Tue 9 Sep: After the Bell

🎙️📄+ Market Data

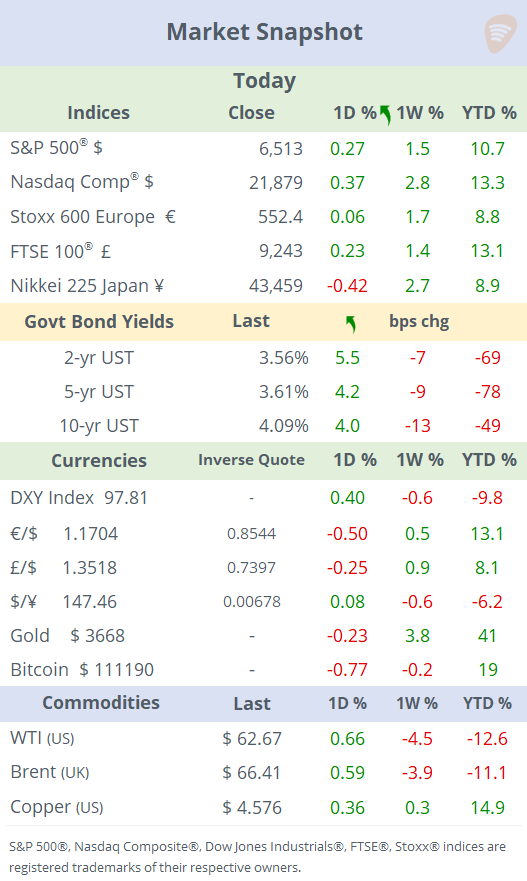

See the ‘Market Data’ post.

Good evening,

In a significant geopolitical escalation, Israel launched airstrikes in Doha, Qatar, targeting senior Hamas leaders. Qatar condemned the strike as a violation of its sovereignty and international law, a sentiment echoed by the United Nations and several Arab nations. The operation, named "Summit of Fire," marks the first Israeli military action in Qatar and threatens to derail ongoing ceasefire negotiations.

U.S. markets saw a quiet, range-bound trading day despite rising geopolitical tension. Benchmark stock indices rose around 0.3% and the dollar stopped its recent decline with a reversal mainly against the € and Swiss Franc.

Gold, already trading at all-time highs due to expectations of lower Fed interest rates, rose further today amid heightened geopolitical tensions but eased towards the end of the trading day to close at $3,630.

Earnings: Oracle (mcap $675bn) reported after the close, slightly missed both top and bottom estimates, but rallied 22% in extended trading as it announced a massive deal with OpenAI. (Chart on Market Data).

Economics: The U.S. BLS released its preliminary annual benchmark revision today, revealing that the economy added 911k fewer jobs than previously estimated over the 12 months ending in March 2025. This marks one of the largest downward revisions in recent decades, suggesting a weaker labour market than initially reported. The revision indicates that job growth averaged ~71k per month during that period, significantly lower than the previously reported average of 147k per month. The weakest sectors were leisure and hospitality, professional and business services and retail trade.

Mexico's annual headline inflation for August revealed a modest uptick to 3.57% while the core reading remained steady at 4.23% YoY. Banxico, which meets on the 25th, has recently slowed the pace of interest rate cuts, reducing the benchmark rate to 7.75% in August, its lowest in three years.

Deals: London-listed miner Anglo American (mcap £26.6bn) and Canada’s Teck Resources (mcap $19.5bn) are set to merge, creating a new global copper-focused powerhouse and recording the second-largest M&A deal in the sector’s history, worth $55bn. Anglo shareholders will own 62.4% of the merged company when completed. Anglo shares gained 9% (+7% YTD) and Teck rallied 14% today (0% YTD). (Reuters)

In the oil & gas refining sector, Phillips 66 (mcap $54bn) will acquire a 50% stake in Canada's Cenovus Energy (mcap $30bn) refining divisions in Texas and Illinois for $1.4bn.

In private markets, France’s Mistral A.I. has doubled its valuation to $14bn following a $1.5bn investment from ASML, Europe’s largest tech company. Mistral plans to develop models and data centres independent of American competitors. (NYT)

Business stories: Apple (mcap $3.48tn) unveiled its new iPhone 17 lineup, including the thinnest iPhone ever, the iPhone Air and also introduced new AirPods and a Watch Series, with enhanced health monitoring features. Shares fell 1.5% and remain lower by 6.4% YTD. (WSJ)

Day ahead: inflation updates in the US (PPI), China (CPI and PPI) and Brazil (CPI); Spanish apparel giant Inditex reports earnings; EIA crude oil inventories.

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.