Tue 16 Dec: After the Bell

Choppy Equity Session as Oil Slump Weighs on Markets. Your 5’ evening market wrap📄📈

ℹ️ Today’s performance tables & charts on the ‘Market Data’ post.

Good evening,

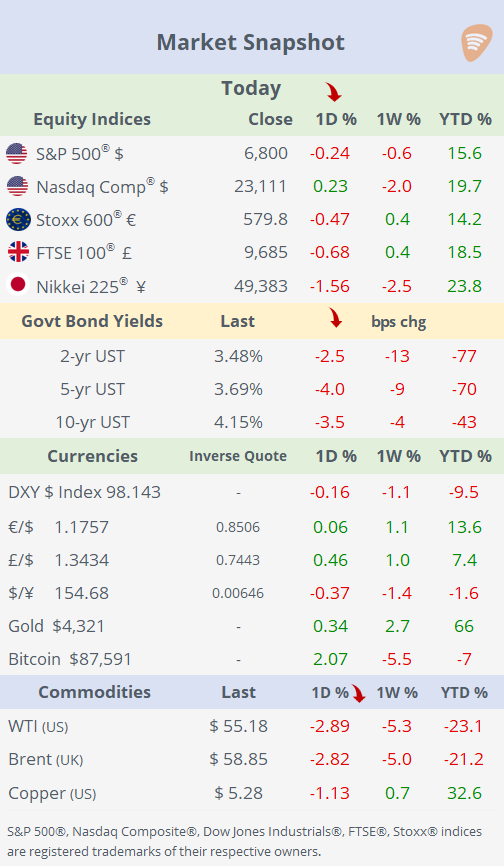

It was a volatile session for US equities, with the Nasdaq Composite swinging from an early 0.6% decline to a modest gain by the close, while the Dow Jones and S&P MidCap indices underperformed, each falling around 0.6%. The S&P 500 logged its third consecutive negative session, weighed down by a sharp sell-off in energy stocks, as the sector fell roughly 3% amid a steep drop in crude oil prices.

The widely anticipated November jobs report reinforced signs of a softening US labour market, though it did little to alter market expectations for another Fed rate cut in late January. Bond markets reacted more clearly, with core yields falling 3–4bp across the curve, extending the weekly decline to about 13bp at the short end and 4bp on the 10-year Treasury, resulting in further curve steepening.

In currency markets, the DXY $ index edged lower and is now more than 1% weaker over the past week, with traditional safe havens such as the Swiss franc and Japanese yen leading gains against the dollar.

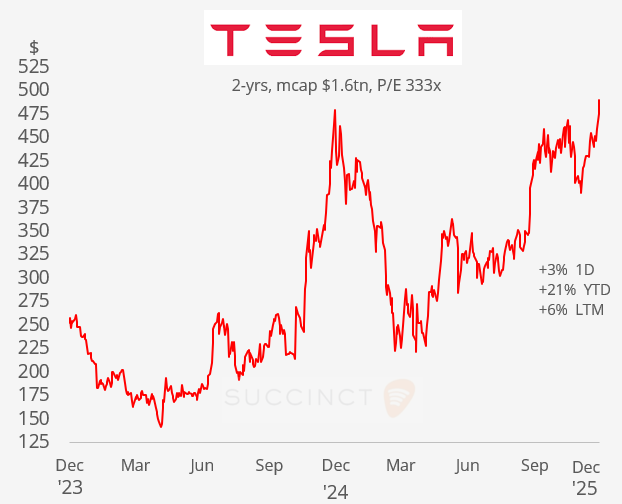

Mega-cap mover today: Tesla shares gained 3% to hit a record high, surpassing the previous peak set roughly a year ago, as optimism builds around the long-promised rollout of robotaxi capabilities. The rally follows renewed momentum after Elon Musk said Tesla is testing fully driverless vehicles in Austin without safety drivers, helping reverse a volatile year that began with a 36% Q1 sell-off. Tesla’s market cap has risen to about $1.6tn, ranking it as the world’s seventh-most valuable publicly listed company.

In commodities, crude oil prices fell sharply, with Brent sliding 3% to $58.80 a barrel, its lowest level since early 2021, and WTI dropping to $55.10, the weakest since early 2021. The move reflects growing expectations of an already oversupplied oil market in 2026, compounded by hopes of a potential Russia-Ukraine peace deal. Comments from Trump that a deal may be closer added pressure, despite ongoing uncertainty around unresolved territorial issues.

Business news: → Warner Bros. Discovery (mcap $71bn) is expected to reject Paramount’s hostile takeover bid in favour of Netflix’s offer, citing superior valuation, certainty, and terms. Shares fell 2.5% today.

Data: → The US labour market data released today showed a loss of 105k non-farm jobs in October and a gain of 64k jobs in November, reflecting weak overall employment growth. The unemployment rate rose to 4.6%, the highest level since 2021, as job creation remained modest and Federal government layoffs weighed heavily on the figures.

Overall sentiment is negative. The sharp downward revision in October employment, combined with only a modest rebound in November, reinforces the view that the US labour market momentum is weakening. The data point to softer hiring conditions and rising slack, increasing confidence that economic growth is cooling and strengthening expectations for a more accommodative monetary policy stance ahead.

→ The US Composite PMI eased to 53.0 from the prior month, remaining firmly in expansionary territory but signalling a moderation in private-sector growth momentum. The €uro-block Composite PMI fell to 51.9 from 52.8, also indicating continued expansion but at a slower pace. Overall, the data point to ongoing economic growth in both regions, though with softer momentum compared with earlier months.

Deals: → Holcim (mcap $52bn), the Switzerland-based building materials group, agreed to acquire a majority stake in Peru’s Cementos Pacasmayo, valuing it at $1.5bn. The deal is expected to be EPS-accretive in the first year and further expand Holcim’s Latin American presence following its entry into Peru last year.

→ In private markets, Databricks, the San Francisco-based data and AI company founded by Apache Spark creators, provides a unified cloud platform for analytics, machine learning, and lakehouse architecture serving over 10,000 enterprises. It is raising $4bn in a new funding round at a $134bn valuation, led by Thrive Capital and including Andreessen Horowitz and DST Global, to accelerate AI innovations like Agent Bricks and Mosaic tools amid surging demand.

Day Ahead: → Data: UK CPI inflation; Indonesia CB rate decision; South Africa inflation.

→ Earnings: Micron Technologies.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient’s personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.