Wed 12 Nov: After the Bell

Your 5’ evening market wrap 📄📈

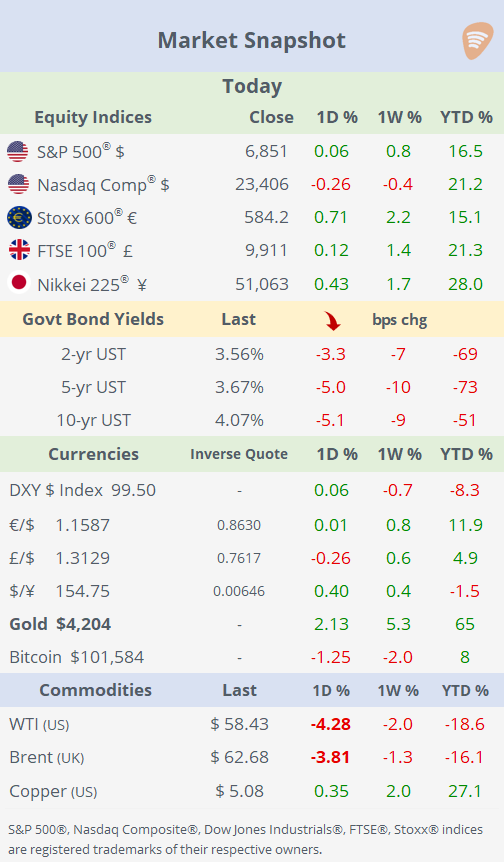

Indices + LargeCaps + FX + Treasuries + Commodities tables on the ‘Market Data’ post.

Good evening,

Market sentiment centered on today’s House vote to end the government shutdown, keeping trading subdued. US equities finished little changed, with tech stocks marginally weaker while the Dow Jones Industrial outperformed, rising 0.7% to a record high above 48,000, driven by strength in Goldman Sachs and UnitedHealth. After the close, Cisco Systems (mcap $291bn) reported stronger-than-expected earnings and raised its full-year profit outlook. The stock gained 3% in extended trading, building on a similar advance during the session to reach a new record high, finally surpassing its March 2000 peak. Treasury yields eased, with the curve shifting lower by ~5bp.

The longest government shutdown could end tonight if the House approves a funding package extending federal funding until the end of January, with a vote expected around 7 pm ET.

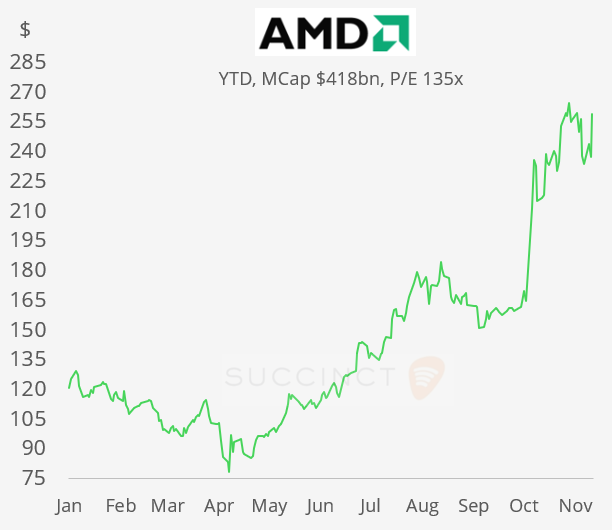

The notable large-cap mover today was AMD (mcap $418bn), rallying over 8% to an all-time high after management raised its growth outlook, projecting more than 35% annual revenue growth over the next 3‑5 years on the back of accelerating AI momentum. The stock is 113% higher this year and trades at 135 times trailing earnings.

European stocks climbed as the German Dax rose 1.2% to near record highs, supported by corporate earnings reports from Infineon, RWE, and E.ON. Infineon surged 7% on AI‑related optimism, RWE jumped 9% after a solid EPS beat, while E.ON dipped 3.6% amid cautious sentiment.

It was an active day in commodity markets. Crude oil fell sharply today (WTI -4.3%) after OPEC upgraded its non-OPEC+ supply forecast and reported large inventory builds, signalling possible supply excess and a weakening demand outlook.

Silver surged over 5% to a new record high of $53.3/oz, surpassing last month’s 45-year peak, and has gained more than 11% so far this week on two of its largest daily moves of 2025.

Treasury Secretary Scott Bessent indicated that substantial cuts to import tariffs on products like coffee and bananas are forthcoming, aiming to ease consumer prices. Coffee futures fell 4.5% today, while Cocoa lost 3.5% to accumulate a 12% drop WTD.

Central Banks: The Fed is increasingly divided over a potential December rate cut, with officials split between concerns over persistent inflation and a slowing labour market. The shutdown, which halted key economic data, has intensified the uncertainty, while futures markets currently imply a 65% chance of a quarter-point cut next month.

US Politics: House Democrats released emails from Jeffrey Epstein that allege Trump “spent hours” with one of Epstein’s victims and was aware of the trafficking, putting the president back in the spotlight over his past ties to the convicted sex offender.

Economic data releases were scarce today. The White House reported that key economic data for October may not be released at all due to the ongoing government shutdown.

There was also little to highlight on the corporate deals front today, with no major new transactions announced.

IPOs: Pollen Street Capital is preparing to take Markerstudy Group, a UK-based insurance platform, public via an IPO that could value the business at £3bn. Expected for early 2026.

Day Ahead: → Data: US CPI, Japan PPI, UK GDP, €-zone and UK industrial production, and Australia employment. → Earnings: Disney, Applied Materials, Alibaba, Tencent, Siemens, Deutsche Telekom.

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient’s personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.