Tue 2 Sep: After the Bell

🎙️📄+ Market Data

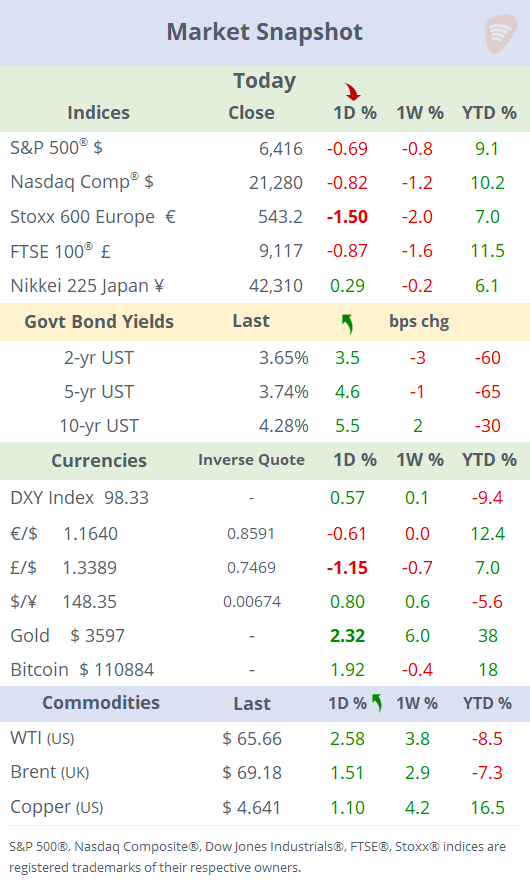

See the ‘Market Data’ post.

Good evening,

A global bond sell-off set the tone in a short trading week after yesterday’s holiday in the US, dragging stocks lower, the VIX index jumping to a one-month high and gold reaching a record. European stocks lagged sharply, led by the DAX, which fell 2.3% to emerge as the day’s biggest loser. It is worth noting that the S&P 500 was trading at record valuations at the end of last week, with a price/sales ratio at 3.2 times and a forward price/earnings multiple of 22.5.

The catalysts for today’s weak trading were largely worries over worsening fiscal outlooks in Europe and the uncertain fate of Trump’s signature tariffs, following an appeals court ruling that struck down the ‘reciprocal’ levies and pushed the case toward the Supreme Court. The White House would have to give back the tariffs charged if the appeal is denied.

A notable stock mover in after-hours trading was Alphabet, with a 7% rally following a judge's order that Google does not need to sell Chrome, but needs to share data with competitors.

European bond markets sold off on Tuesday with 30-year British Gilts yields rising 6bp to 5.70% (and +53bp YTD), the highest since 1998, driven by persistent inflation and rising public debt. The UK’s borrowing costs are the highest among G7 nations, adding pressure on the Chancellor ahead of the Autumn Budget. Britain’s inflation in July, released two weeks ago, accelerated to 3.8% YoY, the highest in 19 months. The Bank of England meets on September 18, and markets are pricing in a 90% chance for rates to remain steady at 4%. In currency markets, sterling plunged over 1% today to a four-week low.

Long-end German bonds reached a 14-year record high of 3.41% compared to 2.60% at the end of last year, and France’s long-end OATs also rose to a 16-year high of 4.50% on fiscal concerns and a political crisis.

In geopolitical updates, India continues to purchase discounted Russian oil despite the 50% U.S. tariff imposed last week, heightening tensions with the White House and prompting a strategic pivot toward closer ties with Russia and China. In Beijing, President Xi Jinping and Putin reaffirmed their strategic partnership amid rising global geopolitical uncertainties.

Economics: Eurozone HICP inflation accelerated slightly to 2.1% YoY in August from 2.0% driven by higher prices for food, alcohol and tobacco. The print came in higher than the 2.0% expected and marginally above the central bank’s target. The Core reading advanced 2.3%, unchanged from July against expectations for a modest decline to 2.2%. These figures reinforce the view that inflation in the bloc remains firm, and traders are pricing in an ECB to hold rates steady through year-end and a 50% chance for a quarter-point cut next March. (Chart on Market Data).

Also, US factory output (ISM) declined for the sixth straight month in August. The next significant release this week will be the US employment report on Friday, with non-farm payrolls expected to increase by 75,000.

Corporate Deals: In a public-to-private deal, Air Lease Corp (mcap $7.2bn) has agreed to be acquired in a $7.4bn all-cash takeover ($65/share) by a consortium led by Sumitomo Corporation and SMBC Aviation Capital, in partnership with Apollo and Brookfield. Air Lease shares jumped 6.6% to an all-time high and accumulated a 33% gain YTD.

Spin-off: A decade after its megamerger, Kraft Heinz (mcap $31bn) is set to split into two publicly traded companies. One covering slower-growth grocery staples like Oscar Mayer and Kraft Singles, and the other focusing on faster-growing sauces, spreads, and seasonings, with completion expected in the second half of 2026. Shares plunged 7% today, are 15% lower YTD and have lost 64% since the merger.

Activist hedge fund Elliott accumulated a $4bn stake (~2%) in PepsiCo (mcap $208bn) and plans to push for changes. Shares ended 1% higher today and are almost flat YTD versus Coke’s (mcap $296bn) 11% gain.

In European private markets, British private equity firm CapVest plans to buy a majority stake in German pharma Stada from Bain Capital and Cinven, at a €10bn valuation and cancels its plan to list.

It was an active day for IPO filings and roadshows. Swedish online payments provider Klarna (KLAR) plans to raise $1.5bn at a $14bn valuation in its NYSE listing (pricing guidance $35-37). Blockchain lender Figure Technologies (FIGR) aims to raise $526mn at a $4.1bn valuation ($18-20).

Crypto exchange Gemini (GEMI) targets a $2.2bn valuation and expects to raise $317mn ($17-19). Drive-thru coffee chain Black Rock Coffee Bar is seeking to raise $265mn at an $861mn valuation ($16-18). Blackstone-backed engineering firm Legence Corp plans to raise $754mn (no guidance provided).

There were no notable earnings releases today; Salesforce and HP are set to report tomorrow after the close.

See you tomorrow.

,Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.