Tue 11 Nov: After the Bell

Your 5’ evening market wrap 📄📈

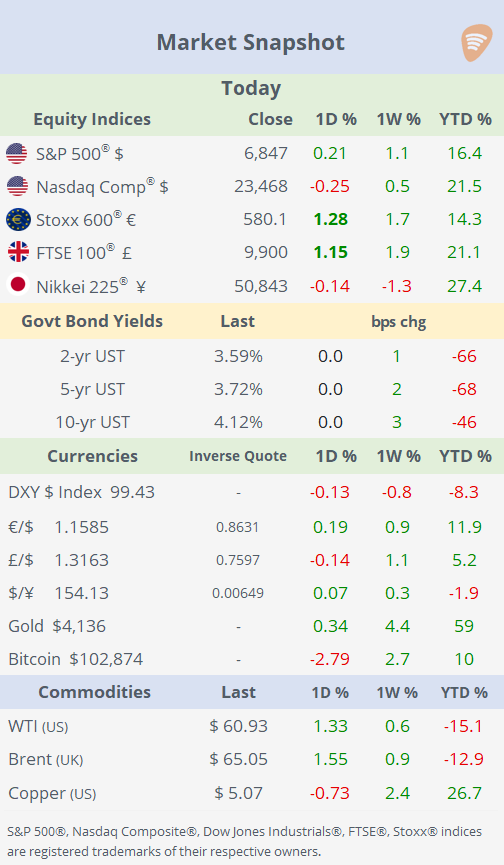

Indices + Large Caps + FX + Treasuries + Commodities tables on the ‘Market Data’ post.

Good evening,

The market remains focused on the government shutdown, with most headlines today dominated by updates on its resolution. The Republican-led Senate passed a $60bn spending package 60–40 to end the record-long US government shutdown, with eight Democrats joining Republicans. The bill now moves to the House for a vote tomorrow, and Trump has expressed support for the measure.

Stock indices finished mixed on Tuesday, with the Nasdaq closing slightly lower on Nvidia’s 3% decline, while the Dow Jones Industrials outperformed as Amgen, Apple, and Honeywell traded higher. The healthcare sector was today’s top performer following the drug pricing agreement with the White House. In Europe, the Stoxx 600 and FTSE 100 rose over 1%, hitting record highs following Wall Street’s rally yesterday. US bond markets were closed for Veterans Day.

Oil prices gained more than 1%, supported by sanctions on Russian oil and optimism over a potential end to the government shutdown, though oversupply concerns limited further upside.

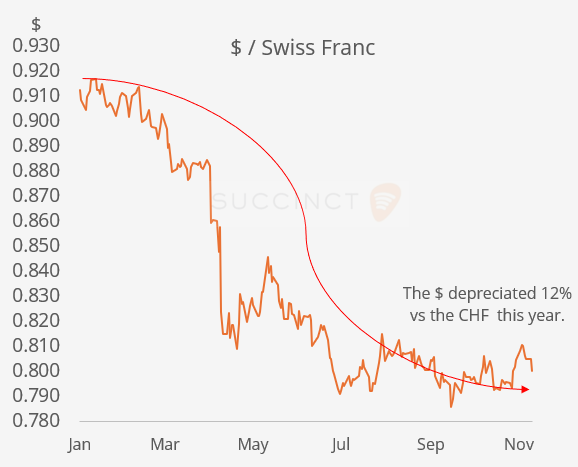

In forex markets, the Dollar Index fell marginally, and the main mover was the Swiss franc, which strengthened for the fourth consecutive day, supported by optimism over a potential 15% US tariff‑reduction deal.

A notable stock mover today was cloud platform CoreWeave (mcap $44bn), whose shares fell 16% after cutting its 2025 revenue forecast to $5.05–5.15bn from $5.35bn, despite third-quarter revenue exceeding analysts’ estimates. The shortfall is due to temporary delays at a third-party data centre developer, slowing AI-related capacity; shares have gained 130% since it went public in March.

Data: → The US private sector lost an average of 11,250 jobs per week in the four weeks ending Oct 25th, according to the ADP employment report. The figure underscores softening labour-market momentum at a critical time for policymakers and markets.

→ UK unemployment rises to 5%, the highest level in four years, as employment fell by 22k in the three months to September, the first decline since March 2024 (after +91k the previous month). The softening labour market fuels expectations of a Bank of England interest rate cut after Rachel Reeves’s budget, with the central bank having kept rates on hold last week but signalling inflation has peaked amid the economic slowdown.

Corporate Deals:

→ SoftBank Group (mcap $210bn) of Japan has sold its stake in Nvidia for $5.8bn, equivalent to 32mn shares or 0.12% of the total outstanding shares as part of a strategic shift to fund its AI investments, including a major commitment to OpenAI. Nvidia closed 3% lower today.

→ Ohio-based industrials Parker‐Hannifin Corp (mcap $108bn) has agreed to acquire Filtration Group, a privately held affiliate of Madison Industries, for $9.25bn. Filtration Group supplies filtration systems for industrial, automotive and HVAC applications, enhancing Parker-Hannifin’s industrial flow control portfolio.

→ In private markets, TPG is preparing to seek bids for its stake in Singapore-based XCL Education, a Southeast Asian school operator that could be valued at up to $2bn, with first-round offers expected around late December.

→ Fintech Fiserv (mcap $34bn) moved its listing from the NYSE (FI) to Nasdaq (FISV).

Day Ahead: The US House will vote on the shutdown deal. → Data: Germany producer prices and final inflation (Oct); India inflation. → Earnings: Cisco, TransDigm, Copart, E.ON, Infineon, RWE.

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient’s personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.