Tue 4 Nov: After the Bell

Your 5’ evening market wrap 📄📈 Risk-off: Stocks fall + cryptos plummet

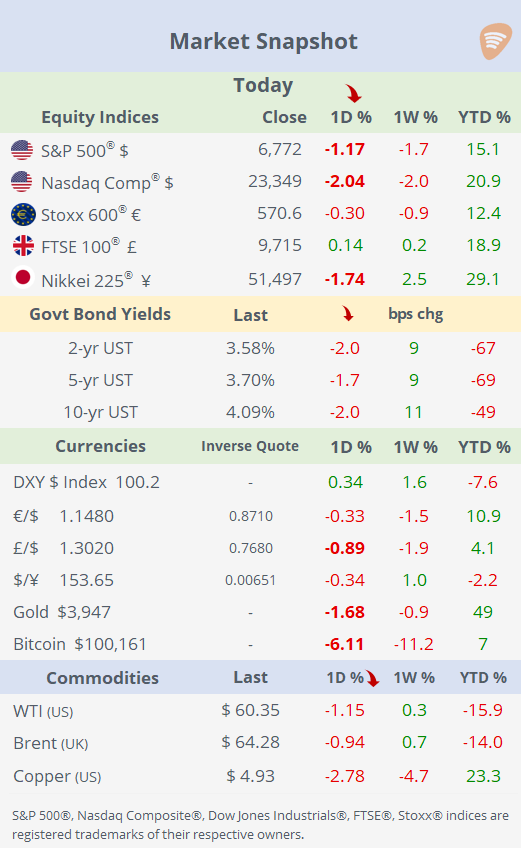

See the ‘Market Data’ post for tables & charts.

Good evening,

Stocks tumbled sharply on Tuesday, with the Nasdaq Composite falling 2% and the VIX rising to 18.9%, its highest level in two weeks, as investors grew increasingly cautious about stretched tech valuations. Despite modest moves in core bonds, the 2-year Treasury Note yield fell just 2bp, risk sentiment deteriorated, driven by warnings from Goldman Sachs and Morgan Stanley executives of a potential 10–15% equity correction.

Palantir shares fell 8% even after solid quarterly results yesterday, as analysts questioned its high P/E ratio, reflecting concerns about whether the tech-led rally can sustain its momentum. Mega-caps Nvidia and Tesla fell 4% and 5%.

The broader market caution was reinforced by a stronger dollar, with the DXY index closing above 100 for the first time in over three months, while £ slid nearly 1% to $1.3018, its weakest level since mid-April, following comments from Chancellor Rachel Reeves that tax increases could not be ruled out in the upcoming Budget.

The crypto market also sold off, with Bitcoin dropping more than 5% to just above $100k, trading below that level for the first time since late June, reflecting a widespread shift toward more defensive positions.

Earnings: Among today’s earnings reports, the movers were Uber and Shopify, both falling over 5% as investors reacted to weaker-than-expected profitability and margin pressures. Uber posted $13.4bn in Q3 revenue, beating estimates, but its operating profit and Q4 guidance came in slightly below expectations. Shopify delivered strong revenue growth of ~32% YoY, yet higher spending on AI and payments weighed on operating income, fuelling the sell-off despite top-line strength.

→ Semiconductor giant AMD (mcap $406bn) reported strong Q3 earnings after Tuesday´s close, beating both top‑line and bottom‑line estimates, and provided Q4 revenue guidance above analyst expectations. Despite the positive results, the stock fell 2% in after-hours trading, following a 3.7% decline during the regular session.

Politics: The first results from the New York election are expected to start coming in shortly after polls close at 9pm ET today, with updates rolling in through the night.

The federal government has been shut down since October 1 after Congress failed to pass a funding bill, making it one of the longest US shutdowns on record. Senate Majority Leader John Thune said he is “optimistic” a deal could be reached this week, but no agreement has been finalised yet.

Central Banks: The Reserve Bank of Australia kept its cash rate unchanged at 3.60%, as expected, citing lingering inflation pressures and strong housing costs. Policymakers signalled that further rate cuts are unlikely soon, stressing a data-dependent approach that could delay any easing until 2026. (see Market Data for the AUD)

Corporate Deals: → Ørsted (mcap €20bn), the Danish renewable-energy group, agreed to sell a 50% stake in its Hornsea 3 offshore wind project in the UK to Apollo Global Management for $6.5bn, one of Europe’s largest energy-infrastructure deals this year. The 2.9 GW project will power over 3mn homes once completed. The sale strengthens Ørsted’s balance sheet as it seeks to ease financial strain and advance new developments. Ørsted shares have lost 65% YTD.

→ Michigan-based diversified manufacturer TriMas Corp (mcap $1.4bn) has agreed to sell its Aerospace segment for $1.45bn in cash to an affiliate of Tinicum, a private investment firm based in New York.

→ Starbucks (mcap $89bn) is selling a controlling stake of up to 60% in its Chinese retail operations to Boyu Capital, a Hong Kong–based private equity firm, in a deal valuing the business at around $4bn.

IPOs: Beta Technologies, the Vermont-based electric aircraft maker, raised $1bn in its NYSE IPO, pricing shares at $34 each, above the indicated $27–33 range. The offering values the company at $7.4bn and highlights strong demand in the resurgent IPO market. Beta designs, manufactures, and sells high-performance electric aircraft, propulsion systems, and charging components. Shares fell 7% on their debut, but managed to recover to end the day 2% above the IPO price.

Day ahead: US and European Services and Composite PMIs, Eurozone PPI, Italy retail sales, Brazil´s central bank policy meeting.

Earnings by: McDonald´s, Qualcomm, AppLovin, Robinhood, BMW and DoorDash.

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient’s personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.