Wed 10 Dec: After the Bell

Risk-On Surge After Fed Delivers Cut and Tones Down Hawkish Guidance. Your 5’ evening market wrap📄📈

ℹ️ Today’s performance tables & charts on the ‘Market Data’ post.

Good evening,

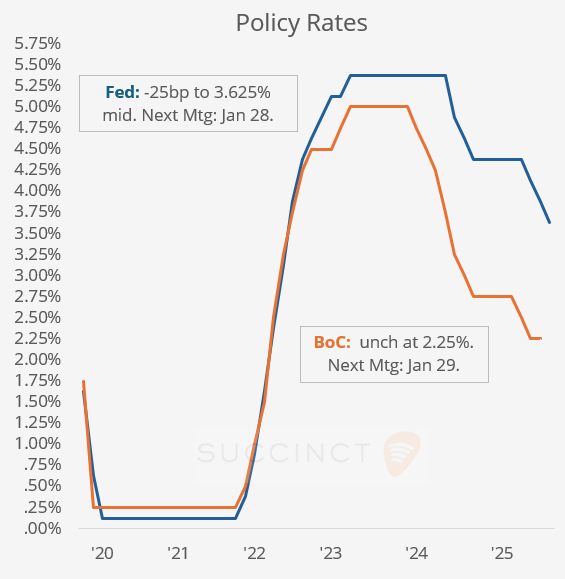

Equity markets rallied after the Federal Reserve delivered the widely expected quarter-point rate cut to 3.625% mid-range and a less hawkish-than-feared outlook, triggering a strong risk-on reaction.

The Dow and Russell 2000 outperformed, jumping roughly 1.5%, and the S&P 500 reached a record high. Short-end yields plunged, with the 2-year Treasury down 8bp to 3.53% as traders aggressively bought bonds.

In forex markets, the DXY Dollar Index (98.65 pts) fell to a five-week low as the greenback weakened broadly across all major currencies.

The FOMC voted 9–3 to cut rates to 3.50%–3.75%, marking a third consecutive reduction and the first meeting in six years with three dissents. Chicago’s Goolsbee and Kansas City’s Schmid opposed the cut, preferring no change, while Governor Miran argued for a larger half-point reduction. The Fed cited cooling job gains and rising downside risks to employment as justification for easing.

The updated ‘dot plot’ shows officials still expect only one additional quarter-point cut in 2026 and another in 2027, unchanged from September. Projections now see inflation at 2.4% and GDP growth at 2.3% in 2026. Powell said the inflationary impact of Trump’s tariffs is likely to be temporary.

ℹ️ Subscription costs $7.5/mth with the annual plan and has a 7-day trial. See unlocked posts for more samples and visit ‘Market Data’.

The Fed also announced it will begin purchasing short-term Treasuries starting on Friday to maintain ample reserves. Powell, whose term ends in May, stressed that future decisions will focus on “the extent and timing” of further adjustments as inflation progress stalls and labour-market cooling becomes more evident.

Before the Fed’s announcement, markets assigned a 22% probability to a quarter-point rate increase at the late-January meeting; that probability rose to 27% during Powell’s press conference as investors recalibrated the policy outlook.

→ A notable large-cap mover today was energy company GE Vernova (mcap $196bn), which rallied 16% after raising 2025-2028 guidance (e.g., $52bn revenue, $22bn FCF), doubling dividends, and expanding buybacks amid AI power demand. Yesterday’s ‘Investor Day’ sparked analyst upgrades, pushing the stock to record highs post-spin. Shares are 120% higher YTD.

Other Central Banks: → The Bank of Canada kept its policy rate unchanged at 2.25%, its lowest level since mid-2022, noting that the economy has remained more resilient than expected after tariff changes, with GDP and job growth outperforming forecasts. Governor Macklem said the current rate is “about the right level” to support the economy’s structural transition while keeping inflation near the 2% target. The BoC reiterated that, after signalling in October that it was done cutting for now, future moves will depend on the evolution of inflation and domestic demand. The Canadian dollar appreciated sharply to a 2.5-month high against the dollar.

Earnings: → Oracle (mcap $636bn) shares fell about 6% in after-hours trading as Q2 adjusted revenue came in below expectations, overshadowing what was otherwise a strong year-on-year performance. The company reported EPS up 54% and revenue up 14%, but cloud revenue disappointed analysts. Investors grew concerned about the slower-than-expected monetisation of Oracle’s large cloud backlog, raising questions about the pace of future growth.

Geopolitics: → Trump said that US forces seized a large, sanctioned oil tanker off Venezuela’s coast (the largest ever) via Coast Guard operation amid military buildup, including carriers and jets. This escalates pressure on Maduro’s regime by targeting Venezuela’s oil revenue following Trump’s “days numbered” rhetoric and anti-cartel actions. WTI gained 1.2% pre-news on inventory draws; impact on global supply unclear as tanker details undisclosed.

Data: → China’s consumer inflation picked up to 0.7% YoY in November, slightly above expectations and marking a 21-month high, driven mainly by food-price increases. PPI remained deeply negative at –2.2%, a sharper contraction than forecast, highlighting ongoing industrial weakness. The combination of soft producer prices and fragile domestic demand suggests that deflationary pressures are likely to persist into 2026, keeping the door open for further policy support.

Deals: → In private markets, Blackstone is acquiring MacLean Power Systems from Centerbridge Partners (majority owner since 2022), merging it with portfolio company Power Grid Components to form a utility-equipment leader valued at $4bn. The deal targets electrification and grid upgrade demand, leveraging MacLean’s transmission/distribution components amid Blackstone’s energy transition strategy.

→ In IPOs, management-owned Cardinal Infrastructure Group, a civil contracting company that provides infrastructure services to the residential, commercial, industrial, municipal, and state infrastructure markets in the US, raised $241.5mn on its Nasdaq listing, priced at $21 for a market cap of $767mn. It placed 31% if its outstanding shares and rose 12% on its debut day.

Day Ahead: → Policy Meetings: Swiss National Bank (unch at 0% exp) and Turkey.

→ Data: US trade, Brazil retail sales, Argentina inflation.

→ Earnings (PM): Broadcom & Costco W.

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient’s personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.