Thu 6 Nov: After the Bell

Your 5’ evening market wrap 📄📈

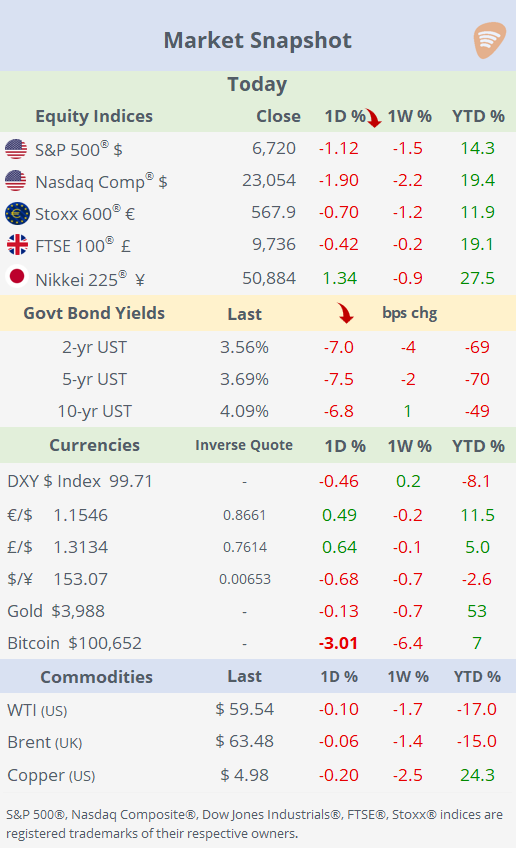

See the ‘Market Data’ post for tables & charts.

Good evening,

Sentiment remains volatile, as equities fell sharply on Thursday, with the Nasdaq dropping nearly 2% and down 2.5% for the week, while mega-cap tech stocks that have driven this year’s AI rally came under renewed pressure over soaring valuations.

The pullback was compounded by a sharp rise in layoffs, with more than 153k job cuts in October, nearly triple September’s pace and the highest October total in 22 years, according to Challenger, Gray & Christmas. The surge in job cuts casts fresh doubt on the US economic outlook, particularly given the lack of key economic data due to the ongoing government shutdown, now the longest in history. Meanwhile, bonds gained, the $ depreciated, and cryptos sold off again.

Business News: → Tesla (mcap $1.48tn) shareholders approved a historic pay package for Elon Musk that could grant him control over 25% of the company if performance milestones are met. Shares fell 3.5% ahead of the vote and traded flat in after-hours following approval, as investors weighed the unprecedented $1tn package and its long-term implications.

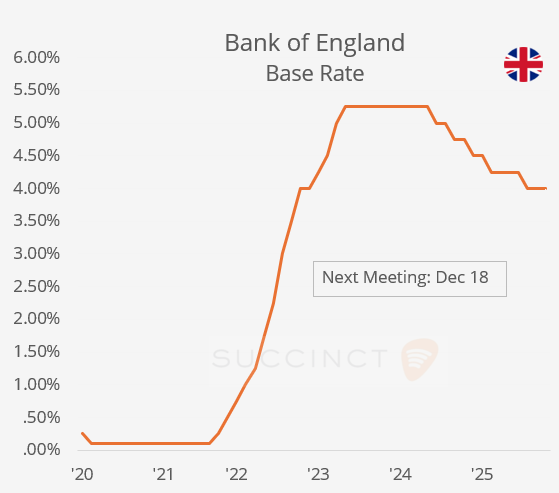

Central Banks: → The Bank of England kept its Bank Rate unch at 4%, as widely expected, following a narrow 5-4 vote by the Monetary Policy Committee. Policymakers noted that while inflation continues to ease, it remains well above the 2% target, warranting caution amid ongoing economic uncertainty. The statement suggested a growing tilt toward easing, acknowledging that if disinflation persists, monetary policy could soon shift into cutting mode. Officials also highlighted that fiscal developments, particularly the upcoming UK Budget, will be an important factor in determining the timing of any future rate moves. The 2-year Gilt yield rose 6bp today to 3.84%, and cable appreciated sharply to >1.31.

→ Mexico´s central bank cut its benchmark interest rate by 25bp to 7.25%, the lowest level since May 2022. While the move was anticipated, Banxico adopted a more cautious forward-guidance stance, signalling that future cuts will be data-dependent, especially considering persistent core inflation. The MXN barely moved and closed at 18.58.

Data: → Eurozone retail sales rose 1.0% YoY in September, matching expectations but sharply down from August’s 1.6% pace and the slowest growth since mid-2024, underscoring weak consumer momentum.

→ The weekly US jobless claims update was not officially released today due to the ongoing federal government shutdown.

Deals: → Charles Schwab (mcap $171bn) will acquire financial services platform Forge Global Holdings (mcap $600mn) for $660mn, paying $45/share, representing a 72% premium to Forge’s last close. Forge offers a private market platform which is designed to connect buyers looking to invest in private companies and sellers of company shares and related products.

IPOs: → California-based molecular diagnostics company BillionToOne (BLLN) raised $273mn at a $4.4bn valuation in its Nasdaq listing and was priced at $60 after upsizing the deal, and shares jumped 82% on their debut.

→ Evommune (EVMN), a Palo Alto‑based clinical‑stage biotech developing treatments for chronic inflammatory diseases, raised $150mn in its NYSE IPO at $16 and a $481mn valuation. Shares gained 26%.

Day ahead: → Data: US and Canada employment report, China trade, Mexico inflation.

→ Earnings: Constellation Energy, KKR, Duke Energy.

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient’s personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.