Thu 30 Oct: After the Bell

Your 5’ evening market wrap 📄🎙️📈

See the ‘Market Data’ post for tables & charts.

Good evening,

Thursday was a risk-off day for markets as investors placed greater emphasis on disappointing tech earnings released yesterday after the close and Powell’s hawkish comments rather than the positive US-China trade headlines today. While the tariffs truce brought some optimism, concerns about higher AI spending and uncertainty over further rate cuts in December weighed on sentiment, driving major indexes lower. Today was also active on the monetary policy front with the ECB and BoJ meetings with rates on hold, as well as mega-cap earnings after the bell.

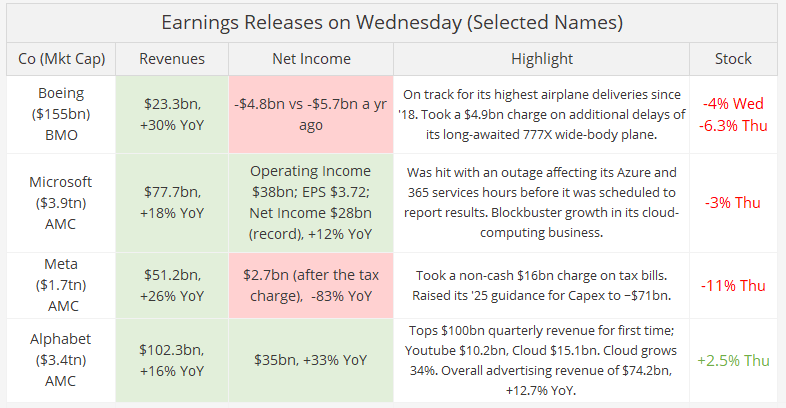

Meta shares plunged 11% as net income fell sharply due to a one-off tax charge and rising capex, and Netflix announced a 10-for-1 stock split, sending shares up 3% in extended trading.

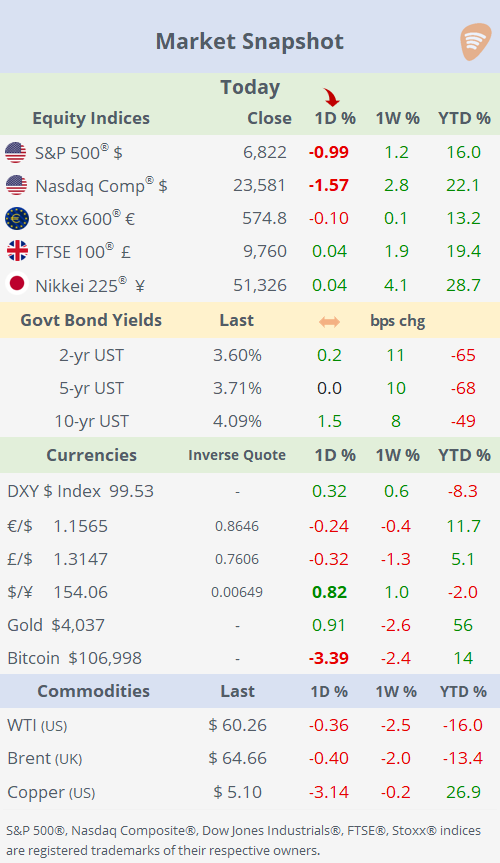

Away from stocks, core bond yields barely moved, the $ appreciated mainly against the ¥, gold closed above $4,000 again, and cryptos fell sharply.

Trade: Trump and Xi Jinping met in South Korea and agreed to lower trade tensions, reducing the average tariff on Chinese goods to around 47%. The US specifically cut tariffs related to fentanyl production to 10%. China committed to buying 12mn metric tons of American soybeans this season and 25mn annually for the next three years, marking a temporary trade truce.

Earnings: Pharma giant Eli Lilly (mcap $762bn) reported before the open with revenue of $17.6bn, +54% YoY. Net income surged to $5.6bn, up sharply from $970mn a year ago, driven by strong demand for Mounjaro and Zepbound, its obesity and diabetes drugs. The company also raised full-year guidance, reflecting robust momentum in GLP-1 drugs. Shares jumped 4% today and remain 10% higher YTD.

