Tue 18 Nov: After the Bell

Your 5’ evening market wrap 📄📈

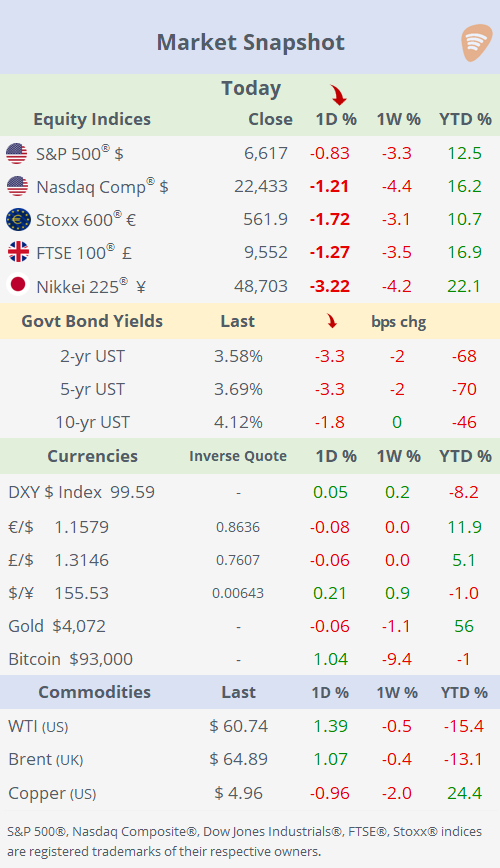

Indices + LargeCaps + FX + Treasuries + Commodities tables on the ‘Market Data’ post.

Good evening,

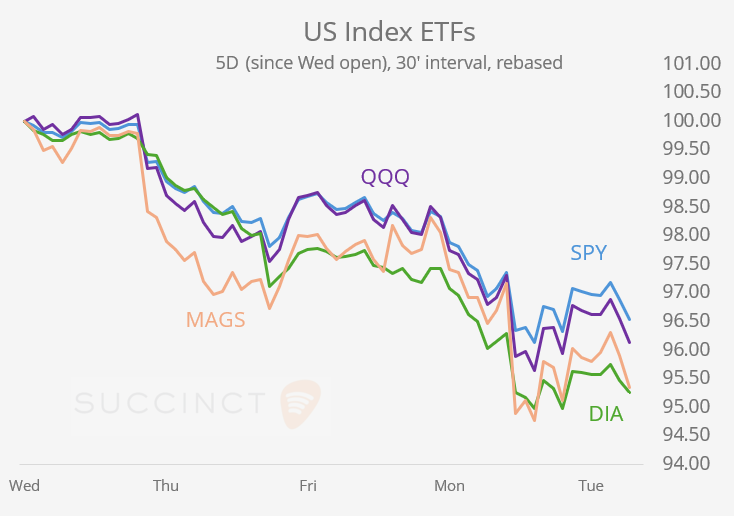

Risk-off sentiment intensified on Tuesday, with US tech stocks slipping 1.2% as major benchmarks fell for the fourth consecutive day. The S&P 500 recorded its longest losing streak since August, weighed down by AI favourites. Nvidia dropped more than 2%, while Amazon fell 4% and Microsoft slid 2%, pushing the IT and Consumer Discretionary sectors down 5% and 6.3% over the past five sessions. Volatility surged, with the VIX climbing to 24.7%, a four-week high.

Investors continue to question the lofty valuations of AI-linked stocks, particularly as firms pile up debt to fund data centre expansion. In BofA’s latest monthly survey, 45% of institutional investors cited a potential AI bubble as the top tail risk.

European markets also saw sharp declines, with bank stocks leading losses amid credit concerns and a cautious macroeconomic backdrop. In Asia, Japan and South Korea fell more than 3%, dragged lower by tech heavyweights including Samsung (-2.8%) and SoftBank (-7.5%).

Meanwhile, forex and bond markets were relatively stable, with the DXY dollar index largely unchanged and benchmark yields edging down slightly.

Business News: → Today, Cloudflare (mcap $70bn) suffered a major global outage: a configuration file grew too large, triggering a software crash in its system for threat-traffic management and knocking sites like ChatGPT, X, Canva (and others 100mn sites) offline for several hours. Cloudflare said there’s no evidence it was a cyberattack. Shares fell almost 3%.

→ Microsoft, Nvidia and privately-held Anthropic announced a big cloud deal, under which Microsoft will invest $5bn into Anthropic, Nvidia up to $10bn, and Anthropic has committed to buying $30bn of Microsoft Azure capacity.

Geopolitics: China sent coast‑guard vessels near the disputed Senkaku/Diaoyu Islands after Japan signalled possible military support for Taiwan, escalating regional tensions.

Earnings: → Home Depot (mcap $343bn) reported Q3 fiscal 2025 revenue of $41.4bn (up 2.8% YoY) above estimates, but its adjusted earnings figure ($3.74) missed expectations, and the company trimmed its full-year outlook, citing weak housing demand, consumer uncertainty and lack of storm-driven volumes. The stock fell over 5% (-13% YTD) as investors reacted to the net profit miss and weaker guidance despite the revenue beat. It was today’s worst performer on the Dow index.

Data: Economic data was light today, with only two US job-related updates released, and both came in on the weak side. → Initial jobless claims for the week ending Oct 18 stood at 232k, up from 219k in the last pre-shutdown week, highlighting some softening in the labour market. → The latest ADP employment update showed a loss of 2.5k posts over the four weeks ending early Nov 1.

Deals: → Dutch paint leader AkzoNobel (mcap $9.4bn) is merging with Axalta Coating Systems (mcap $6.1bn) in an all-stock “merger of equals” to create a global paint and coatings company with an EV of $25bn and revenues of $17bn, with Akzo’s shareholders getting 55% of the new entity. Additionally, Akzo will pay a $2.5bn dividend to its shareholders. Akzo shares fell ~3%.

→ Topgolf Callaway Brands (mcap $1.9bn) is selling 60% of its Topgolf and Toptracer business to private equity firm Leonard Green Partners, valuing the driving‑range unit at ~$1.1bn, with Callaway set to receive about $770mn in net proceeds. Shares fell ~over 5% today but remain higher by 32% this year. Topgolf Callaway plans to change its name to Callaway Golf Co and update its ticker to CALY.

Day Ahead: → Data: US trade, housing starts and FOMC minutes; UK inflation (CPI and PPI); €-zone inflation; Indonesia policy rate.

→ Earnings PM: Nvidia❗, Palo Alto Networks; AM: TJX, Lowe’s Companies, Deere & Co, Target.

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient’s personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.