Tue 16 Sep: After the Bell

🎙️📄+ Market Data

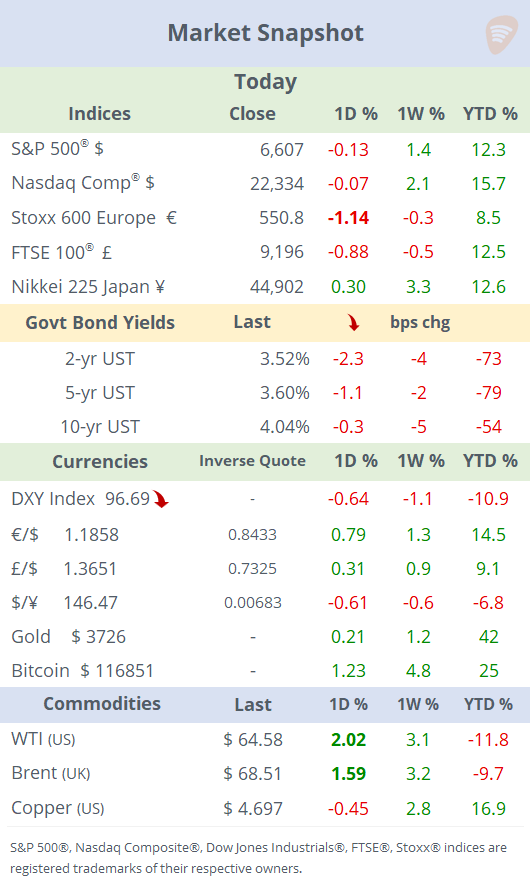

See the ‘Market Data’ post.

U.S. stocks traded mixed on an uneventful session, with utilities lagging (-1.8%) and energy leading (+1.7%), and no major moves among large caps, while European markets underperformed, the DAX falling 1.8% on weakness in banks and insurers.

Bond yields were little changed ahead of tomorrow’s Fed meeting, with the short end of the Treasury curve shifting lower by 2bp and 2-yr notes at 3.52%, not far from the lowest level of 2025.

The $ index fell to its lowest level since early July, mainly against the € and Swiss Franc and accumulated an 11% depreciation this year. Gold surged past $3,700 for the first time, fueled by Fed rate-cut optimism and a weaker $ and is already 41% higher YTD.

Crude oil rose again today, with WTI up 2% to $64.60, after Ukrainian drone strikes on Russian refineries disrupted oil shipments, raising concerns about supply shortages. These facilities account for over 10% of global oil output.

Geopolitics: A U.S. investor consortium including Oracle, Silver Lake, and Andreessen Horowitz would control 80% of TikTok’s U.S. operations under the emerging U.S.-China framework deal.

Domestic news: Trump filed a $15bn lawsuit against The New York Times, alleging election interference and defamation.

Central Banks: A U.S. appeals court rejected the Trump administration’s bid to remove Fed Governor Lisa Cook, a ruling set to be appealed.

Data: U.S. retail sales rose 5.0% YoY in August (up from 4.8% in July), signalling resilient consumer demand despite inflation and labour-market concerns. Industrial production rose 0.9% YoY, a modest pace that underscores continued weakness in manufacturing compared to historical growth rates.

Canada’s headline inflation rose 1.9% YoY in August (up from 1.7%), slightly below forecasts, driven by slower declines in gasoline prices and higher food costs.

Deals: Software company Workday (mcap $60bn) announced it will acquire privately held AI firm Sana for $1.1bn, aiming to integrate AI into its HR software offerings. The transaction follows a wave of sector consolidation, including Thoma Bravo’s $12.3bn purchase of Workday rival Dayforce last month.

Apollo is considering selling AOL, which it acquired in 2021 as part of the Yahoo deal, for an estimated $1.5bn.

IPOs: California-based cybersecurity firm Netskope lifted its price range and targets a $7.3bn valuation.

Day Ahead: Fed and BoC policy meetings (-25bp rate cut expected for both), €-zone and UK inflation.

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.