Wed 15 Oct: After the Bell

🎙️📄+ Market Data. More bank earnings, gold's new record, Fed's signals.

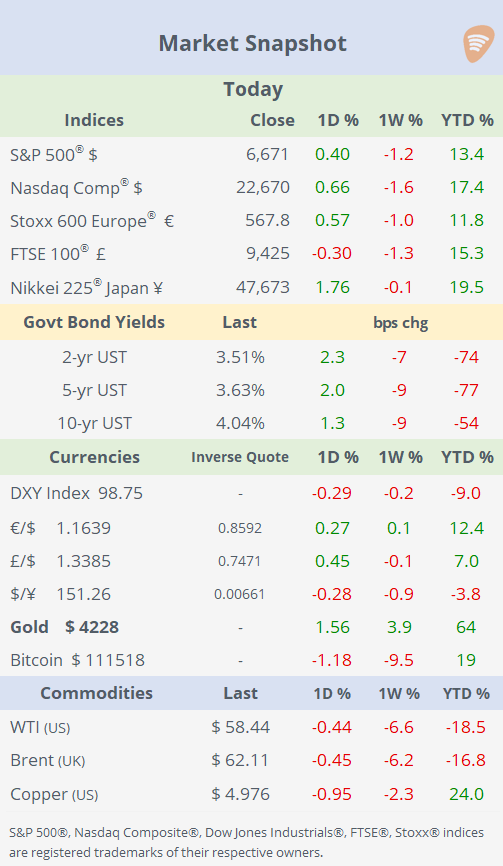

See the ‘Market Data’ post for tables & charts.

Good evening,

Stocks climbed and gold reached fresh record levels, supported by another round of strong bank earnings and dovish remarks from Fed officials. Meanwhile, the U.S. dollar slipped, mainly against a stronger sterling, and crude oil traded sideways as investors remain alert to further announcements on the tariffs front, which continues to top the agenda alongside the earnings season.

Geopolitics: Washington warned that new Chinese export controls on rare earths and critical minerals could force a global decoupling from China. Treasury Secretary Bessent signalled that Washington will take retaliatory measures if Beijing proceeds with the policy.

Central Banks: The Fed’s Beige Book reported that US economic activity was little changed in recent weeks, with employment levels mostly stable and mixed signals on input costs and consumer spending. Fed officials Miran and Bostic spoke today, emphasising the need for additional rate cuts amid increased downside risks to growth. Miran highlighted the urgency of moving quickly toward a more neutral policy stance to reduce vulnerability to economic shocks, while Bostic pointed to ongoing labour market concerns supporting a cautious but dovish approach on rates.

Earnings: Bank of America, Morgan Stanley, and PNC reported strong results, exceeding analysts’ expectations. BAC posted a 23% increase in net income, driven by a 43% surge in investment banking fees, while MS’s earnings were bolstered by a 35% rise in stock trading revenue. PNC also reported record revenue and earnings per share, reflecting robust fee income and disciplined cost management, though its stock dipped slightly on weaker-than-expected guidance regarding net interest income. Overall, the results underscore the resilience and profitability of the banking sector amid a strong economic backdrop (see Market Data for table).

Economics: China’s CPI inflation fell 0.3% YoY in September, marking its sixth decline this year as deflationary pressures persisted despite policy support and modest core stability. PPI inflation dropped 2.3% YoY, staying negative for nearly three years, reflecting continued strain on industrial margins from weak demand and a sluggish property sector.

The NY Empire State Manufacturing Index rebounded to 10.7 in October from -8.7, signalling a return to modest growth in New York’s factory activity and beating negative expectations. Improved new orders, shipments, and employment drove the headline gain, but the outlook remains only cautiously optimistic.

In Europe, €-zone industrial production rose 1.1% YoY in August, marking the seventh consecutive positive reading and signalling steady though cautious momentum amid ongoing trade uncertainties.

Inflation in Spain rose 3.0% YoY in September, the highest since June ‘24, reflecting moderate inflationary pressure. Inflation in France came in at 1.1% YoY, an uptick from August, marking the highest inflation rate since January, driven by rising service prices.

Corporate Deals: BlackRock, Global Infrastructure Partners, and Abu Dhabi’s MGX, alongside Nvidia, Microsoft, and xAI, agreed to acquire Texas-based Aligned Data Centers from Macquarie Asset Management in a $40bn deal. The deal marks one of the largest data infrastructure transactions to date and underscores investor confidence in the long-term AI buildout.

S&P Global (mcap $148bn) agreed to acquire With Intelligence for $1.8bn, expanding its presence in the fast-growing private capital markets. The deal gives S&P access to a large pool of proprietary data from private equity, hedge fund, and venture capital firms. It marks the company’s latest move to diversify beyond its core public-market indices and credit ratings.

Lone Star Funds agreed to acquire Hillenbrand Inc. (mcap $2.2bn), the Indiana-based industrial company, for $2.25bn in cash, for an EV of $3.8bn. Terms: $32/share, representing a 21% premium over the undisturbed price. Shares jumped 18% today on the news but remain largely flat year to date.

Day Ahead:

Earnings: Charles Schwab, US Bancorp, BNY, Travelers, TSMC, and ABB.

Data: UK GDP, manufacturing and industrial production, Italy inflation, US (suspended) jobless claims, retail sales, PPI, and Philly Fed Business.

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient’s personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.