Wed 10 Sep: After the Bell

🎙️📄+ Market Data

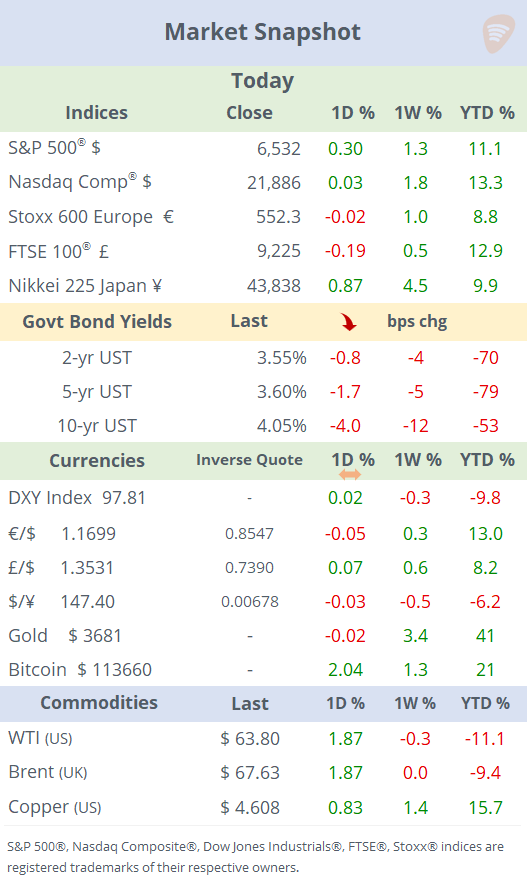

See the ‘Market Data’ post.

Good evening,

Despite easing U.S. inflation pressures and Oracle’s standout rally, Wall Street closed mixed to slightly weaker on Wednesday but remained at record highs. The Dow Jones Industrials underperformed as Apple dropped over 3%, its sharpest daily fall since April, after the iPhone 17 launch disappointed with few A.I. features and new tariff costs. Bond yields fell, driven by the PPI update and ahead of tomorrow’s key consumer inflation report. Trump insisted the Fed eased policy and posted “Just out: No inflation!”.

On the political front today, conservative activist and Turning Point USA founder Charlie Kirk was shot dead during a live Q&A at Utah Valley University.

Earnings: Cloud and AI software giant Oracle (mcap $930bn) shares jumped 36% after a blockbuster earnings report yesterday after the close. A massive $455bn in outstanding customer contracts, driven by multibillion-dollar AI-related deals (OpenAI), fueled projections for rapid growth in Cloud Infrastructure and lifted Wall Street optimism about the broader AI-fueled tech rally, boosting Nvidia shares by 4%.

Chip design software firm Synopsys (mcap $72bn) shares plummeted nearly 36% after a disappointing Q3 earnings report that missed analyst expectations. The shortfall was driven by U.S.-China export restrictions and integration costs from the $35bn Ansys acquisition, prompting it to lower its full-year profit projections.

Spain’s fast fashion giant Inditex (mcap €141bn, P/E 24x) marginally missed revenue (+1.7% YoY to €10bn) and profit (€2.8bn in H1) estimates as sales growth slowed under the pressure of U.S. tariffs. However, shares rallied 6.5% today (-8.5% YTD) to the highest level in three months on the back of a strong August sales pickup and resilient margins.

Regarding central bank updates, a judge ruled late Tuesday that Fed Governor Lisa Cook, whom Trump has sought to dismiss, can remain at the Fed for now and will be able to vote in next week’s policy meeting.

Data: U.S. producer prices (PPI inflation) unexpectedly rose 2.6% YoY in August, down from 3.1% in July and well below the expected 3.3%, indicating easing inflation pressures.

China's CPI inflation declined by 0.4% YoY in August, marking the sharpest drop in six months and surpassing expectations. This deflationary trend, attributed to weak consumer demand and falling food prices, points to continued weakness in the economy.

The Energy Information Administration reported today that U.S. crude inventories unexpectedly rose 3.9mn barrels for the week ending September 5, against expectations for a decline, and noted that global oil prices are expected to decline in the coming months due to rising production from OPEC+. However, crude oil prices rose amid heightened geopolitical tensions following Israel's strike in Qatar.

Deals: Swedish fintech Klarna’s IPO was priced at $40, above the guidance range, raising $1.37bn. Shares opened at $52 and closed at $46, up 14% on their debut day on the NYSE for a market valuation of $17bn.

In private markets: Starling Bank, the London-based digital bank with plans to expand into the U.S., is preparing a secondary share sale that could value the fintech at up to £4bn.

Day ahead: ECB’s policy meeting (no rate change exp); US CPI inflation (modest uptick exp); 30-year UST auction; Adobe Systems and Kroger report earnings.

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.