Thu 18 Sep: After the Bell

🎙️📄+ Market Data

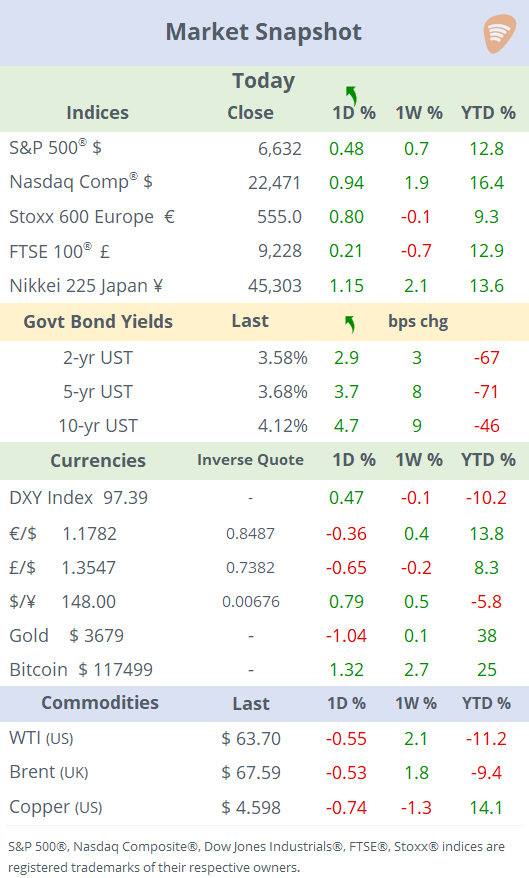

See the ‘Market Data’ post.

Good evening,

Risk-on sentiment dominated markets following the Fed’s rate cut and signals for further easing, with tech stocks supported by Nvidia’s investment in Intel and small caps leading the rally with the Russell 2000 advancing 2.5% to an all-time high. The S&P 500 and Nasdaq also closed at fresh records and gained 13% and 16% this year.

Bond yields edged slightly higher after their recent rally, while the dollar index staged a partial recovery, mainly versus sterling and the yen, as markets reacted to today’s Bank of England meeting and ahead of tomorrow’s Bank of Japan decision. Gold retreated for a second day from its all-time high. Traders are pricing in a 94% chance for another quarter-point rate cut by the Fed in October and 75% for a half-point cut by year-end.

Stock Highlight: Nvidia (mcap $4.3tn) announced a strategic $5bn investment in Intel (mcap $143bn) equal to ~4%, purchasing shares at $23.28 each. This partnership aims to co-develop custom chips for data centres and personal computers, integrating Nvidia's GPU technology with Intel's CPU architecture. Intel jumped 23% to $30.6, a 14-month high, and accumulated a 52% gain YTD.

Earnings: FedEx (mcap $53bn) reported after the close, beat top ($22.2bn) and bottom ($820mn, +3.8% YoY) estimates, and shares rallied 8% in extended trading but remain 20% lower in 2025.

Monetary Policy: The Bank of England kept its key rate steady at 4%, as expected. The decision was supported by a 7–2 vote, with two members advocating for a quarter-point cut. The bank also announced a £70bn reduction in its quantitative tightening program, lowering the annual pace of gilt sales from £100bn to £70bn to ease pressure on the bond market, particularly long-dated gilts, and bring the BoE’s holdings to £488bn in the next twelve months.

Governor Bailey emphasised that the UK is "not out of the woods yet" regarding inflation, which remains above the 2% target. The bank’s cautious stance reflects ongoing concerns about persistent inflationary pressures and the need for a gradual approach to future rate cuts. 10-year Gilt yields rose marginally to 4.65%, the pound weakened 0.5% and the FTSE 100 finished a touch firmer

Also, Norway’s Norges Bank reduced its policy rate from 4.25% to 4.0%, aiming for a gradual return to its 2% inflation target without putting too much strain on the economy. The central bank also signalled a cautious outlook for future rate adjustments, leaving the door open for further cuts depending on economic conditions.

Data: U.S. initial weekly jobless claims fell by 33k to 231k, reversing the previous week's surge. While this decline suggests some stabilisation, the labour market shows signs of softening.

Deals: Swiss pharma giant Roche (mcap $261bn) agreed to acquire U.S.-based biotech firm 89bio (mcap $2.2bn) for up to $3.5bn, aiming to strengthen its portfolio in cardiovascular, renal, and metabolic diseases. 89bio shares jumped 85% today and are 91% higher this year.

In private markets, Blackstone and TPG have renewed talks over a possible acquisition of women’s health diagnostics specialist Hologic (mcap $15bn), a transaction that could become one of the largest in healthcare private equity this year.

IPOs: Cybersecurity firm Netskope raised $908mn for a $7.2bn valuation and was priced at $19. Shares rallied 18% on their Nasdaq debut.

Day ahead: Bank of Japan policy meeting (unch at 0.5% exp), Japan inflation, UK and Canada retail sales, Germany PPI.

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.