Tue 9 Dec: After the Bell

Muted Equities Before the Fed, JPMorgan weakness, SpaceX IPO plans. Your 5’ evening market wrap📄📈

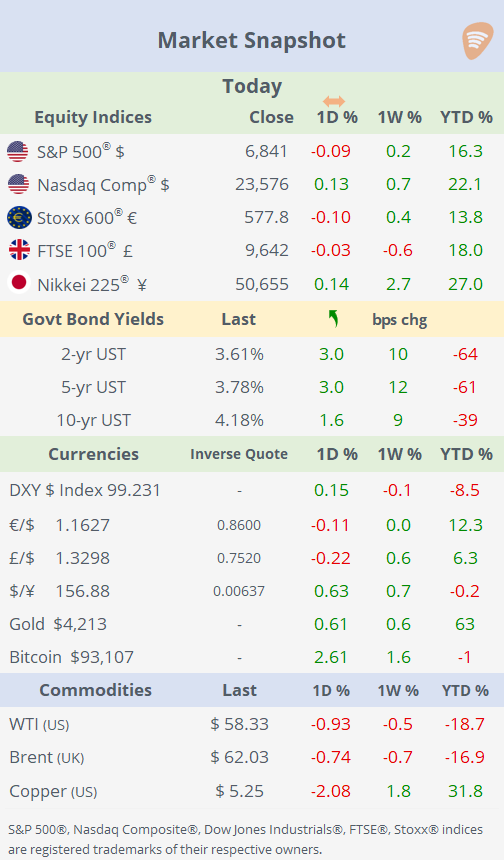

ℹ️ Today’s performance tables & charts on the ‘Market Data’ post.

Good evening,

Markets were broadly steady ahead of tomorrow’s Fed decision, with investors reluctant to take new positions before the central bank’s updated guidance. Sentiment was weighed down slightly by JPMorgan, whose warning about higher 2026 expenses dragged on the Dow, while the S&P 500 and Nasdaq were little changed. SpaceX’s plans for a record IPO next year added a notable corporate headline but had limited market impact.

Core fixed income softened further, with investors positioning around tomorrow’s policy outlook. A quarter-point rate cut is fully priced in, leaving the focus on the Fed’s tone for 2026. The 2-year Treasury yield rose 3bp to 3.61%, its highest close in three weeks, though still comfortably below its 200-day moving average.

Silver surged to fresh all-time highs, breaking above the $60 level, as momentum buying and safe-haven flows intensified.

Currencies were mostly quiet, aside from renewed ¥ weakness driven by expectations of higher relative yields, while cryptocurrencies posted another positive session.

Business News: → JPMorgan (mcap $832bn, P/E 15x) shares fell ~5% today (still +26% YTD and near their all-time high) after the bank issued a warning that its upcoming costs will be higher-than-expected, sparking investor concern about profit pressure. The drop reflects fears that rising expenses could dent near-term earnings at what had been one of the sector’s strongest big banks.

→ Trump said he would allow Nvidia to export H200 chips to China, with the US taking a 25% cut. The chips are more powerful than the H20 model Nvidia had previously been permitted to sell, but still fall short of its top-tier offering.

Central Banks: → The Reserve Bank of Australia kept its policy rate unch at 3.60%, matching market expectations. The central bank remains cautious about inflation and economic growth, signalling that future adjustments will be subject to inflation data and labour-market strength. The guidance suggests the RBA is likely to stay on hold in the near term, but remains ready to tighten again if inflation proves sticky or economic conditions warrant. The AUD finished a touch firmer and accumulated a 7% appreciation this year vs the $.

Earnings: → AutoZone (mcap $58bn) shares slipped 7% after quarterly earnings fell short of estimates as continued spending on expansion initiatives pressured margins even as revenue grew solidly. Still, shares are 9% higher YTD and trade at 24 times earnings.

Data: → Mexico’s headline inflation rose to 3.80% YoY versus October’s 3.57%, beating estimates of 3.69% amid upticks in food (3.0%) and clothing prices. This reverses three months of easing, signalling reacceleration within Banxico’s 2-4% target, driven by services and core inflation pressures (4.43% YoY). The Mexican peso is 12% stronger against the $ in ‘25.

Deals: → French beauty leader L’Oréal (mcap €196bn) is raising its stake in Swiss dermatology company Galderma (mcap $48bn) to 20% by purchasing a block from existing investors valued at $4.8bn based on Friday’s close. The move deepens L’Oréal’s dermatology and medical-skincare exposure, continuing its recent push into higher-growth skin-health categories. Galderma shares gained 64% YTD.

→ In IPOs, the Magnum Ice Cream Company (MICC) began trading in Amsterdam at a valuation of €7.8bn, coming in below analyst expectations as some investors questioned the growth outlook for a sugar-heavy brand in a more health-conscious market. The spinoff from Unilever created the world’s largest standalone ice-cream company, but the stock had a lukewarm debut.

→ Also, Bloomberg reported that Elon Musk’s SpaceX is advancing 2026 IPO plans (mid-to-late year), targeting $1.5tn valuation and raising “far above” $30bn, the largest IPO ever, fueled by $15bn 2025 revenue rising to $22-24bn in ‘26.

Day Ahead: Policy Meetings → Fed, Bank of Canada, Brazil and Saudi Arabia.

Data → Inflation updates in China, Brazil and Russia.

Earnings (PM) → Oracle, Adobe and Synopsys.

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient’s personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.