Wed 14 Jan: After the Bell

Tech and Bank Earnings Weigh on Equities as Precious Metals Surge to Records. Your 5’ evening market wrap📄📈

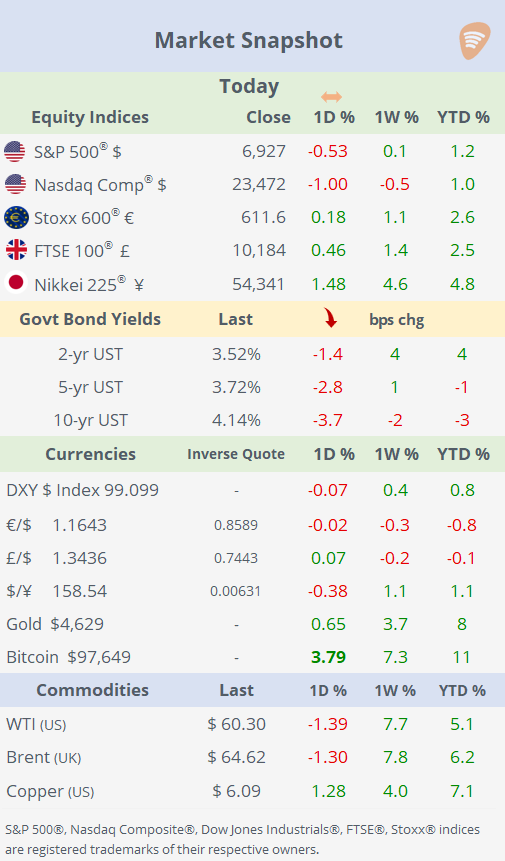

ℹ️ Today’s performance tables & charts on the ‘Market Data’ post.

Stocks retreated on Wednesday, led by declines in the Nasdaq as large-cap technology names, including Microsoft, Amazon, Meta and Broadcom, traded lower following fresh restrictions on Nvidia’s ability to export advanced AI chips to China. Risk sentiment was further undermined by another round of underwhelming earnings from major US banks, with Citi, Wells Fargo and Bank of America disappointing investors, extending the cautious tone set by financial results earlier in the week.

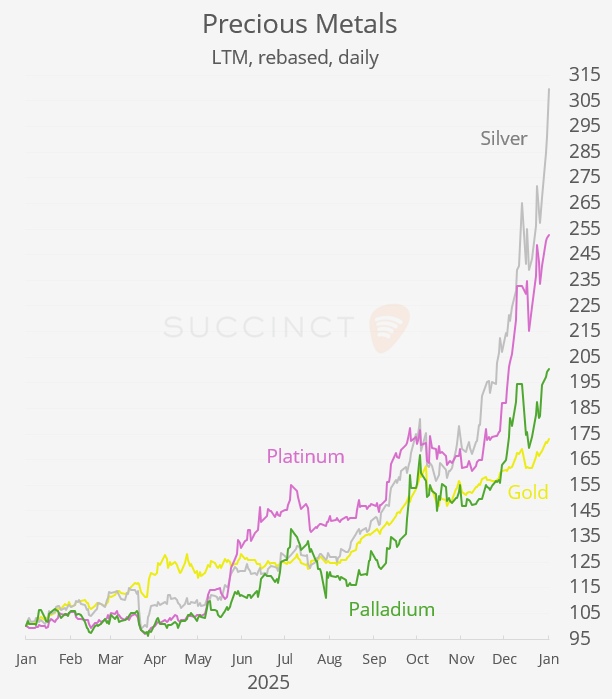

The shift toward risk aversion drove a sharp acceleration in the precious metals rally, with silver surging 7% to a new record above $92, while gold also traded at fresh all-time highs, underscoring growing demand for defensive assets.

In geopolitics, the Trump administration has approved conditional exports of Nvidia’s H200 AI chips to China, but mandated new security requirements, including third-party testing, US supply assurances and restrictions on recipient use before shipments can proceed. While the move opens a narrow pathway for China-bound sales, it has sparked debate over national security risks and enforcement challenges, adding to investor uncertainty around the tech sector. The ambiguous policy shift, amid broader US–China tech tensions, contributed to today’s weakness in US equities.