Tue 2 Dec: After the Bell

Risk Assets Stabilise After Global Selloff; Nasdaq Leads Renewed Gains. Your 5’ evening market wrap📄📈

ℹ️ Today’s performance tables & charts on the ‘Market Data’ post.

Good evening,

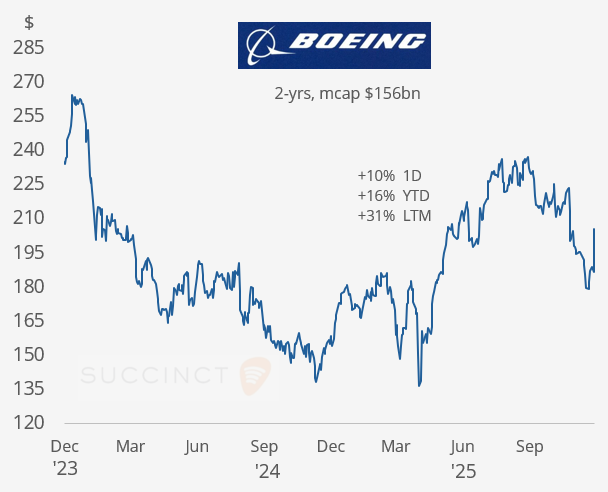

US equities advanced on Tuesday, recovering from Monday’s global risk-off selloff that broke five-day winning streaks across major indexes. Bitcoin rebounded sharply, rising 6% to $91k. The Nasdaq led gains, up 0.7%, with Intel jumping 9% on reports it will supply chips to Apple and Boeing surging 10% after management signalled stronger aircraft demand. The VIX index dropped below 17%, remaining well under its 200-day moving average. South Korean auto stocks rallied after Washington confirmed reduced tariffs.

US core bonds were little changed, with the 10-year Treasury yield steady near 4.09% as markets maintain roughly 90% odds of a Fed quarter-point cut next week. In Japan, government bonds remained in focus after Monday’s hawkish remarks from the Bank of Japan governor; the 30-year yield hit a record intraday high before easing after a strong long-bond auction.

The day brought no major US data releases as investors look ahead to this week’s key print: the delayed September CPI inflation reading, closely monitored by the Federal Reserve.

The large-cap mover of note today was Boeing (mcap $156bn), which gained 10% driven by positive management remarks. At a UBS investor conference, CFO Malave announced that Boeing expects significantly higher deliveries of its 737 and 787 jets next year as well as a return to positive free cash flow. Shares are 16% higher this year.

Data: → €-zone headline inflation in November ticked up to 2.2%, while core inflation held at 2.4%, with services remaining the main source of price pressure. The slight upside surprise keeps inflation above the ECB’s target, reinforcing expectations that rate cuts are unlikely in the near term. The ECB meets on the 18th. Bund yields climbed 6.5bp to 2.75%, the highest since late September, as markets reacted to the slightly hotter inflation print.

Earnings: → A quiet day for earnings. Bank of Nova Scotia - Scotiabank (mcap C$88bn) delivered a Q4 earnings beat today, its adjusted EPS of C$1.93 topped consensus, and revenue came in above expectations. Shares added 3% to accumulate a 30% gain this year.

Deals: → Fairstone Bank (formerly Duo Bank of Canada, controlled by Smith Financial), a Canadian lender focused on consumer and commercial financing, agreed to acquire Laurentian Bank of Canada (mcap C$1.8bn, P/E 13x) for ~$1.4bn. The deal will leave Laurentian stripped of its retail and SME banking operations, which will be transferred to the National Bank of Canada, while Fairstone will retain Laurentian’s commercial lending business. Laurentian shares jumped 18% today to accumulate a 40% gain this year.

→ Santander sold ~3.5% of its Polish subsidiary Santander Bank Polska for $473mn, leaving the Spanish group with about a 9.7% stake.

→ There were no IPOs of note today.

Central Banks: → Jerome Powell delivered a speech today but made clear he would not address monetary policy or the economic outlook, consistent with the Fed’s blackout period ahead of the Dec 10 FOMC meeting.

Day Ahead: Data → US ADP employment, ISM Services PMI, Imp/Exp prices, industrial production; Switzerland inflation; Australia GDP; Italy and Spain Services PMIs.

Earnings → Salesforce, Inditex (Zara), RBC, National Bank of Canada, Dollar Tree, Macy’s.

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient’s personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.