Tue 14 Oct: After the Bell

🎙️📄+ Market Data. Volatile equity session, oil drops, yields fall, bank earnings, Powell's signal.

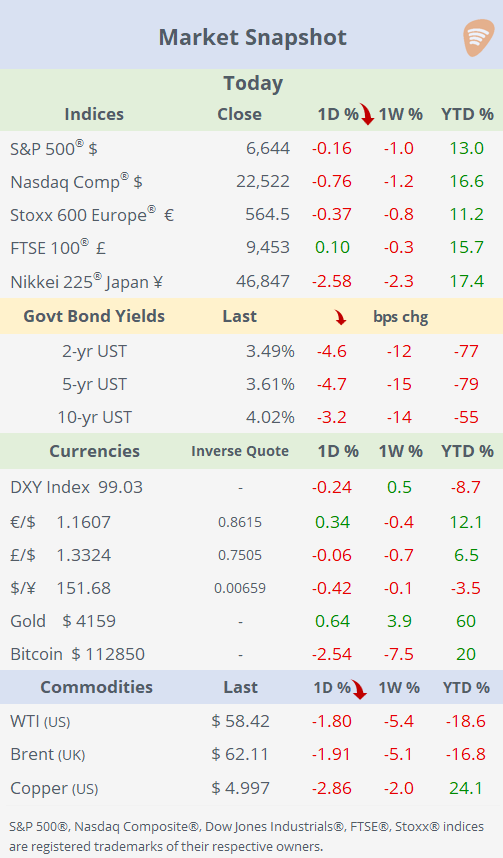

See the ‘Market Data’ post for tables & charts.

ℹ️ USMD’s subscription costs $7.50 per month with the annual plan – for now, and has a 7-day trial. Visit About to learn about the Refer & Save program and pay even less. Or try Lite.

Good evening,

In a volatile session, US stocks initially fell sharply amid renewed trade tensions and surprise sanctions, with technology and AI stocks leading the decline. Later, markets recovered as investors seized buying opportunities, while strong results from major banks helped ease downside pressure at the start of the Q3 earnings season. Indices ended mixed, with the Nasdaq Composite losing 0.8% while the small-cap Russell 2000 gained 1.5%. Core bond yields resumed their downward trend following Monday’s holiday.

Crude oil prices dropped to a five-month low after the IEA reported a large surplus and a recent build-up in shipments. Brent fell as much as 3% but later recovered partially.

Geopolitics: China sanctioned US units of a South Korean shipping company on Tuesday, signalling a new tit-for-tat escalation in trade tensions. Beijing also promised broader retaliatory measures targeting the industry.

Crypto: Over $19bn in leveraged crypto positions were liquidated over the weekend, marking the largest single liquidation event in crypto history. Bitcoin traded as low as $110k today before recovering, down 13% from its all-time high last week.

Earnings: Major US financials delivered strong Q3 results, with JP Morgan, Goldman Sachs, Citigroup, Wells Fargo, and BlackRock all beating both revenue and profit expectations. Broad strength in trading, investment banking, and asset management supported the outperformance across the sector. Financing activity is accelerating, with mergers climbing and significant investments pouring into artificial intelligence, including the expansion of data centres and related infrastructure. Despite the strong results, bankers remain cautious about risks from a slowing labour market, asset bubbles, and geopolitical uncertainties. The financial sector significantly outperformed the broad market today. (see Market Data for table)

Central Banks: Fed Chair Powell signalled support for additional rate cuts as the US job market cools. Inflation is easing, and inflation expectations are approaching the Fed’s 2% target. Markets are pricing in a likely quarter-point rate cut at the upcoming meeting. The 2-yr Treasury yield dropped 5bp today to 3.47%, the lowest level in two years.

Economics: It was a quiet day on the data front. The UK labour market showed signs of further cooling, with employment rising by 91k in the three months to August compared to a year earlier, well below the 232k increase seen in the prior period but slightly above expectations of 70k. The unemployment rate ticked up to 4.8% from 4.7%, reflecting slower hiring momentum as the economy loses steam.

Deals: Two of the largest US timberland owners, Rayonier (mcap $3.8bn) and PotlatchDeltic (mcap $3.2bn), announced an all-stock merger to create a $7.1bn forestry company with an EV of $8.2bn. The combined firm will control roughly 4.2mn acres of timberland, second only to Weyerhaeuser (mcap $17bn).

Goldman Sachs will acquire Industry Ventures (AUM $7bn) for up to $965mn in cash and equity, a move aimed at strengthening its services for technology entrepreneurs.

Europe’s low-cost airline EasyJet (mcap £3.8bn) shares jumped on reports that investors, including Swiss-based global shipping and logistics conglomerate MSC, are exploring a potential takeover, with options ranging from a majority stake to full control. No deal has been finalised, and discussions are reportedly at an early stage. Shares rallied 8% on Tuesday but remain 10% lower YTD.

Oura, the maker of the Oura Ring, has secured $900mn in a Series E funding round, bringing its valuation to $11bn. The investment highlights growing interest in wearable health technology.

IPOs: There were no significant listings today. Navan, formerly TripActions, the Palo Alto-based corporate travel and expense management company, is set to price its IPO in late October. The offering targets a $6.5bn valuation with a $24–26 price range.

Strava, the popular fitness app, plans a US IPO as early as 2026, following a $2.2bn valuation in May 2025 from a funding round led by Sequoia Capital.

Day Ahead: Earnings (AM): Bank of America, Morgan Stanley, ASML, Abbott, Progressive, and PNC. Data: China inflation (CPI & PPI), €-zone industrial production, US NY Empire State Mfg, Fed Speeches (Bostic, Miran, Waller, Schmid).

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient’s personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.