Tue 28 Oct: After the Bell

Your 5’ evening market wrap 📄🎙️📈

See the ‘Market Data’ post for tables & charts.

Good evening,

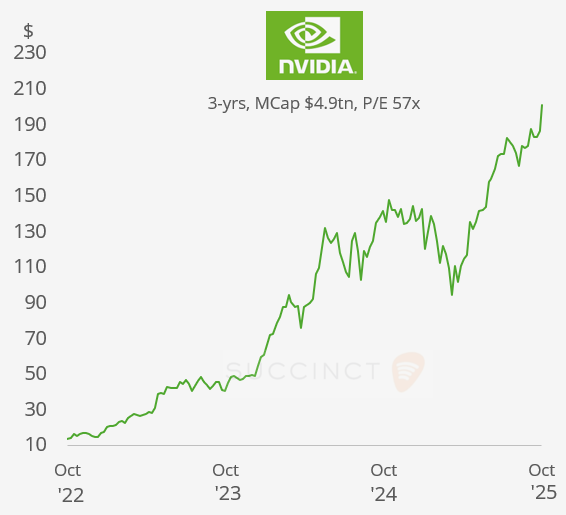

Artificial intelligence-related headlines and deal activity drove another strong session for leading equity benchmarks, with Nvidia surging 5% to a fresh record (+50% YTD). However, today’s gains were concentrated on mega-cap names like Nvidia, Microsoft and Broadcom as 8 out of 11 sectors fell, and the equal-weight S&P 500 dropped 0.9% while the Nasdaq Composite advanced 0.8%. Earnings sentiment remained positive ahead of tomorrow’s heavyweight tech reports, while crude oil fell for a third straight day on expectations of higher OPEC+ output. Benchmark bond yields were little changed, currencies traded calmly, and the yen’s modest appreciation was the day’s only notable mover.

Nvidia (mcap $4.9tn) announced it will build seven new supercomputers for the US Department of Energy to support research and innovation. It added that it has $500bn in AI chip orders, highlighting strong demand for its technology.

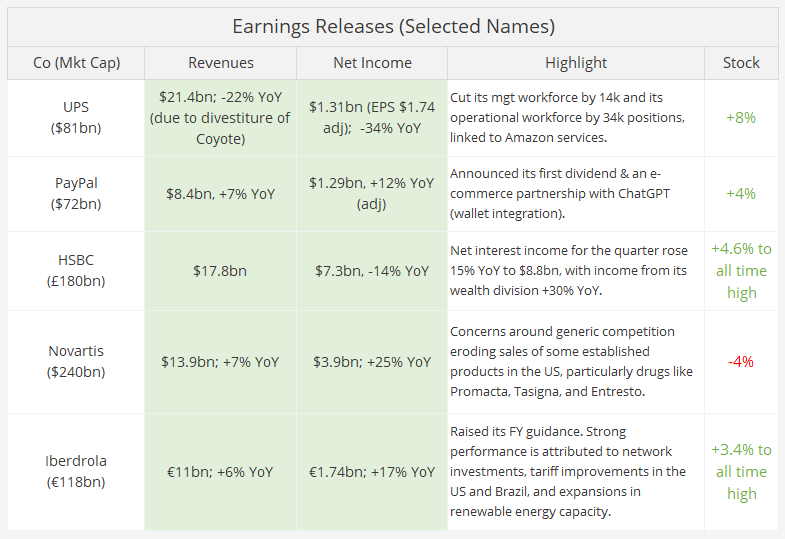

Earnings: Pre-market open releases and those in Europe were mostly positive, but after the US close, Mondelez (mcap $78bn) missed on diluted EPS and cut its full-year profit forecast, sending shares down by 4% in extended trading. Visa and Booking Holdings beat top and bottom estimates.

Links to official releases: UPS PayPal HSBC Novartis Iberdrola

Economics: It was a light day on the data front. ADP’s new format of weekly updates (from monthly previously) showed US private payrolls rose by an average of 14,250 jobs in the four weeks ending Oct 11, a modest gain that highlights muted hiring momentum.

Corporate Deals: Tuesday was another active day for M&A and significant investment announcements.

→ ChatGPT parent OpenAI has completed its restructuring into a for-profit public-benefit corporation, granting Microsoft (mcap $4tn) a 27% stake valued at $135bn and giving OpenAI a $500bn valuation. The shift clears a major hurdle for OpenAI to raise capital more freely and clears the path for a potential public listing, while Microsoft secures rights to its AI models through 2032. MSFT gained 2% today to a new all-time high.

→ Westinghouse Electric (controlled by Brookfield Asset Mgt) and Canada’s Cameco Corp (mcap $65bn), the world’s largest publicly traded uranium co, announced plans to build $80bn worth of nuclear reactors across the US in partnership with the federal government, one of the largest atomic energy investments in decades. The initiative aligns with Trump’s energy agenda to expand domestic production across oil, gas, coal, and nuclear power. Cameco rallied 23% today, has doubled this year and is trading at a record high.

→ Nokia (mcap $42bn) announced that Nvidia will invest $1bn in the Finnish telecom equipment maker, marking a major strategic partnership aimed at accelerating the development of AI-powered network solutions. Nokia shares jumped 23% in New York to a 10-year high and have gained 79% YTD.

→ Barclays (mcap £56bn) is paying $800mn to acquire privately-owned Best Egg, a Delaware-based online platform that originates loans and then sells them to asset managers, earning fees for facilitating and servicing the debt.

Day ahead:

→ Monetary Policy: Fed (-25bp to 3.875% mid exp) and BoC (-25bp to 2.25% exp).

→ Data: US pending home sales; Spain GDP.

→ Earnings: Microsoft, Meta, Alphabet, Caterpillar, Boeing, Verizon, Starbucks, Santander, Deutsche Bank and Airbus, among other large-caps.

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient’s personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.