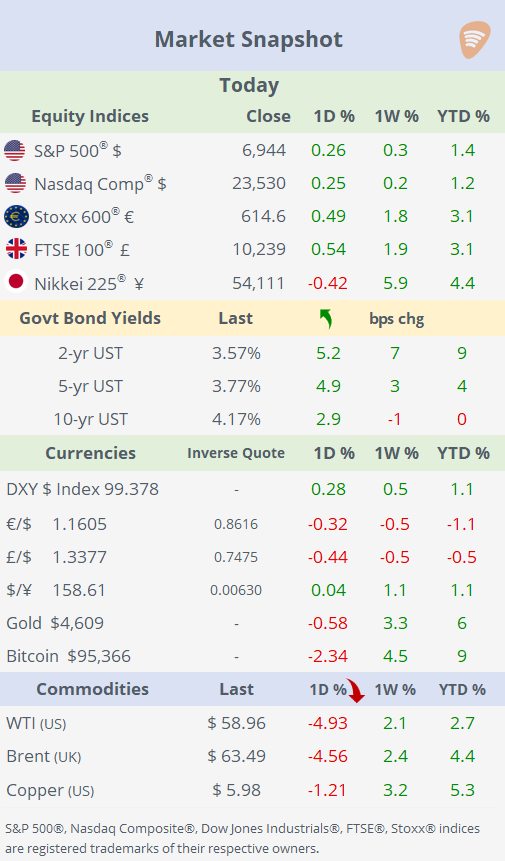

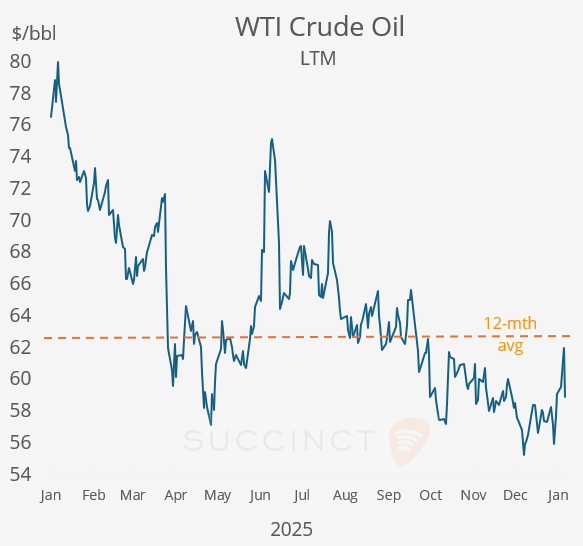

In commodities, oil prices plunged after signals of de-escalating tensions between Washington and Tehran reduced geopolitical risk premia. Core bond yields rose as investors further scaled back expectations for Fed rate cuts, while the $ strengthened against majors, with the DXY index climbing to its highest level in six weeks.

Treasury yields rose by ~5bp across the curve as stronger economic data pushed traders to further scale back expectations for rate cuts, reinforcing a repricing of the Fed policy path. Markets are now pricing roughly a 95% probability of no rate change at this month’s meeting and around 80% odds of another hold in March, with broader concerns over Fed independence remaining a secondary, background factor.

Crude oil futures fell sharply (-5%) after Trump signalled a de-escalation in tensions with Iran, saying he had been assured that the killing of protesters had stopped and that no executions were planned. His comments suggested a reduced near-term risk of military action, easing fears of supply disruptions in the Middle East. Despite the sharp drop in crude oil prices, energy stocks proved relatively resilient, with the sector down ~1% on the day.

In corporate news, Amazon Web Services signed a two-year copper supply deal with Rio Tinto’s Nuton venture, securing domestic supply for AI data centres and validating a new low-grade ore extraction technology. The agreement underscores surging AI-driven copper demand, projected to rise 50% by 2040 amid concerns of a structural supply shortfall.

Earnings: Today’s earnings releases were broadly positive, helping improve investor sentiment.

→ Goldman Sachs (+4%), Morgan Stanley (+6%) and BlackRock all beat Q4 earnings expectations, driving significant upside in their stock prices as broader financials rebounded. Goldman and Morgan Stanley saw double-digit profit increases underpinned by strong investment banking fees, record trading revenues and solid wealth management results, reflecting healthy dealmaking and market activity. BlackRock’s shares jumped 6% on better-than-expected revenue growth, robust net inflows and rising assets under management, highlighting continued strength in the asset-management complex. The strong results contrast with earlier bank disappointments this week and shifted sentiment toward optimism on financial earnings and capital markets momentum.

→ Chip giant Taiwan Semiconductor (TSMC, mcap $1.8tn) reported stronger-than-expected Q4 results, with net profit up by 35% YoY and revenue beating forecasts, driven by continued robust demand for advanced and AI-related chips. TSMC’s stock rose roughly 6% in Taiwan on the upbeat earnings and positive outlook, helping lift broader tech sentiment.

Data: Thursday was light but positive on the economics front.

→ US weekly jobless claims fell to 198k in the week ending Jan 10, coming in below expectations (consensus 215k) and marking one of the lowest readings in recent months. While the surprise drop could partly reflect seasonal adjustment noise, it still suggests layoffs remain subdued and the labour market broadly resilient as 2026 begins.

→ UK GDP rose 0.3% MoM in November, rebounding from October’s decline and beating expectations. The annual growth rate was 1.4%, also above forecast and the fastest since July, driven by strength in services and manufacturing. While the data were sentiment-positive, annual growth remains modest and uneven, and sterling weakened, with cable falling to a three-week low.

→ €-zone industrial production grew 2.5% YoY in Nov, reversing recent weak prints. The annual increase, while positive, reflects moderate momentum rather than strong acceleration in the industrial cycle, consistent with uneven manufacturing activity across member states.

Corporate Deals: → In the US healthcare sector, Boston Scientific (BSX, mcap $134bn) agreed to acquire thrombectomy specialist Penumbra (PEN, mcap $13.7bn) in a $15bn cash-and-stock deal, valuing it at $374/share, a 19% premium to the prior close, to strengthen its cardiovascular and vascular portfolio. The transaction will be funded with cash on hand and new debt, with roughly 73% of the consideration in cash and 27% in stock. Penumbra shares jumped 12% (+34% LTM), while Boston Scientific fell ~4%.

→ In the US energy sector, media reports indicate that Devon Energy (DVN, mcap $23bn) and Coterra Energy (CTRA, mcap $20bn) are in early-stage talks to explore a potential merger, which could create one of the largest independent US shale producers. If completed, the combination would rank among the largest energy sector tie-ups in recent years.

Day Ahead: → Data: US industrial and mfg production; Germany and Italy inflation updates. → Earnings: PNC, State Street, M&T Bank.

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient’s personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.