Tue 24 Jun: After the Bell

🎙️📄

See the ‘Market Data’ post. FYI- Only subscribers can access the podcast and the full script below. Non-subscribers can access unlocked episodes.

Good evening,

Global markets rallied on Tuesday as Trump declared the end of the Israel – Iran conflict. The president reacted angrily to ongoing exchanges of fire between both countries last night after a White House-brokered cease-fire took effect.

However, in the early hours of Tuesday the delicate truce was stabilizing and Israel announced that its airports were resuming full operations and that restrictions on civilian movement were lifted. Trump called the end of this 12-day war; Israel claimed Iran’s nuclear threat was destroyed, and Tel Aviv will now focus on Gaza.

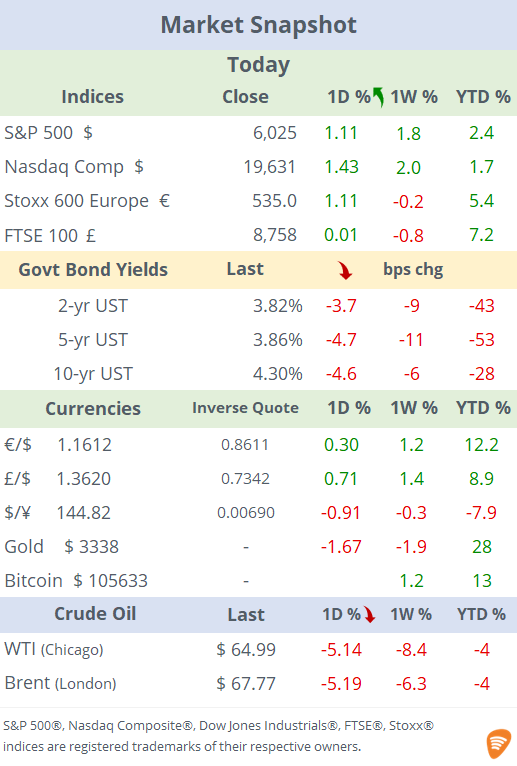

US equity indices rallied between 1 and 1.5% and are nearing their all-time highs a 26% rally for the S&P 500 from its level at the bottom of the tariffs sell-off on April 8 triggered by Liberation Day. Crude oil continues to fall sharply with another 5% decline today and Brent is now trading well below the $70 mark, a two-week low.

Benchmark bond yields continue to decline with 2-yr Treasuries yielding 3.82%, the lowest since early May, as lower oil prices reduces inflation pressures and the latest Fed officials’ comments have been mostly dovish. The yield curve has shifted lower by ~22bp in the past four weeks. With a risk on mode in markets, the $ depreciated 0.5% today and the DXY index trades below 98 pts.

It was an active day for central bankers’ speeches in the US and Europe. Jerome Powell testified before Congress and said the threat of inflation and the uncertainty that Trump has generated with his policies, make it difficult for the Fed to make any moves as he defends the current level of interest rates. Trump has insisted that policy rates should be reduced between 200 to 300bp and, should inflation accelerate, the Fed can revert the decision. Powell said the Fed had to adopt a cautious wait-and-see approach due to the potential impact of tariffs on inflation.

The Fed governor also mentioned that all forecasters he knows expect a meaningful increase in inflation before year end. Although inflation has been decelerating it is still above the Fed’s target (2%). The last headline PCE inflation reading was 2.1% YoY in April, and the next update is on Friday.

ECB’s Lagarde focused on modernizing Eurozone payments with a digital € that still needs legal framework and reaffirming the central bank’s stance on rate cuts as inflation decelerates.

Bank of England Governor Bailey also testified today and said that the impact of trade tariffs on inflation is more ambiguous than the impact on economic growth and that it is highly unpredictable where US import tariffs are going to end up.

Economic data updates: Canada’s headline CPI rose by 1.7% YoY (0.6% MoM) in May, unchanged from the previous month, in line with estimates and within the BoC’s target range (1-3%). The central bank’s policy rate is 2.75% and the next meeting is on July 30. Germany’s Ifo Surveys (Business 88.4 and Expectations 90.7) came in marginally better than a month ago.

Earnings released today: Carnival Corp (mcap $35bn) beat top ($6.3bn, +10% YoY) and bottom ($0.35/sh, $470mn, +220% YoY) estimates and increased its outlook on more passengers and lower costs. Over the last four quarters, Carnival has surpassed consensus estimates four times. Shares gained 7% today and are 57% higher in the LTM.

Also, Fedex (mcap $55bn) reported after the close and beat revenue ($22.2bn, 0% YoY) and earnings ($6.07/sh, $1.43bn, +9% YoY) estimates but outlook missed analysts forecast as the soft demand for logistics extends and shares dropped 3.5% in extended trading, after ending the session unch.

Deals today: the Spanish government imposed new conditions on BBVA’s hostile takeover bid for smaller rival Banco Sabadell and blocked the merger for at least 3-yrs. Both stocks ended flat today.

In UK sports, New York Jets owner Woody Johnson has agreed to buy John Textor’s ~45% stake in south London’s football club Crystal Palace at a £550mn valuation.

In IPOs, German online car parts Autodoc postponed its planned listing in Frankfurt a day before its debut without providing reasons or timeline. It had planned to raise ~€450mn at a €2.2bn valuation.

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.