→ Apple and Amazon reported after the bell, with Amazon beating on most estimates as AWS revenues grew 20% YoY, but it missed on operating margins. The stock rallied 11% in extended hours. Apple also reported in line but missed marginally on iPhone and China sales. The stock traded sideways to modestly positive. Overall sentiment after the bell was positive.

Monetary Policy: → The ECB kept all its benchmark interest rates steady as expected, with the deposit rate at 2.0%, the refinancing rate at 2.15% and the marginal lending facility rate at 2.4%.

Traders’ outlook for future interest rate cuts remained largely unchanged after the rate decision, with markets pricing in about a 40% chance of a further quarter-point reduction by mid-2026.

The block’s annual inflation was 2.6% in September, up from 2.4% in August, and the preliminary inflation rate update for October will be released tomorrow.

“The EU-US trade deal reached over the summer, the recently announced ceasefire in the Middle East and today’s announcement of progress in the US-China trade negotiations have mitigated some of the downside risks to economic growth”, ECB president Christine Lagarde said.

“Political uncertainty in France could weigh on its economy, but elsewhere the outlook is improving and suggests monetary policy is filtering through to the real economy,” she added.

→ The Bank of Japan also held its key policy rate steady at 0.5% with a 7-2 vote, with two members favouring a quarter-point hike to 0.75%. Inflation remained above the 2% target for 41 months, but the central bank maintained a cautious stance due to external economic uncertainties and the new Prime Minister’s support for loose monetary policy. The BoJ emphasised watching upcoming data before committing to raising rates further, signalling a gradual approach to tightening. Market expectations suggest a possible rate hike early next year, but no immediate changes. The ¥ depreciated ~1% to 154 per $.

Economics: → €-zone GDP surpassed expectations to grow 0.2% in Q3 (and 1.3% YoY), driven by a strong rebound for the French economy, which expanded at the fastest pace since 2023 (0.9% YoY).

→ Germany’s inflation rate for October 2025 was 2.3% YoY, slightly down from 2.4% in September. Core inflation excluding food and energy held steady at 2.8%, with declines in energy prices offset by rises in services and food costs. The German economy expanded for a third consecutive quarter, +0.3% YoY in Q3.

Corporate Deals: → Mastercard (mcap $505bn) is reportedly set to acquire crypto infrastructure startup ZeroHash for $1.5-$2bn, according to media sources. The move underscores Mastercard’s push into stable-coin payments and blockchain settlement rails, as it looks to bridge traditional finance with digital commerce.

→ The proposed $9bn all-stock merger between Core Scientific (mcap $6.6bn) and CoreWeave (mcap $66bn) has been terminated, after the deal failed to secure enough CoreWeave shareholder support.

→ In private markets, Canadian private equity firm Onex and AIG will jointly acquire speciality insurer Convex for $7bn, with Onex taking a 63% stake. The deal expands both firms’ presence in the property and casualty market, where Convex has grown rapidly since its 2019 launch.

IPOs: Palo Alto-based travel tech company Navan (formerly TripActions) was priced at $25, the middle of the guidance range and raised $923mn at a $6.4bn valuation. It began trading on Nasdaq, with shares losing 20%.

Day ahead: → Data: US PCE inflation, €-zone inflation, Germany and Japan retail sales, Canada GDP. → Earnings: Exxon Mobil, Chevron, AbbVie, Colgate, Linde, Intesa Sanpaolo, AON.

Interesting facts: on Wednesday, Nvidia became the first company to reach a $5tn market cap. I took 6,138 days to reach a $1tn market cap, 180d to double, 66d to reach $3tn, 273d to hit $4tn, and just 78d to achieve $5tn. In total, just 597 days from $1tn to $5tn. It represents over 7% of the total US market cap. Stock fell ~2% on Thursday.

The top 10 US stocks now reflect 41% of the S&P 500’s market cap, an all-time high. The market cap of the top 10 stocks has surpassed $25tn for the first time.

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient’s personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.