Thu 16 Oct: After the Bell

🎙️📄+ Market Data. Regional Banks sell off, Indices fall, new record for gold.

See the ‘Market Data’ post for tables & charts.

Good evening,

Wall Street stocks initially opened marginally higher, driven by robust earnings by large financial firms, but sold off through the day, led by regional banks, after Zions Bancorp (mcap $7bn) and Western Alliance (mcap $8bn) disclosed bad loans tied to alleged fraud. While these events were reported as company-specific rather than broad sector issues, analysts caution that the private credit market could still produce further surprises.

The KBW Nasdaq Regional Banking Index plunged 6%, hitting its lowest level in four months. Zions and Western’s shares plummeted over 10%. The S&P 500 closed 0.6% lower, and the small-caps Russell 2000 lost 2% from its record high, with Financials as the clear underperforming sector.

Risk-off sentiment pushed gold to a fresh peak of $4,300, following gains in 17 of the past 20 trading sessions. Core bonds gained as front-end Treasury yields remain at a three-year low, and 10-year yields dropped below 4% for the first time since Liberation Day in early April. The $ fell against safe-haven currencies, the yen and Swiss franc. Crude oil could not escape the trend, as it was also weighed down by higher-than-expected weekly inventories, falling over 2% to a five-month low.

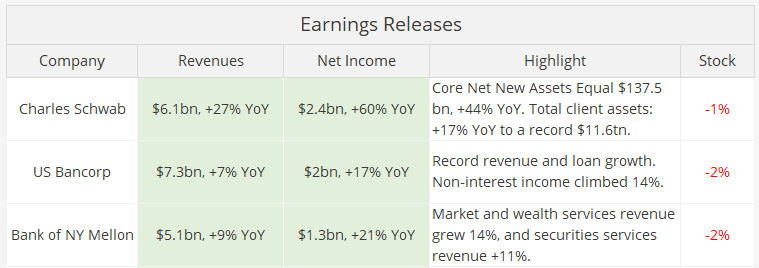

Earnings: Three big financials, Charles Schwab, US Bancorp, and Bank of NY Mellon, reported earnings, all surpassing expectations with Schwab’s record profit ($2.4bn) as the highlight, reflecting robust performance across key metrics. Shares of these were little changed following the release, but later dropped on the broader weakness.

Taiwan’s chip manufacturing giant TSMC (mcap $1.2tn) reported a record Q3 net profit of ~$15bn, a 39% YoY increase, driven by strong demand for advanced chips. It also raised the full-year revenue growth forecast to mid-30% in dollar terms, citing robust AI-related demand. Shares in Taiwan are 40% higher YTD.

Fed Speech: Governor Chris Waller supported market expectations for a rate cut later this month but cautioned that the Fed should ‘move with care,’ balancing signs of solid growth against a softer labour market.

Economics: It was another light day for data. The preliminary Philadelphia Fed Manufacturing Index fell to –12.8 in October (from +23.2 in September), well below expectations and signalling a sharp contraction in regional factory activity. UK GDP grew 1.3% YoY in August, its slowest three-month momentum in recent quarters, signalling a mild slowdown in growth. UK industrial output declined 0.7% YoY, while manufacturing slipped 0.8% YoY, underlining weakness in production sectors.

Deals: In private markets, San Francisco-based fintech lender Upgrade raised $165mn at a $7.3bn valuation, with backing led by Neuberger Berman. The company says it has been cash-flow positive for three years and is aiming for an IPO in 12–18 months.

Deel, a California-based HR software startup, has completed a $300mn funding round that lifts its valuation to $17bn, underscoring continued backing from leading Silicon Valley venture firms despite an alleged spying scandal involving its chief competitor.

Blockchain payment network Ripple has acquired GTreasury for $1bn from private equity firm Hg, marking its third major acquisition this year and signalling a strategic move into the corporate treasury sector. The acquisition gives Ripple access to GTreasury’s platform, which manages over $12.5tn in annual payment volumes for Fortune 500 companies.

Also, investment firm Baillie Gifford is seeking co-investors for its Bending Spoons venture, the Italian app developer behind popular titles like Evernote and Splice, at an estimated valuation of around €10bn. The move underscores continued investor appetite for high-growth European tech firms despite a subdued IPO market.

IPOs: Taiwan-based blockchain technology company, Obook Holdings, began trading on Nasdaq via a direct listing for a total market value of $2.2bn. Shares traded as high as $90 and closed at $55.

Vermont-based Beta Technologies, an electric aircraft manufacturer, is targeting a $7.2bn valuation in its upcoming listing next month. It plans to raise $825mn with cornerstone investors including AllianceBernstein, BlackRock, GE Aerospace, Ellipse, and Federated, potentially purchasing up to $300mn in Class A shares.

Day Ahead:

Earnings: Amex, Truist, State Street, Schlumberger, China Mobile, Reliance Industries (India). Data: US (suspended) housing starts, import/export prices.

See you tomorrow. Please 🙏 use your referral link to share!

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient’s personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.