Thu 9 Oct: After the Bell

🎙️📄+ Market Data

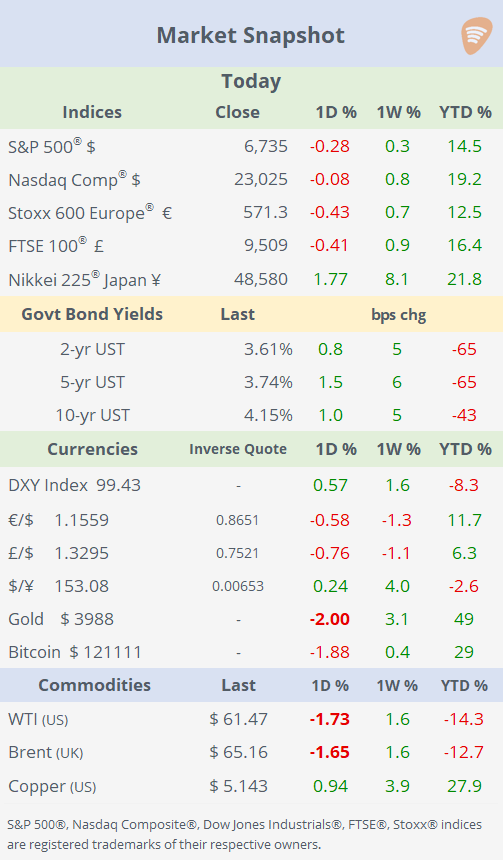

See the ‘Market Data’ post for tables & charts.

Good evening,

Equities edged lower today, with the S&P 500 struggling to reach the 6,800 level as it starts to trade sideways around its record high. The $ strengthened, pushing the DXY index above 99 points for the first time since early August as the ¥ extended its decline, down 4% over the past week. Commodities also suffered broadly, with energy, precious metals, softs, and grain futures all posting losses.

In an unprecedented move, US Treasury Secretary Scott Bessent confirmed today a $20bn swap line with Argentina and purchases of Argentine pesos, a rare step aimed at stabilising the country’s currency and financial markets. Argentine bank ADRs rallied 17% on the news.

Geopolitics: Israel and Hamas agreed to the first phase of a Gaza peace plan under which all living hostages will be freed in exchange for Palestinian prisoners. Israel will withdraw from 70% of the enclave, with other key details yet to be disclosed.

France remains mired in acute political turmoil, with President Macron still scrambling to appoint a new prime minister after Lecornu’s abrupt resignation just days ago, making this the sixth such change in less than two years. 10-yr OAT bonds are yielding 3.53%, above Italy, Greece, Portugal and Spain.

Earnings: PepsiCo (mcap $195bn), beat top and bottom-line estimates; net income fell ~11% YoY to $2.6bn. Reiterated guidance and announced a new CFO starting in November. Sentiment: mixed but slightly positive, with shares up ~4% but remain 6% lower YTD.

Delta Air Lines (mcap $39bn) also beat on revenue and earnings; net income rose 11% YoY to $1.42bn. Strong guidance and continued strength in premium and corporate travel lifted sentiment, and shares jumped 4% but are nearly unchanged this year.

Data: Inflation in Mexico has been gradually easing this year after peaking at 4.42% in May; it has since drifted downward, with September at 3.76%. Inflation in Brazil has remained persistently above target, with a small uptick to 5.17% in September.

Deals: Danish pharma giant Novo Nordisk will acquire US biotech Akero Therapeutics (mcap $4.3bn) for up to $5.2bn in cash, including contingent payments tied to regulatory approval of Akero’s liver drug efruxifermin. Akero shares jumped 16% today and accumulated a 95% gain this year.

IPOs: Phoenix Education Partners, owner of the University of Phoenix, was priced at $32, raised $136mn and gave the company an initial market valuation of $1.35bn on its NYSE debut. Shares gained 19%.

Wisconsin-based Alliance Laundry Holdings, a commercial laundry equipment manufacturer, priced its IPO at $22, raising $826mn and debuting on the NYSE with an initial valuation of $4.3bn. Shares closed 13% higher today.

Germany’s Otto Bock SE, a leading medical technology firm specialising in prosthetics and orthotics, priced its IPO at €66 per share, raising over €800mn and debuting on the Frankfurt Stock Exchange with an initial valuation of €4.2bn and a 3% stock gain.

Day ahead: US Michigan consumer sentiment; Canada employment report; Norway and Denmark consumer inflation; Brazil and Japan producer inflation.

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient’s personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.