Wed 1 Oct: After the Bell

🎙️📄+ Market Data

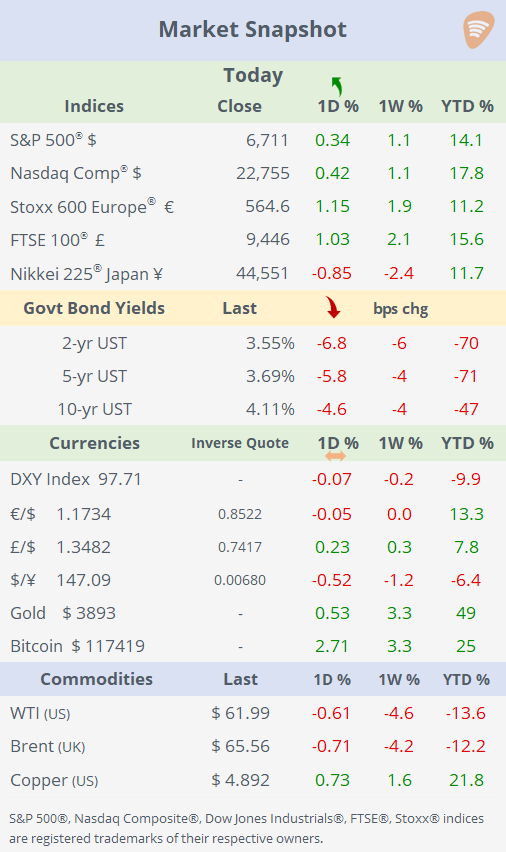

See the ‘Market Data’ post.

Good evening,

US stock markets closed at fresh record highs today, with the S&P 500 hitting a new peak, driven by strength in healthcare names. Bond yields fell as investors balanced uncertainty in Washington with rising expectations for a Fed rate cut this month.

European stock markets were strong today, led by a sharp rally in healthcare following a US-Pfizer deal that eased sector uncertainty and boosted major pharma companies. Despite Washington’s turmoil, markets focused on positive sector developments and stable macro signals.

Politics: The US government funding lapsed at midnight, triggering a shutdown expected to halt federal services and furlough hundreds of thousands of workers. Key economic data releases, disease surveillance, and many safety inspections will be paused as the shutdown impacts multiple federal agencies. Republicans proposed a seven-week stopgap funding bill, but Democrats opposed it, demanding hundreds of billions in healthcare funding, resulting in the current stalemate.

Earnings: Nike (mcap $107bn) reported last night, with a surprise beat for revenue ($11.7bn, +1% YoY) and profit ($727mn, -30% YoY), and said it expects sales to fall by a low single-digit percentage in the next quarter as its China division is struggling. Shares responded positively with a 10% recovery before easing to a 6% gain today.

Central Banks: The US Supreme Court has allowed Fed Governor Lisa Cook to remain for now, postponing a decision on whether Trump has the authority to remove her until it hears arguments in January. Futures markets are pricing in a 99% chance for the Fed to cut rates by a quarter point to a 3.75 to 4% range in four weeks.

Monetary Policy: The Reserve Bank of India left rates steady at 5.5% today, maintaining a neutral stance. Inflation has softened to 2.6% and economic growth remains resilient despite global trade uncertainties.

Data: The US ISM Manufacturing PMI rose slightly to 49.1 from 48.7 in August, marking a soft improvement, but the sector remains in contraction territory for the seventh consecutive month.

ADP reported that US private businesses cut 32k jobs in September, well below forecasts of a 50k gain, highlighting ongoing weakness in the labour market.

Eurozone headline inflation rose to 2.2%, slightly up from the 2% in August, driven by slower declines in energy prices. Core inflation remained steady at 2.3% for the fifth consecutive month, signalling persistent underlying price pressures and supporting the ECB’s cautious stance on further rate cuts this year.

There were no steep changes in the UK and Germany manufacturing PMIs, with the UK hitting its lowest level in five months. In contrast, France’s manufacturing PMI dropped sharply from 50.4 to 48.2, signalling a return to contraction amid political uncertainty and weakening demand.

The EIA reported US crude oil inventories rose by 1.8mn barrels last week, exceeding expectations. The surprising build contributed to a decline in oil prices today, reflecting weaker-than-expected demand, considering production and import drops.

Deals: BlackRock’s Global Infrastructure Partners is nearing a $38bn (including debt) takeover of utility The AES Corp (mcap $11bn), one of the largest infrastructure deals ever. AES operates power plants across the US and 13 other countries, supplying energy to data centres. AES shares jumped 37% today to an eleven-month high.

In the US mid-market chip sector, Axcelis Technologies (mcap $2.9bn) and Veeco Instruments (mcap $1.9bn) will merge in a $4.4bn all-stock transaction, creating the fourth largest US wafer fabrication company.

Bain Capital has submitted a bid for Costa Coffee, as Coca-Cola seeks around £2bn for the UK’s largest coffee chain. Costa, with over 2,700 branches mainly in the UK and Ireland, is the world’s second-largest coffee chain after Starbucks.

IPOs: Data centre REIT Fermi (FRMI) was priced at $21 and raised $682mn for a total market valuation of $12.5bn at pricing. Shares jumped 41% on their Nasdaq debut, fueled by strong investor interest in AI infrastructure.

Florida-based flood insurer Neptune Insurance (NP) raised $368mn in its NYSE listing at $20, valuing the company at $2.8bn. Shares closed at $24.

Day ahead: US factory orders and weekly jobless claims; inflation in Switzerland and Korea; Tesco (UK) earnings.

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient’s personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.