Thu 20 Nov: After the Bell

Your 5’ evening market wrap 📄📈

Good evening,

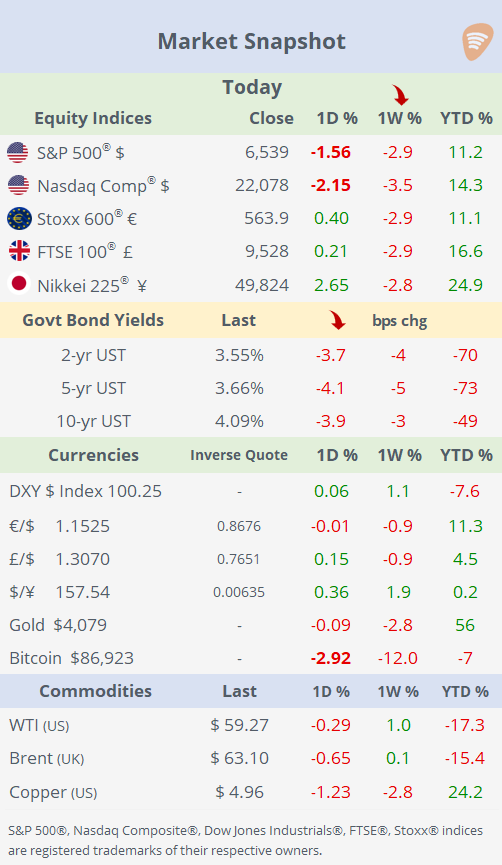

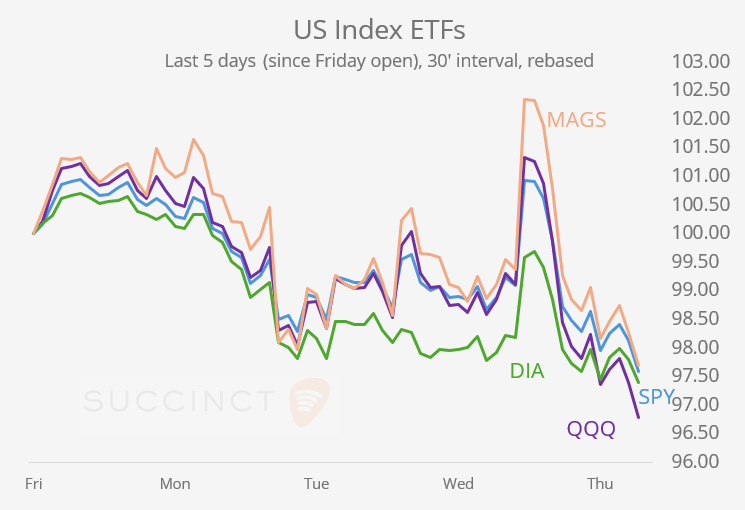

Thursday delivered exceptional volatility across risk assets. US equities initially surged on Nvidia’s blockbuster earnings yesterday evening, with the Nasdaq 100 jumping 2.3% at the open, before sentiment sharply reversed in the afternoon. The index ultimately closed down 2.4%, a ~5% intraday swing, while Nvidia fell 3% after an almost 8% round-trip move despite reporting record results. The VIX spiked from 20 to 28 intraday before settling at 26.5%.

The catalyst was a series of hawkish remarks from Fed officials, which raised caution around the December meeting and the broader easing cycle. With 20 days to go until the next FOMC decision, futures now imply a 60% probability of no rate change. The shift in tone overshadowed strong Walmart earnings, robust labour-market data, and the first meaningful set of economic releases following the longest government shutdown on record.

Treasury yields eased by roughly 4bp across the curve, with the 2-year closing at 3.55%. Risk aversion hit digital assets hard: Bitcoin and Ethereum each fell more than 3% again, with Bitcoin sliding to $86,680, its lowest level since April, leaving it 31% below its October peak and 22% under its 200-day moving average. Despite the turbulence, gold and the $ index were largely unchanged.

Central banks: → Cleveland Fed President Beth Hammack said the Fed may be nearing the end of what could be a short rate-cutting cycle, stressing that policy is “barely restrictive, if at all.” She argued the Fed must maintain a “somewhat restrictive” stance to ensure inflation continues to move toward the Fed’s target and warned that easing too quickly risks prolonging elevated inflation. Hammack added that the labour market remains solid enough that further cuts aimed at supporting employment could heighten financial-stability risks.

Economic Data: → The US economy added 119k jobs (non-farm payrolls) in September, beating expectations of 50k. This follows a revised loss of 4k jobs in August (previously reported as +22k). The October employment report was cancelled and will not be released, and November’s will be published on December 16. → The unemployment rate rose to 4.4%, a four-year peak. → Existing home sales in October rose 1.2% MoM to 4.1mn units, +1.7% YoY.

→ The People’s Bank of China (PBoC) kept the one‑year Loan Prime Rate at 3.00% and the five‑year LPR at 3.50%, as expected.

Earnings: → Walmart (mcap $847bn) beat expectations on both revenue ($179.5bn, +5.8% YoY) and earnings (net income $6.1bn+34% YoY) and raised its full‑year forecast. Same-store sales grew 4.5% YoY and e-commerce sales expanded by 27% globally. Shares gained 5.5% today and are 17.5% higher YTD. It also announced plans to move its listing from the NYSE to Nasdaq after 55 years, marking the largest company by market value to make such a switch.

→ Nvidia (after the bell Wed) Q3 revenues surged to a record $57bn, +62% YoY. Their revenue projection for Q4 is $65bn, which would be a 65% YoY increase. Net income hit a record $32bn, up 65% YoY. Net profit margins improved marginally to 56%. Shares fell 3% today after opening 5% higher.

Deals: → Abbott Laboratories (mcap $216bn) will acquire Exact Sciences (mcap $19bn) for $21bn, paying $105 per share, a 50% premium to its undisturbed price. The deal expands Abbott’s position in the fast-growing cancer-screening market, anchored by Cologuard. Exact Sciences’ $3bn+ revenue base will lift Abbott’s diagnostics business to over $12bn in annual sales. Exact shares gained 17% today, 50% in the past week and are 80% higher this year.

→ Palo Alto Networks (mcap $127bn) is buying observability platform Chronosphere, a private company controlled by a private equity consortium led by Greylock and Lux Capital. The deal comes as Palo Alto reported Q1 revenue of $2.47bn, beating expectations, and raised its full‑year forecast to $10.5bn. Palo Alto shares fell over 7% today and are little changed YTD.

IPOs: → Central Bancompany (CBCY) raised $373mn in its US IPO and was priced at $21, the bottom of the guidance range. The deal values the Jefferson City–based regional lender at $5bn, coming as scrutiny of regional banks intensifies amid private-credit concerns.

Day Ahead: → Data: US Michigan Consumer Sentiment; UK and Canada retail sales; Japan inflation; G7 PMIs (Nov); Mexico GDP. → Earnings: BJ’s Wholesale and Macy’s.

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient’s personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.